High housing costs ultimately drain our cities and communities of the brains and the brawn needed to thrive economically. Because this risk is real and the consequences painful, community stakeholders are actively—and in some cases aggressively—engaging in this topic of affordable housing.

At the local and state levels, debates are heating up over inclusionary zoning and rent control policies. Similarly, federal legislators are participating in summits and hearings to better understand the factors driving the issue and possible solutions.

The apartment industry cannot afford to be a bystander in these debates over solutions to address affordability challenges. Government programs alone cannot meet the need and, without our input, ineffective, misguided or even ill-advised solutions could be put in place. NMHC has a prominent seat at the table with policymakers and other constituency groups. And we look to industry members who are living out the reality of this debate day to day to help us shape meaningful solutions based on their practical experiences with development and preservations efforts. Our industry’s ability to work together assertively now will ultimately determine our success in producing the desired housing.

A complicated problem

At the heart of the affordable housing challenge is a fundamental supply-demand imbalance. Demand for apartments is growing faster than our industry can produce new units. This trend is keeping occupancies high and creating upward pressure on rents across the spectrum. While some branches of the market have been able to absorb the price increases, others—especially low- and very low-income households—have not. Household incomes also have remained flat for roughly a decade, leaving many families with moderate to severe housing cost burdens.

It would seem the problem has a simple fix: Just build more, cheaper units. And in many areas, policymakers and other community stakeholders today are hyper focused on doing just that. They are using a variety of tools, from affordable mandates to creative financing programs and beyond, to try and spur the new development of more affordable housing to meet a variety of income levels.

However, beyond the significant political and financial obstacles that come with any new development, much less affordable development, there is a limit to how much new construction alone can move the needle on affordable housing supply. Considering that total new multifamily construction has averaged under 175,000 new units annually for the past five years, it’s clear that the apartment industry alone cannot build a way out of a national affordable housing deficit when it isn’t delivering enough units to meet current demand.

While programs and policies to build new affordable housing development are part of the solution, there are other strategies that our communities should also pursue to be able to more effectively address affordable housing challenges. For example, preservation efforts are critical in today’s constrained budgetary environment. We need to protect government funding for key affordable housing financing and subsidy programs, such as HUD’s Section 8 Housing Choice Voucher programs and the Low-Income Housing Tax Credit, which keep units available at below-market rents.

Rehabilitation is also vital because it can keep existing apartment stock from dwindling further. According to the most recent data from Harvard’s Joint Center for Housing Studies, between 2001 and 2011, 650,000 housing units with rents of $400 or less were permanently removed from the housing stock. An additional 560,000 affordable units that are currently occupied by low-income households are characterized as structurally inadequate

Conversation starters

Because expanding affordable housing options requires a combination of strategies, we are looking to provide leadership in that direction. Earlier this year, we launched an affordable housing task force to evaluate various programs and policies like inclusionary zoning that are currently in place in many parts of the country and develop new ideas to overcome some of the hurdles to financing, developing and preserving affordable units.

We also are engaging with a variety of public and private parties on the topic. Recently, there have been several important, preliminary steps in advancing the dialogue.

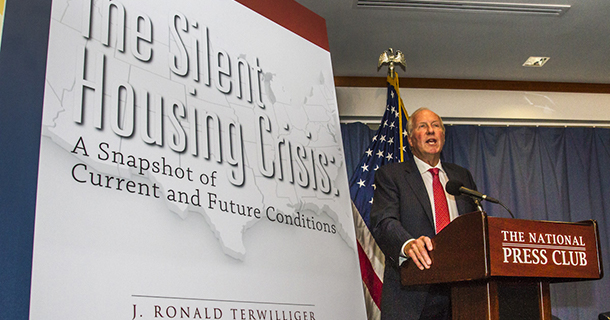

First, I participated in the New Hampshire Housing Summit. Sponsored by the J. Ronald Terwilliger Foundation for Housing America’s Families and the Bipartisan Policy Center, the summit is part of a push to raise the visibility of the issue, making housing policy a key discussion point in the 2016 presidential race. To kick start that conversation on affordability, I submitted a pre-summit opinion editorial to the local newspaper that focused on the many state and local barriers that prevent the production of much needed affordable rental homes.

Second, the House Financial Services Subcommittee on Housing also held a hearing in October on the “Housing Opportunity Through Modernization Act of 2015,” which provides common-sense reforms to federal affordable housing programs. The apartment industry joined with a real estate coalition in offering our support for the reforms to federal affordable housing policy.

The full House Financial Services Committee also held a hearing the same week that examined whether legislative changes are needed to help ensure affordability and promote self-reliance and upward economic mobility. For this hearing, we outlined key solutions to the nation’s affordable housing challenges. In part, we emphasized that local, state and federal collaborations, and partnerships between the public and private sectors, are critical in addressing this issue.

Policymakers at all levels of government—federal, state and local—are making affordability a priority issue. NMHC remains a vocal participant in the discussions and aims to help policymakers develop effective solutions that will preserve programs that work, stem the loss of additional housing stock and promote the development of new units. More industry input will help us recommend and shape better policies, so I urge you to please share your experience and insight with me on what you see working or otherwise.