Last week, the Census Bureau released the 2016 County Business Patterns (CBP) report. The report shows that housing construction employment and the number of construction businesses are on the rise but neither has fully recovered to their 2008 levels.

The CBP was described in an earlier blog post. Please consult that post for more information on the report.

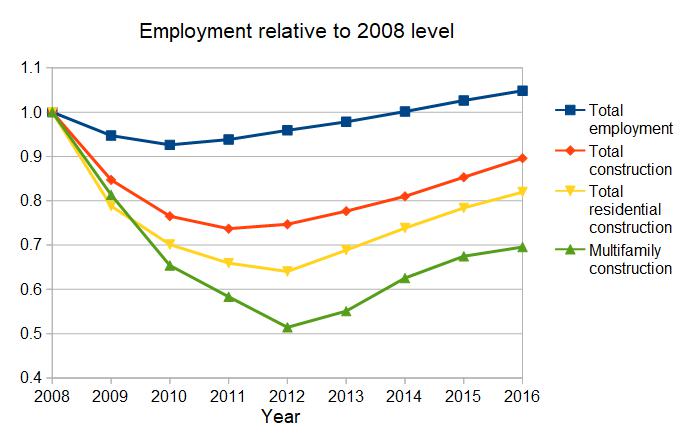

Construction employment still recovering

The first chart presents information on employment in the economy as a whole, in construction and in certain construction sub-sectors. Note that total residential construction is a sub-sector of total construction and that multifamily housing construction is a sub-sector of residential construction. Companies are classified by their primary businesses but they may do more than one type of construction.

The chart shows employment levels relative to their levels in 2008. It is clear that the recession hit housing construction much harder than it did the economy as a whole. Construction employment fell further and has stayed down longer than employment generally. Residential construction employment was even harder hit and has been even slower to recover. In 2016, Construction employment was still 10 percent below its 2008 level and residential construction employment was still 18 percent lower. By contrast, employment in the economy as a whole had returned to its 2008 level by 2014 and was 5 percent above that level in 2016.

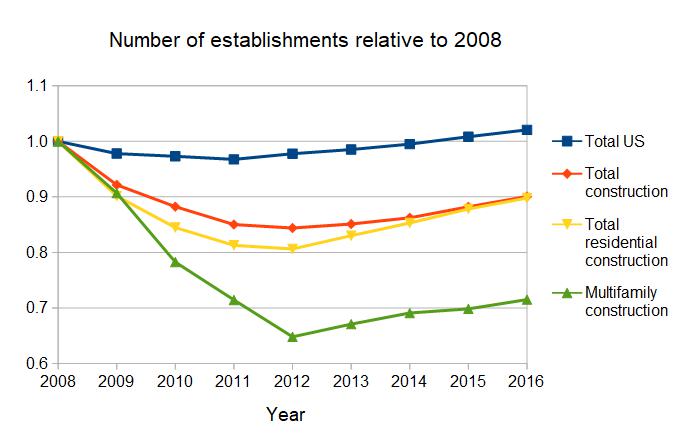

Construction businesses bouncing back, slowly

The second chart presents information on the relative change in the number of business establishments since 2008. It shows that the number of businesses dropped significantly after 2008 but not as significantly as did employment. However, for the economy as a whole and for total construction, the number of business establishments continued to drop for another year after employment began to recover.

At the CBP survey date in March, 2016, the total number of US business establishments was about 2 percent above its level in 2008 but the numbers of businesses in each of the construction sectors shown was down at least 10 percent.

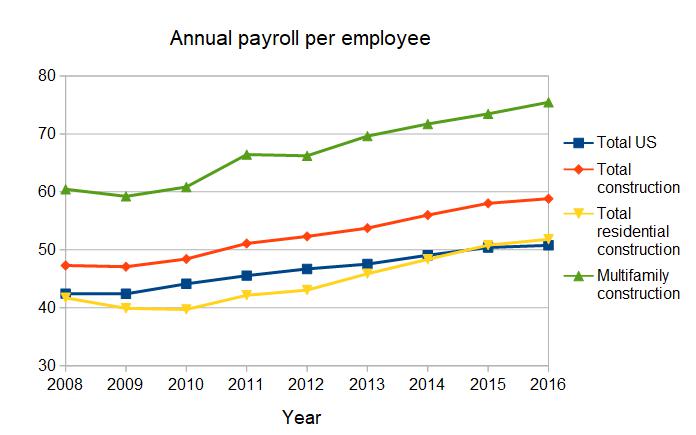

Nice work if you can get it

The final chart presents information on the annual payroll per employee for all US businesses and also for the three segments of the construction industry we’ve been highlighting. It shows that payroll per employee for construction was above the national average in each of these segments in 2016. Generally, it has been increasing faster for construction than for all US businesses since 2012.

While the payroll data for the multifamily housing construction sector seems unusually high, this is a very small sector compared to the others. In 2016, it comprised 2885 business establishments in the entire country. By contrast, there were 168,202 residential construction businesses and 696,733 construction businesses. Clearly, there is something different about those few businesses who define themselves as being primarily in the multifamily housing construction business but the information in the CBP report does not identify what that is.