Last week, the Mortgage Bankers Association (MBA) released its Q1 2018 quarterly survey of commercial/multifamily mortgage bankers originations. The report shows that originations of multifamily mortgages were up strongly in Q1 compared to the same quarter last year.

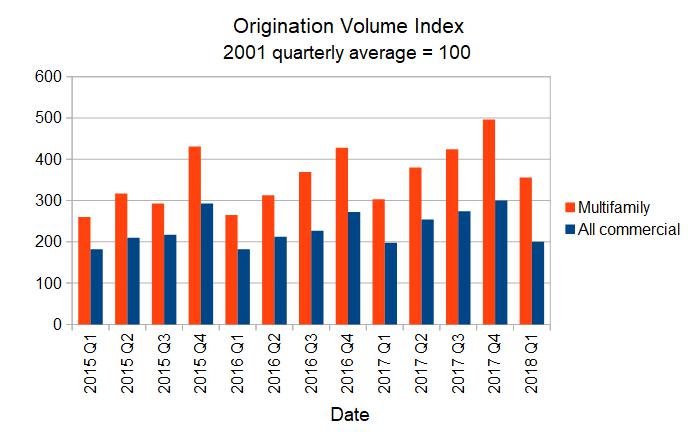

The chart below shows the strongly seasonal pattern of growth in mortgage originations for commercial property types tracked by the MBA. These types include office, retail, industrial, hotel and health care, in addition to multifamily. It found that mortgage originations for commercial property as a whole were up 1 percent on a year-over-year basis. By contrast, Q1 mortgage originations in multifamily were up by 18 percent year-over-year.

The strong growth in multifamily mortgage originations in Q1 was more remarkable since it came on top of similarly strong growth in 2017. Q1 2017 multifamily mortgage originations were up by 14 percent from Q1 2016 levels and originations for the year 2017 were up by 17 percent from 2016.

The report also examined the sources of funds being used for commercial mortgages, although it did not differentiate by commercial property type.

It found that commercial mortgage backed securities (CMBS) were up slightly as a source of funds compared to a very weak 2017, but that CBMS have become relatively less important as a source of funds since 2001.

On the other hand, commercial banks have become relatively more important as a source of funds since 2001 but their mortgage issuance dropped 23 percent in Q1 2018 from a very strong Q1 2017.

The other sources of funds tracked by the MBA, life insurance companies and GSE’s (Fannie Mae and Freddie Mac), saw commercial mortgage originations increase by 9 percent and 8 percent respectively in Q1 on a year over year basis.