A Mortgage Bankers Association (MBA) report on the level of outstanding commercial and multifamily mortgage debt shows that the GSE’s increased their already dominant share of this debt in Q3.

The MBA reported that multifamily mortgage debt outstanding rose by $31.0 billion in Q3, lower than the $32.2 billion increase recorded in Q2. Total multifamily mortgage debt rose by 1.9 percent, reaching a level of $1.65 trillion.

Supplying the market

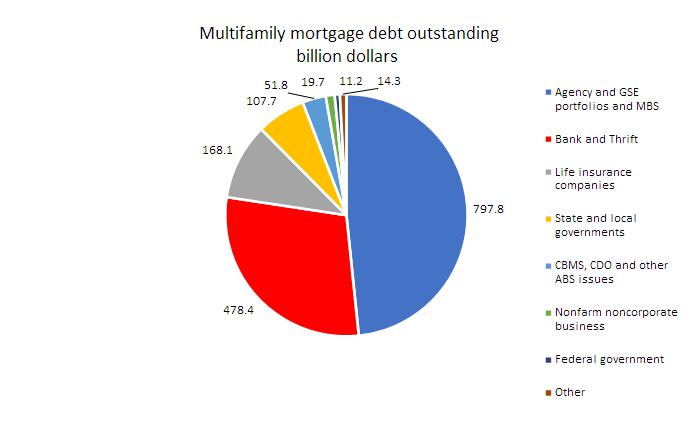

The shares of multifamily mortgage debt held by various classes of suppliers are shown in the first chart, below.

Of the $31.0 billion increase in multifamily mortgage debt outstanding, fully 75 percent was supplied by “Agency and GSE portfolios and MBS”. These are agencies, like the Federal Housing Administration and Government Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, who buy up mortgages and sell some of the debt as Mortgage Backed Securities (MBS). This share was up from the 71.4 percent of the net new multifamily mortgage debt these agencies issued in Q2. It is also well above the 48.4 percent of the total outstanding multifamily mortgage debt which they now hold.

Banks and Thrifts share of outstanding multifamily mortgage debt slid again in Q3, falling from the 29.3 percent share they held at the end of Q2 to 29.0 percent. In dollar terms, Banks and Thrifts holdings of multifamily mortgage debt increased by $4.4 billion to $478.4 billion.

Life insurance companies held 10.3 percent of debt in Q2 but increased their holding by only 2.9 percent of new debt in Q3. At the end of Q3 they held $168.1 billion in multifamily mortgage debt, 10.2 percent of the total.

State and local governments held 6.5 percent of outstanding multifamily mortgage debt at the end of Q3, totaling $107.7 billion.

Reducing exposure

The other issuers of multifamily mortgage debt listed by the MBA hold less than 6 percent of outstanding debt. Taken together, they reduced their holdings of multifamily mortgage debt by $667 million during Q3.

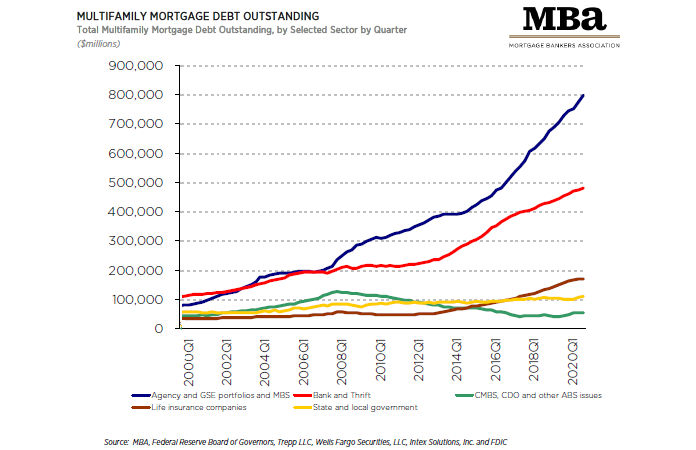

The growing market share of the lenders with implicit government backing is illustrated in the next chart, below. It shows how the GSEs have come to dominate the market. It also shows how commercial mortgage backed securities (CMBS) and collateralized debt obligations (CDO) have fallen out of favor since they were implicated in the housing crash in 2009.

The report does not cover loans for acquisition, development or construction, or cover loans collateralized by owner-occupied commercial properties. The full report includes information on mortgage debt outstanding for other commercial property types. These include property types such as retail, office, hospitality and industrial. The full report is called Commercial/Multifamily Mortgage Debt Outstanding and can be found here.