A pair of economic forecasts, one from Fannie Mae and one from the Federal Reserve project lower growth and higher inflation for the rest of 2021 than did earlier forecasts by the same agencies.

Fannie Mae issues a monthly forecast for the economy and for housing production. The forecast provides both quarterly and annual estimates for standard economic metrics, with a current forecast horizon that runs through the end of 2022.

The forecast from the Federal Reserve (Fed) was released in conjunction with the recent meeting of the Federal Open Market Committee (FOMC), which meets 8 times per year. The Fed forecast presents yearly figures through 2024 and a “longer run” forecast for the more distant future. The consensus Fed forecast is developed by the combining the forecasts of 18 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast.

GDP: less now, more later

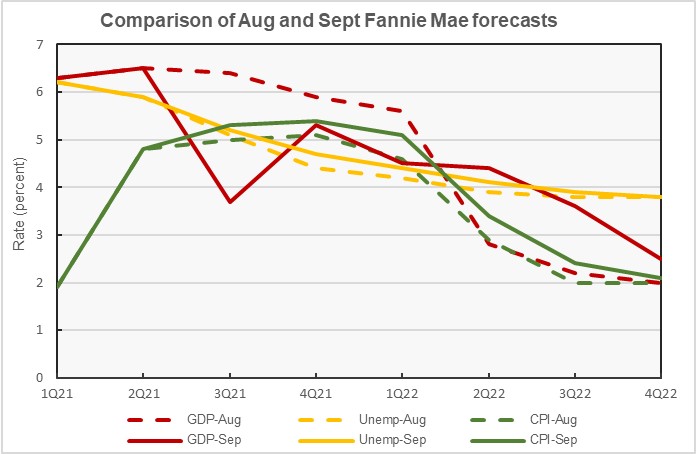

Since Fannie Mae releases its forecast reports monthly, the changes from one report to the next are generally small. However, in the September forecast significant revisions were made to both the GDP forecast and to the inflation forecast as measured by the Consumer Price Index (CPI). These are illustrated in the first chart, below.

Even though we are well into Q3, its economic growth forecast was revised downward by 42 percent since last month, from a 6.4 percent annualized rate to only a 3.7 percent annualized rate. Just as May’s jump in inflation seemed to catch most of the forecasters off guard, the recent slowdown in growth seems to have surprised many forecasters. However, they appear to believe that there is pent up demand in the economy that will eventually be satisfied. Accordingly, they raised their economic growth forecast for 2022 at the same time they were cutting it for 2021. As an example, the Q2 2022 GDP growth forecast was revised upward from a 2.8 percent annualized rate in August’s forecast to a 4.4 percent annualized rate in September’s forecast.

The Fed’s forecast for GDP growth for 2021 is now 5.9 percent. This is down from the 7.0 percent economic growth forecast in June and compares to Fannie Mae’s forecast of 5.4 percent GDP growth for the year. The Fed’s GDP growth forecast is now 3.8 percent for 2022 and 2.5 percent for 2023.

Inflation is expected to last a little longer

As the above chart illustrates, Fannie Mae revised its Consumer Price Index (CPI) inflation forecast higher for every quarter in its economic forecast window. The revisions for Q1 and Q2 2022 call for inflation 50 basis points higher than in last month’s forecast, rising to 5.1 percent and 3.4 percent, annualized, respectively.

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than on the CPI. Both the Fed and Fannie Mae provide forecasts for inflation as measured by the PCE.

Fannie Mae’s forecast for PCE inflation for 2021 was revised upward in the September report to 4.6 percent from the 3.5 percent forecast in August. The annual inflation forecast (PCE) for 2022 was revised upward to 3.1 percent from the 2.8 percent forecast in August.

The Fed’s economic forecast for PCE inflation for 2021 is now 4.2 percent. This is up from the 2.4 percent forecast in March and the 3.4 percent forecast in June. The Fed’s PCE inflation forecast is now 2.2 percent for 2022 and also 2.2 percent for 2023.

Unemployment forecast slightly higher

Fannie Mae’s quarterly forecasts for the unemployment rate were up slightly across the board compared to August’s forecast. The revisions to these forecasts were more minor than were the revisions to the inflation or GDP forecasts. The unemployment rate is now expected to be 5.5 percent (up 10 basis points) in 2021 and 4.1 percent (up 20 basis points) in 2022.

The Fed forecast for the unemployment rate was also up slightly in the near-term compared to its June forecast. The Fed now expects unemployment to be 4.8 percent (up 30 basis point) in 2021, 3.8 percent (unchanged) in 2022 and 3.5 percent (unchanged) in 2023.

Housing: less now, more later

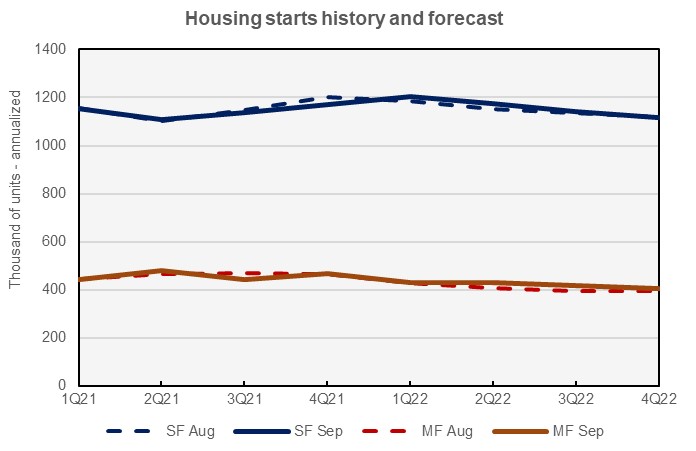

Fannie Mae’s forecasts for the housing construction market is shown in the final chart, below, along with last month’s forecast. For 2021 as-a-whole, Fannie Mae now expects single family starts to be 1,143,000 units, down 10,000 units from the level forecast in August. This is the fourth report in a row in which Fannie Mae revised their forecast for single-family starts in 2021 downward. However, the forecast for single-family starts in 2022 was adjusted upward by 11,000 units to 1,159,000 units.

Fannie Mae expects multifamily starts (2+ units per building) to be 458,000 units in 2021, down 2,000 units from the level forecast in August. The forecast for multifamily starts in 2022 was revised upward by 19,000 units to 425,000 units.

Fannie Mae’s Multifamily Market Commentary focused on manufactured housing communities (MHC). These communities have seen rising occupancy over the past year. They have also seen pad rents rise 3.4 percent nationally, well behind the rates seen for apartments generally.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecasts.