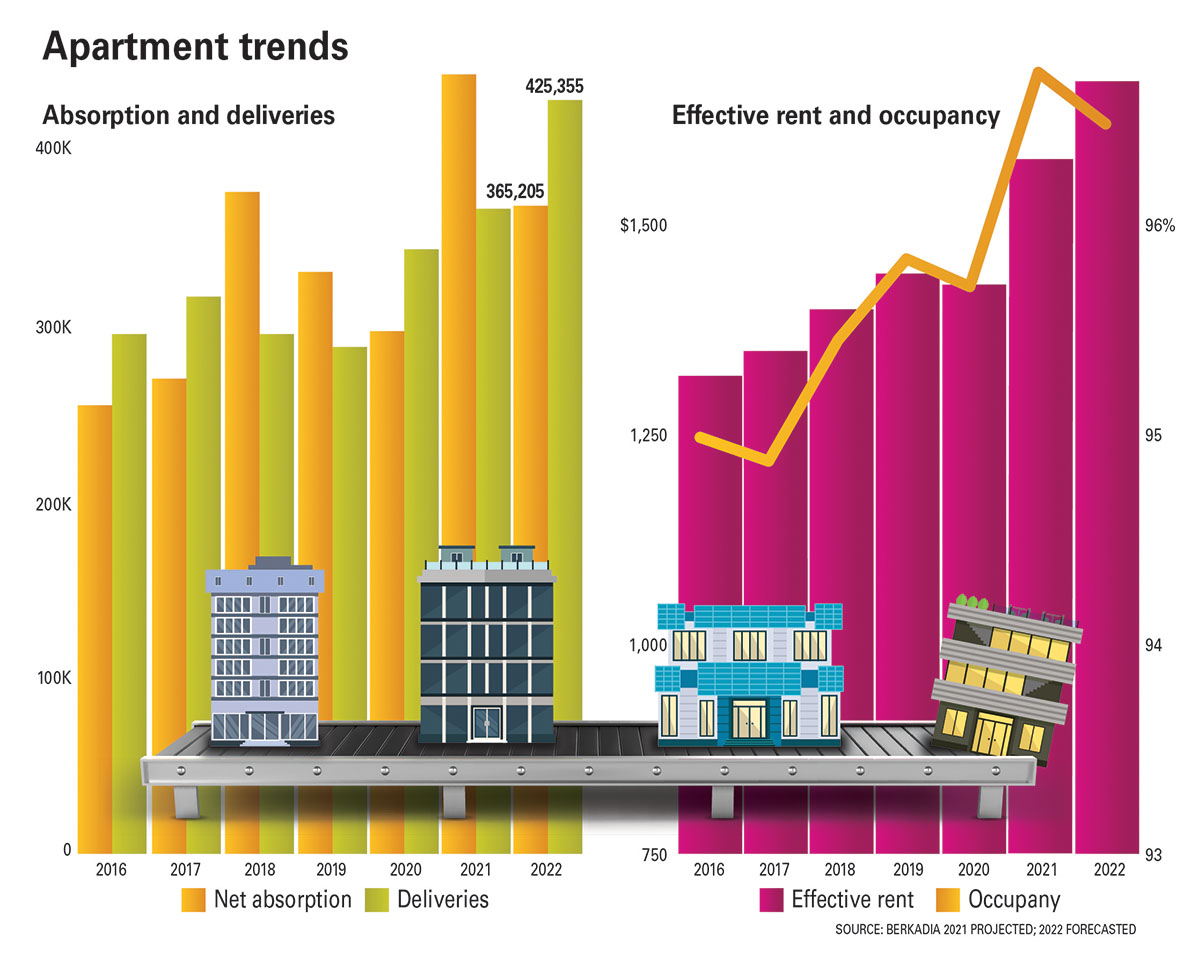

At the dawn of 2022, the outlook for multifamily real estate looked as bright as in the year just ending. Industry experts released bullish forecasts and a number of loan specialists spoke on the shiny outlook for the sector.

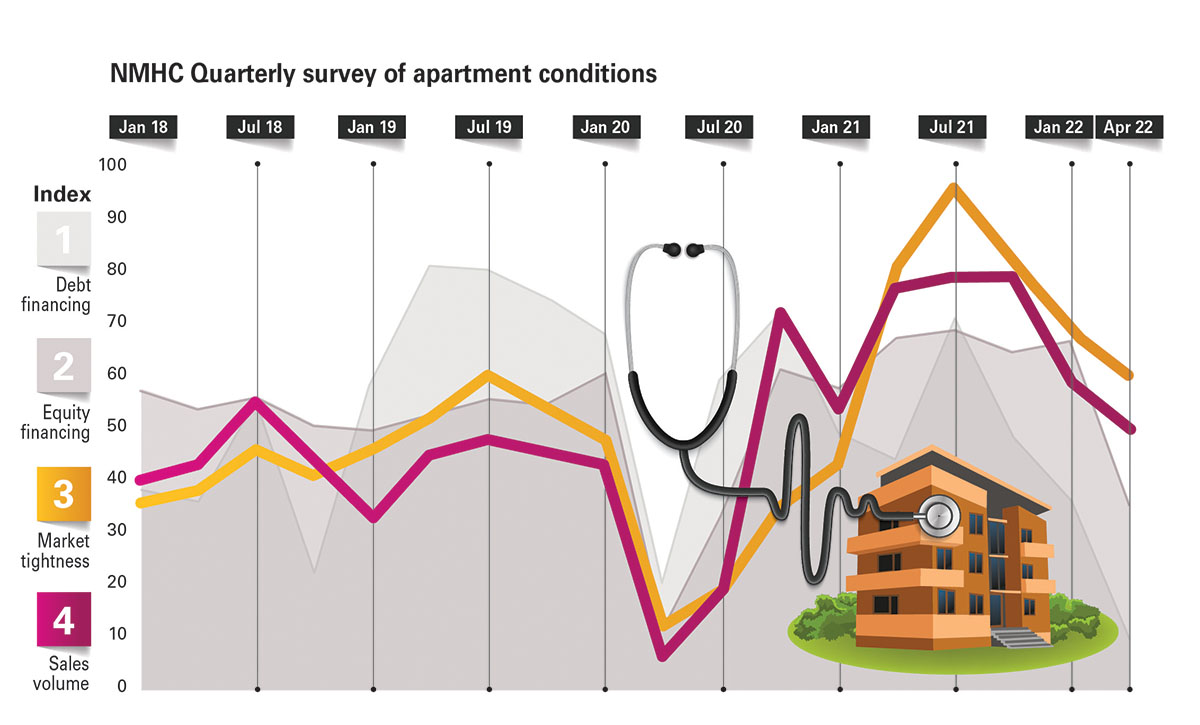

The prognosis took a turn when the Federal Reserve set in motion a series of interest rate hikes to taper inflation, raising federal fund rates of 0.25 percent to a target range between 0.25 and 0.50 percent on March 16, bringing to an end a long period of no rate hikes that began in 2018.

For the fifth straight month, the availability of debt financing for apartments waned, according to the National Multi Housing Council’s quarterly survey of apartment market conditions issued in early May. Forty-two percent of respondents indicated they were very concerned about the combined impact of rising rates and inflation with 55 percent somewhat concerned.

“After the stratospheric heights of 2020 and 2021, the market is coming back down to earth. To a certain extent, the headwinds we expected have finally arrived. Rising rates are putting pressure on new loans and refinancings. After ramping up, the focus is now on scaling down,” said Bob Broeksmit, Mortgage Banker’s Association (MBA) president and CEO, at the 2022 Secondary and Capital Markets Conference in May.

While multifamily mortgage loan originations increased 72 percent year over year in Q1 as a result of ongoing strong demand for the asset class, MBA lowered its forecast for originations, purchases and refinancings for this year and next, prompting Broeksmit to warn lenders attending the conference to be ready for smaller volumes now that the mortgage boom is over.

Investors still hungry

Despite the bad news, recent analysis from Yardi Matrix indicates that multifamily investors are willing to pay more than ever for apartment projects. According to investment firm CBRE Group, investment in the sector hit an all-time high in Q1, increasing 56 percent year over year to $63 billion and compressing cap rates for multifamily to an all-time low.

Michael Friedman, founder and CEO of Ohio-based The REvision Group, a company that helps match best-in-class sponsors/developers with limited partner capital, agrees that demand for multifamily will remain strong, but offers a caveat to eager investors who throw caution to the wind to make a deal.

“Interest rates, the lifeblood of underwriting, will affect everyone but renters, because renters don’t need a mortgage. But rising interest rates also will affect developers’ ability to borrow money at a good rate and they will have to work for less returns or bring more equity into the deal, which will also dilute their returns,” he said.

Friedman warns that investors who ignore the higher interest rates will get themselves in trouble years down the line.

Hilary Provinse, EVP and head of mortgage banking at Berkadia, said in an online interview that, “The Fed has signaled to us that rates will continue to go up, particularly on the short end of the curve.”

Her company is helping clients put together strategies to outperform the market in the current environment, while advising them of possible threats to their bottom line.

Multifamily real estate is an inflation hedge because rents can increase every year, she said, so we tell our clients it’s all relative.

Floating rate debt will get more expensive and impact underwriting and proceeds. Rising interest rates could result in higher debt service payments and lower property cash flow and affect loan sizes for multifamily properties.

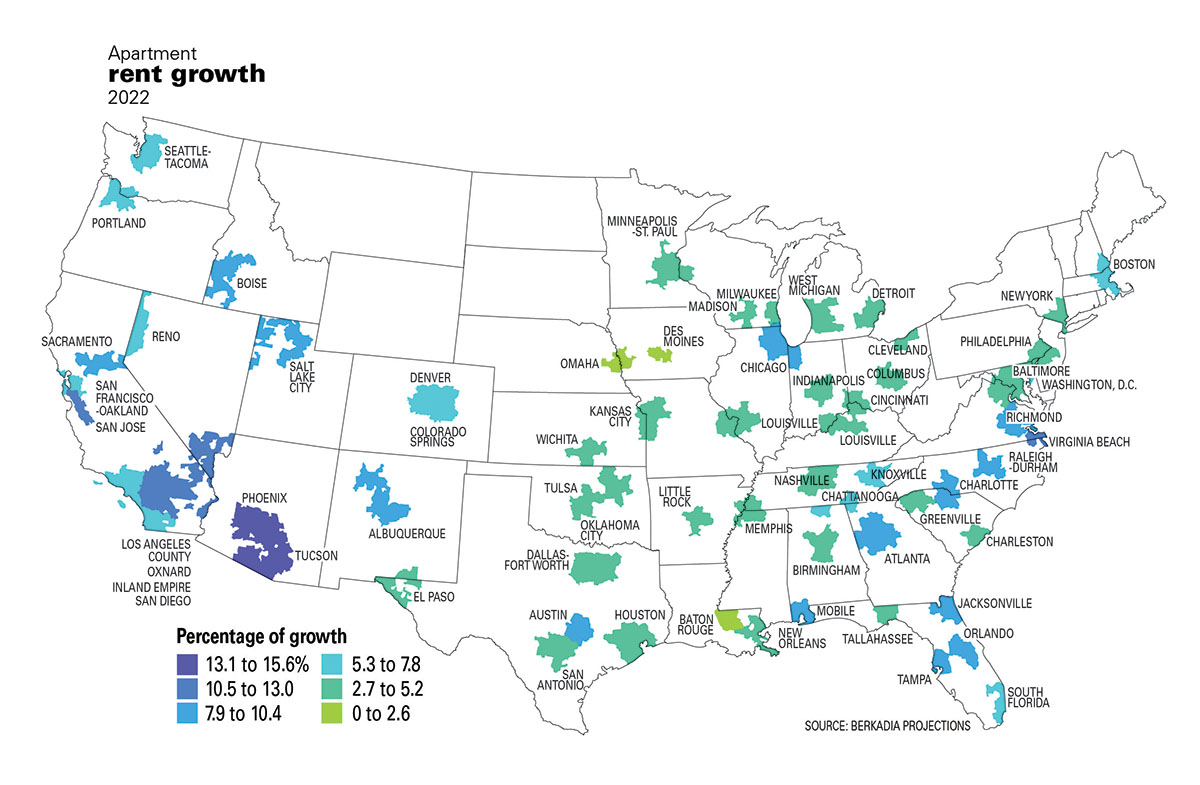

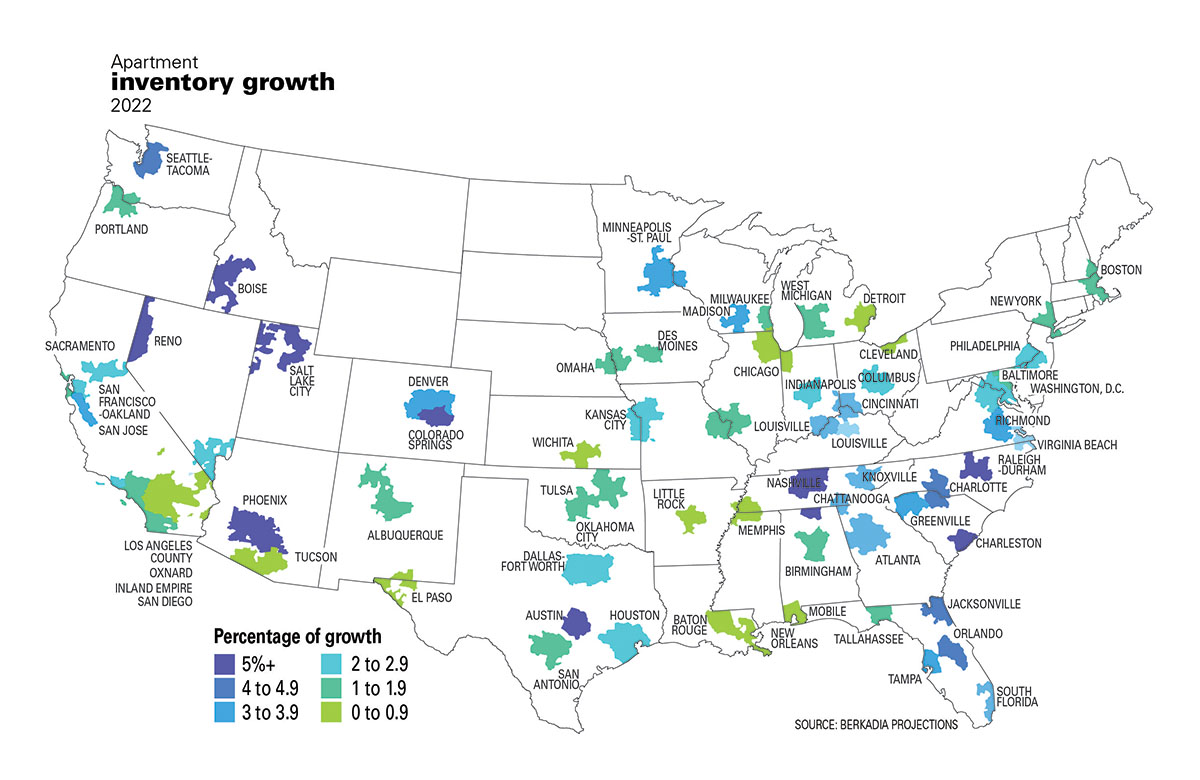

Even so, Freddie Mac expects multifamily rent growth to continue to outpace inflation mainly because of the dearth of supply in most metros.

While rent growth as a result of supply and demand produces income, it also poses possible issues for multifamily players.

“Some markets saw 40 percent rent growth year over year in 2021, and while that’s great for apartment owners, it’s not so great for apartment renters. We are watching an increasingly complex web of legislative overlays as municipalities and states are thinking about rent control. That’s something we want to be on top of for our clients and make sure we are advising them where those threats might be from a rent control regulatory standpoint,” said Provinse.

Keys to success in any market

The REvision Group’s Friedman details what he calls the “three predictors of a successful real estate deal” in any environment.

“One is timing, and no one can predict the future. Two is the quality of the sponsor, and we can analyze that. But the most important factor is basis. In real estate, money is made when you buy not sell, so if you pay too high a price you will struggle to make money no matter how great the architectural elements of the project or even the location,” he said.

“Buying below replacement value is key to having a fighting chance to profit from your deal. Then add in a good location, a good project concept and an experienced sponsor. But, because everything depends on the low basis, the near-term trends are not good because of interest rates and inflation. Nevertheless, as long as demand is strong, deals can still be found,” he said.

The REvison Group has completed $800 million in limited-partner transactions.

“We work with both sides. Sometimes capital calls us, asking us to hook them up with a project in a specific market, which is about 20 percent of our business, while 80 percent is sponsors looking for capital.

“Limited-partner capital represents 80 to 90 percent of the equity needed for a project, while the general partner typically contributes about 10 to 20 percent and also sources the debt financing piece, which is 60 to 70 percent of the entire deal,” said Friedman, noting his company focuses on both value-add and new development deals.

According to Ed Zimbler, Berkadia senior managing director and head of California originations, ensuring the right solution for a debt assignment is more than just finding the right partner.

“Flexibility on the timing of the rate lock is an important factor. With one rate increase already under our belts and the Fed indicating several more to come this year, as well as the day-to-day increased volatility in longer-term treasuries, timing financing is more important than ever,” he said in a company release.

In 2021 alone, Berkadia worked with more than 262 different third-party capital sources, representing nearly half of its $40 billion in loan production.

The company’s most recent financing product—Berkadia Small Loans—was launched in 2019 and demand for GSE-sponsored small loans has continued to expand. The pandemic temporarily quelled demand, but with COVID measures waning, borrower appetite for small loans is rising again.

According to Josh Bodin, Berkadia senior VP of securities trading, agency small-loan executions remain among the best options for newer, smaller sponsors that meet the minimum requirements of a two-year track record with at least three multifamily projects under their belt.

These sponsors prefer streamlined loan documents and simpler structures, making them a great fit with agency small loan programs that often offer more leverage and better terms than local banks, he said.

And, because most GSE small loans are for Class B and C workforce housing with affordable rents, they are more favorable in the eyes of the agencies and merit better pricing, Bodin noted.

Berkadia’s application-to-funding timeline is the shortest for Freddie Mac’s Optigo Small Balance Loan product that targets five to 50 units and $1 million to $75 million.

In addition to banks and life companies, debt funds are the latest competition for the underserved small loans market.

One such debt fund newcomer is Bellevue, Washington-based JB Capital, which rolled out a new debt fund in May to provide mezzanine debt, preferred equity and alternative sources of funding to multifamily owners, operators and developers looking to fill the capital stack that banks and other lenders often are unwilling to provide.

In a release announcing the fund’s creation, JB Capital stated that there is a waiting list of money and deals looking to capitalize on the fund’s strategy focused on multifamily residential housing and industrial projects.

The fund targets a 50 percent to 60 percent mezzanine and preferred equity composition with some senior positions in the mix. The fund charges no management fees and takes an atypical approach of no leverage, which opens the door to writing checks as small as $5 million, something larger funds cannot afford to do.

In prepared remarks, Seattle-based JB Capital founder Jeremy Hill, describes the fund as evergreen, meaning new iterations of the same strategy won’t be rolled out year after year.

The fund targets second-tier growth markets and SMILE states that stretch from Arizona to the Carolinas for geographical opportunities. JB’s home base of Seattle is also on the company’s radar for deal potential.

Tertiary markets have become popular with renters in response to working at home during the pandemic, a trend that appears to be continuing. Hill cites this trend as a driver for his fund’s geographical focus.

Latest trend

With the rise in interest rates and current cap rate compression, more people want to build new, even though it’s riskier, because the yields are higher, said REvision Group’s Freidman, noting that his company’s percentage of deals recently shifted from 80 percent value-add and 20 percent new construction to 60 percent value-add and 40 percent ground up.

“Value-added plays are getting tougher and if you don’t have the competitive sourcing and a good basis it will be tough times ahead in the value-add world. It might be a good time to sit on the sidelines for a few years and wait to take advantage of the distress plays that will eventually present themselves, he said.

For this reason, many sponsors are pivoting to the latest and hottest trend—the single-family build-for-rent and buy-for-rent sectors, Freidman said.

“People can’t afford to buy, so developers are building purpose-built, single-family

communities for rent in Sunbelt markets,” said Berkadia’s Provinse. These SMILE states offer great weather, tax friendliness, attractive migration trends and available land parcels conducive to the product.

While multifamily projects can be built vertically on three acres, single-family rental projects require 20- to 30-acre parcels that are only available outside of cities.

While individuals have been buying second homes for income purposes and most recently to “flip,” buying large numbers of single-family homes was a trend started by Blackstone following the subprime crisis, when lenders sold off foreclosed homes at marked down prices,” said Friedman.

The New York firm built a portfolio of tens of thousands of single-family homes then rented them out through a company called Invitation Homes Inc. Blackstone exited the single-family rental market in 2018 but dipped it’s toe back in the market in 2020 when it purchased a $240 million equity stake in Toronto’s Tricon Residential, which buys single-family rentals in the USA, and more recently purchased the 17,000 single-family home portfolio of Home Properties of America for $6 billion. Institutional investment giant BlackRock recently got in on the action buying single-family homes in desirable neighborhoods for rent. BlackRock has trillions of dollars under management and can afford to pay high prices and consistently beat out the competition.

“The newer model of this trend is to buy whole clusters of homes and create a community with shared amenities. Because it’s hard to source large numbers of homes in close proximity to each other, most developers are building them from the ground up. Single-family rentals are perfect for people who want to live in a home with a yard, but not have to worry about roof fixes or property taxes,” said Friedman.

He expects The REvision Group will complete $100 million of deals in this sector over the next two quarters.

“The only thing that would hurt this trend is if interest rates come crashing down even lower than before or if the housing market crashes and prices devalue 30 percent,” he said.

So, while the business of providing multifamily housing is entering a new phase in 2022, new players and products are emerging to supply needed capital in the new environment. Multifamily builders and developers who adapt to the new market conditions will survive and thrive in the years ahead.

Author Wendy Broffman