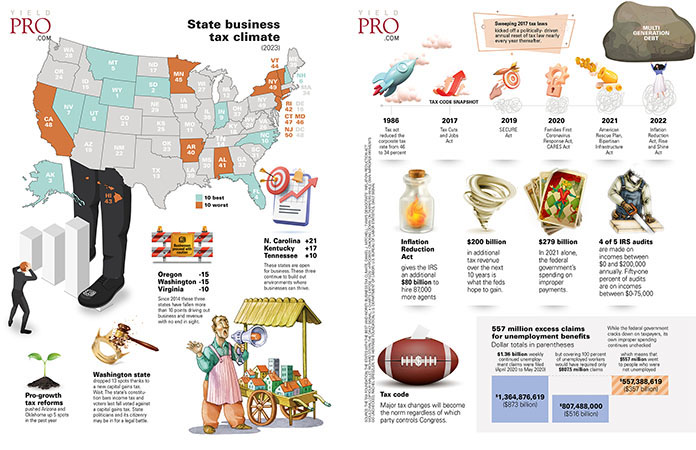

Oregon -15

Washington -15

Virginia -10

Since 2014 these three states have fallen more than 10 points driving out business and revenue with no end in sight.

Carolina +21

Kentucky +17

Tennessee +10

These states are open for business. These three continue to build out environments where businesses can thrive.

Washington state dropped 13 spots thanks to a new capital gains tax. Wait. The state’s constitution bars income tax and voters last fall voted against a capital gains tax. State politicians and its citizenry may be in for a legal battle.

Pro-growth tax reforms pushed Arizona and Oklahoma up 5 spots in the past year

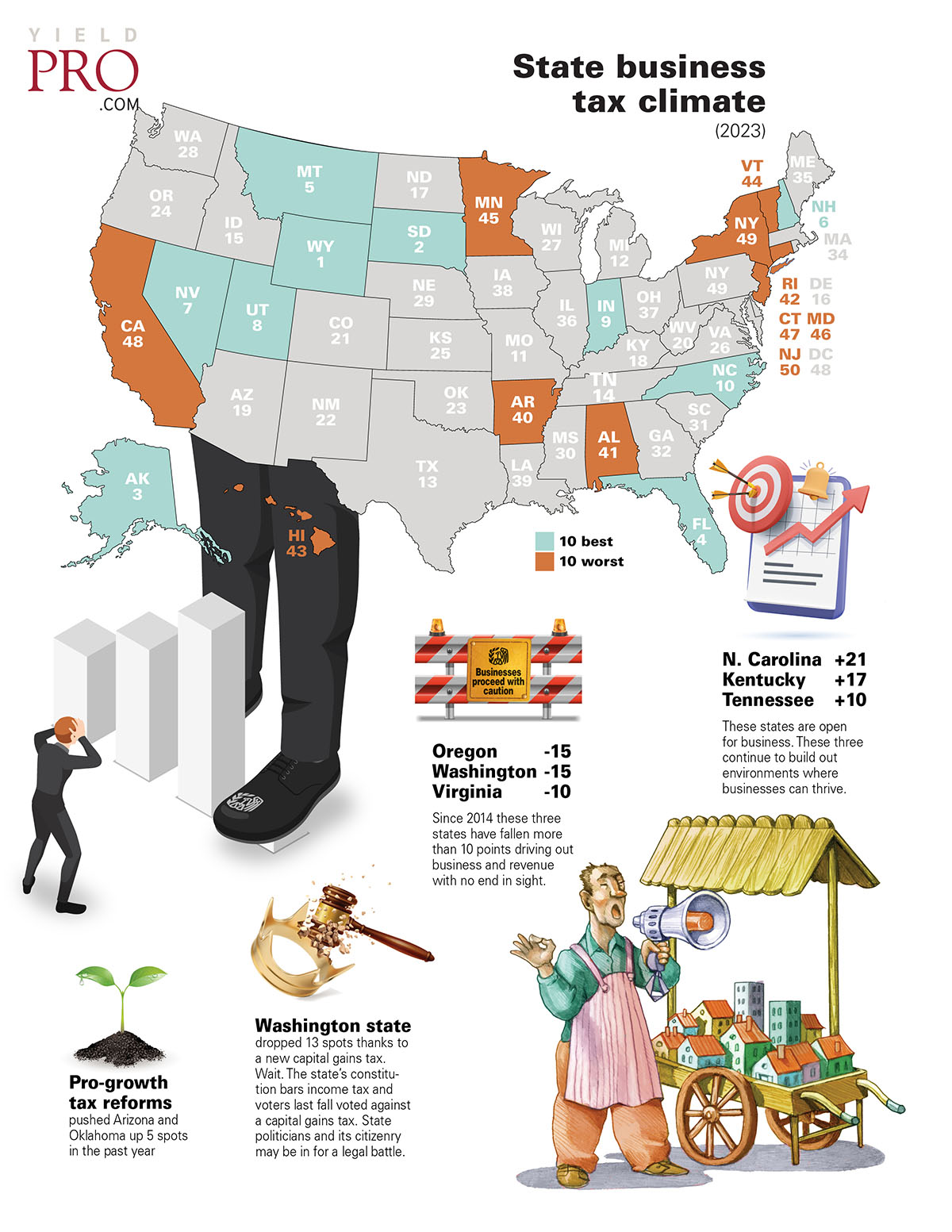

Sweeping 2017 tax laws kicked off a politically-driven annual reset of tax law nearly every year thereafter.

- 1986 Tax act reduced the corporate tax rate from 46 to 34 percent

- 2017 Tax Cuts and Jobs Act

- 2019 SECURE Act

- 2020 Families First Coronavirus Response Act, CARES Act

- 2021 American Rescue Plan, Bipartisan Infrastructure Act

- 2022 Inflation Reduction Act, Rise and Shine Act

Inflation Reduction Act gives the IRS an additional $80 billion to hire 87,000 more agents

$200 billion in additional tax revenue over the next 10 years is what the feds hope to gain.

$279 billion in 2021 alone, the federal government’s spending on improper payments.

4 of 5 IRS audits are made on incomes between $0 and $200,000 annually. Fifty-one percent of audits are on incomes between $0-75,000

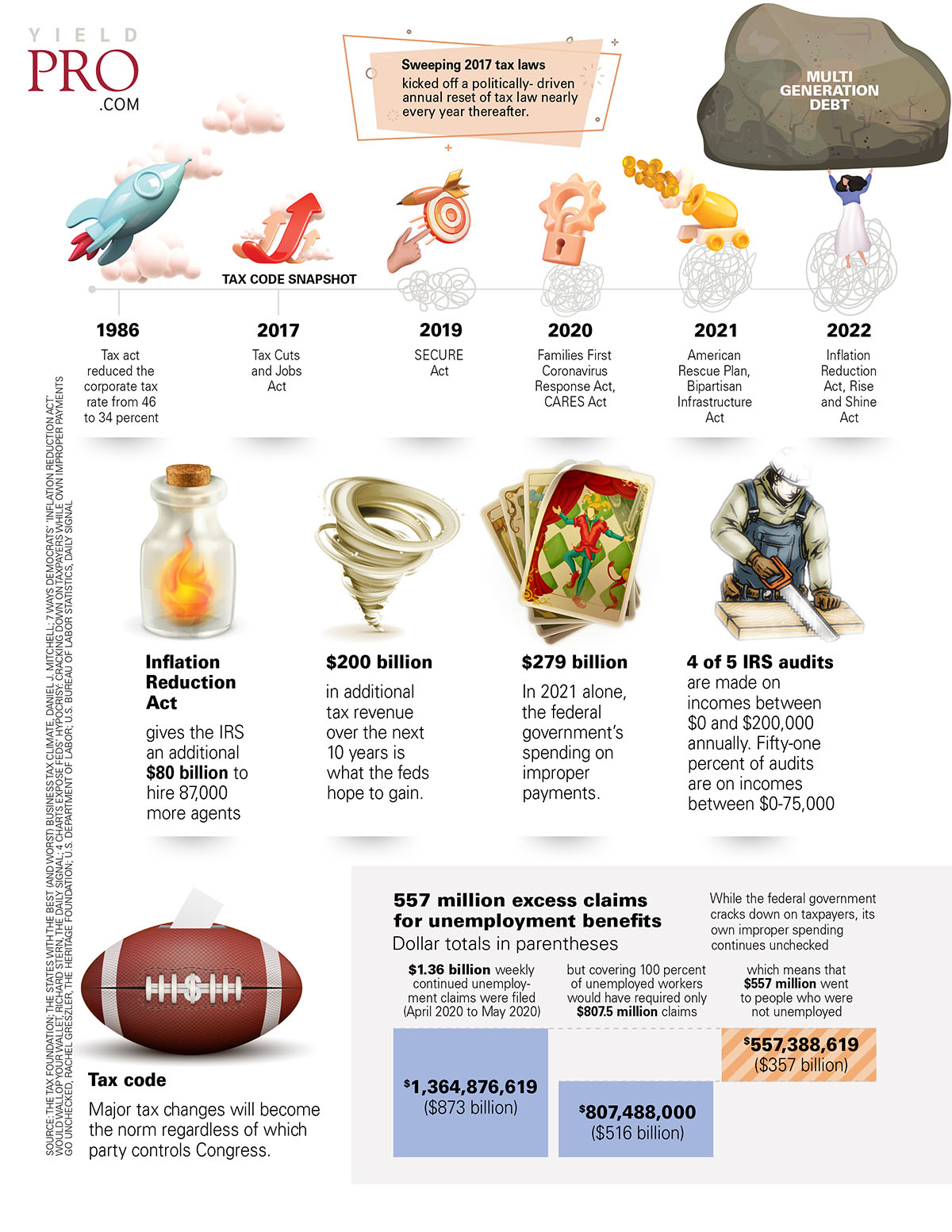

Tax code

Major tax changes will become the norm regardless of which party controls Congress. Dollar totals in parentheses.

$1.36 billion weekly continued unemployment claims were filed (April 2020 to May 2020) ($873 billion)

but covering 100 percent of unemployed workers would have required only $807.5 million claims ($516 billion)

While the federal government cracks down on taxpayers, its own improper spending continues unchecked which means that $557 million went to people who were not unemployed ($357 billion)