Three reports, two from Trepp and one from the Mortgage Bankers Association (MBA) show that loan delinquencies and other signs of stress are growing for commercial mortgages, although from low levels in the case of multifamily loans.

Distress definitions vary

The MBA report is issued quarterly and the latest version provides data through Q4 2022. It covers commercial property lending by Fannie Mae and Freddie Mac as individual entities and also by issuers of commercial mortgage-backed securities (CMBS), life insurance companies, and banks and thrifts as classes of lenders. The report does not separate out reporting on loans on multifamily properties from other commercial property types.

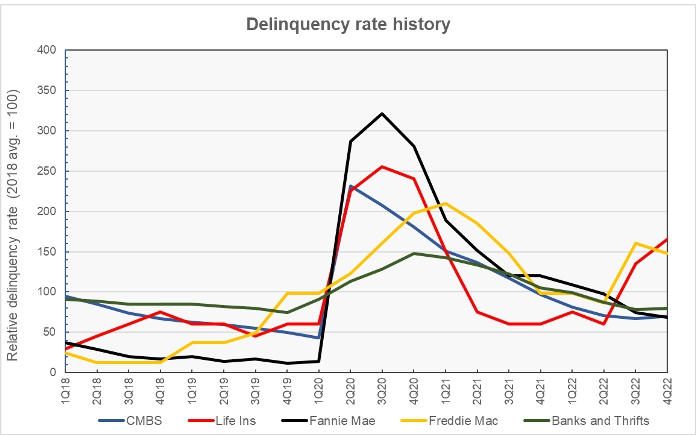

MBA notes that the standards that these various classes of lenders use in assessing whether to report a loan as delinquent vary widely. Therefore, the absolute delinquency rates reported by the different lenders are not directly comparable. Because of this, the first chart, below, shows the relative delinquency rate history for the lenders covered in the MBA report. The data displayed is normalized so that the average quarterly delinquency rate for each of the lender classes over the time period covered by the chart is set to a value of 100.

The chart shows that the portion of loans that were classified as delinquent rose sharply when the pandemic-inspired shutdowns were imposed in the Spring of 2020. However, delinquency rates have been falling since 2021. However, in the last two quarters, delinquency rates have risen significantly for Life Insurers and for Freddie Mac. In the latest quarter, delinquency rates also edged up for CMBS and for Banks and Thrifts.

Only Fannie Mae has not seen its delinquency rate move higher in recent quarters but delinquency rates for its loans are much more elevated relative to their pre-pandemic levels than are the rates for the other classes of issuers.

By the numbers, the reported delinquency rates in Q3 2022 were 2.90 percent for CBMS, 0.11 percent for life insurance companies, 0.24 percent for Fannie Mae, 0.12 percent for Freddie Mac and 0.45 percent for banks and thrifts.

Trepp focuses on CBMS

The Trepp reports are issued monthly with the latest versions providing data through February 2023. They only look at CMBS loans but break out results by the type of property covered by the loans.

The Trepp delinquencies report lists the portion of loans that are 30 or more days delinquent. Trepp found that the delinquency rate on loans on multifamily property in February was 1.83 percent, up from 1.56 percent in January but down from 2.17 percent in December. One year ago, the delinquency rate on CMBS loans for multifamily property was 1.51 percent.

The other property types whose CMBS loan delinquencies were examined were industrial, lodging, office and retail. Delinquency rates for industrial and lodging were effectively unchanged for the month at 0.40 percent and 4.45 percent respectively. Delinquencies on CMBS loans for office properties rose from 1.83 percent in January to 2.38 percent in February while delinquencies for CMBS loans on retail properties rose from 6.58 percent in January to 6.75 percent in February.

Trepp also issued a report on special servicing rates in February for CMBS loans. It found that special servicing rates rose between January and February for loans on multifamily and office properties. February special servicing rates on multifamily CMBS loans rose to 2.70 percent, up from 2.27 percent in January and from 1.95 percent one year ago.

The full MBA report includes definitions of how each class of lender defines a delinquent loan. It can be found here, while the full Trepp delinquency report can be found here while the Trepp report on special servicing rates can be found here.