JLL Capital Markets announced that it has closed the $13.1 million acquisition financing for The Independent, a Class A, 61-unit multihousing asset located in Sand City, California within Monterey County.

JLL marketed the property on behalf of the borrower, Diversyfund, to secure a fixed-rate loan through a life insurance company.

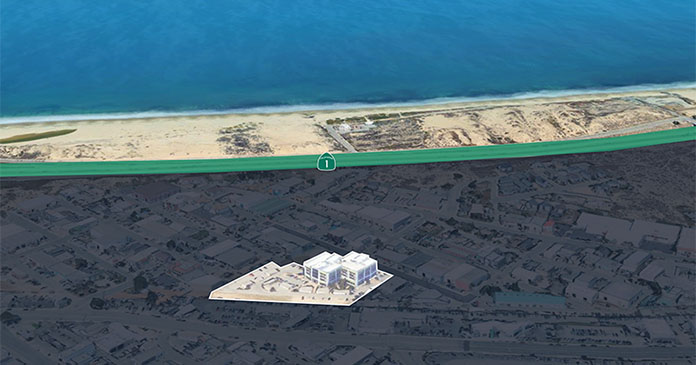

Built in 2008 and renovated in 2014, The Independent offers a mix of modern studios, one-bedroom and two-bedroom units with stainless steel appliances, granite countertops and modern cabinetry. Community amenities include a courtyard, carports and garage parking. Further upside from the property comes from the 11,000 square feet of vacant commercial space and the opportunity to develop additional units on the underutilized, excess land included with the purchase.

Situated at 600 Ortiz Ave., the property is walking distance to Monterey State Beach and less than ten miles away from the famous Pebble Beach Golf Courses and Monterey Bay Aquarium. Sand City is set on the shores of Monterey Bay, offering a high quality of life with proximate boutiques, fine dining, art galleries, shops and cafes.

“The Independent represents a unique investment opportunity to purchase a great asset in a supply-constrained coastal California market below replacement cost. Real estate is truly a team sport, and we couldn’t have asked for better partners than JLL and Eagle Realty Group on this acquisition,” said Isaac Dixon, Senior Vice President, Real Estate at DiversyFund.

The JLL Capital Markets Debt Advisory team was led by Managing Director Bryan Clark and Associate Brad Vansant.

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients—whether investment sales and advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.