The Mortgage Bankers’ Association (MBA) recently released its Q4 2022 quarterly databook which contains updated forecasts for key economic metrics through 2025. It still predicts that an economic downturn will begin in Q1 2023.

What’s ahead for the economy

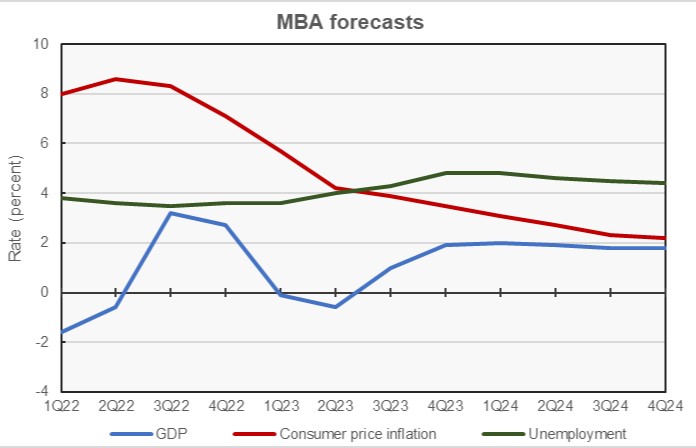

The first chart, below, contains the MBA’s forecasts for several key economic metrics. The MBA provides quarterly forecasts through the end of 2024 and annual forecasts through 2025.

The MBA forecast calls for slightly higher GDP to end 2022 than had their prior forecast. While the current forecast also raises the GDP outlook in Q1 and Q2 of 2023, it still calls growth to be negative in those quarters. This is a little surprising given that the GDP Now data from the Atlanta Fed and revised forecasts from other sources such as Fannie Mae call for positive growth in the first part of 2023. The MBA forecast calls for positive growth to return in Q3 2023 and for growth to remain positive, if subdued, through the end of 2024.

By the numbers, the MBA is calling for GDP growth of 0.9 percent in 2022, up from the 0.3 percent forecast last quarter. Growth in 2023 is forecast to be 0.5 percent, up from the prior forecast of 0.1 percent. The GDP growth forecast for 2024 was revised up 0.1 percentage points to 1.9 percent and the GDP growth forecast for 2015 was revised upward by 0.2 percentage points to 1.8 percent.

The MBA believes that inflation peaked for this cycle in Q2 2022. They expect consumer price inflation to decline through the end of 2024. However, their predicted inflation rates for Q2 2023 through Q3 2024 are higher than those forecast last quarter by up to 1 percentage point.

By the numbers, the MBA is calling for Q4 year-over-year consumer price inflation of 7.1 percent in 2022, 3.5 percent in 2023, 2.2 percent in 2024 and 2.0 percent in 2025. These are revised from rates of 7.0 percent in 2022, 3.0 percent in 2023, 2.3 percent in 2024 and 2.1 percent in 2025 forecast last quarter.

The Q3 databook predicts that the unemployment rate reached its lowest point in this cycle in Q3 2022. It is then predicted to rise as the economy slows down, peaking at the end of 2023. Unemployment now is expected to be 4.2 percent in 2023, down from the 4.8 percent forecast last quarter. It is now expected to rise to 4.6 percent in 2024, compared to the 4.8 percent forecast in last quarter’s databook. The unemployment rate forecast for 2025 is unchanged at 4.2 percent.

Interest rates cuts to come sooner

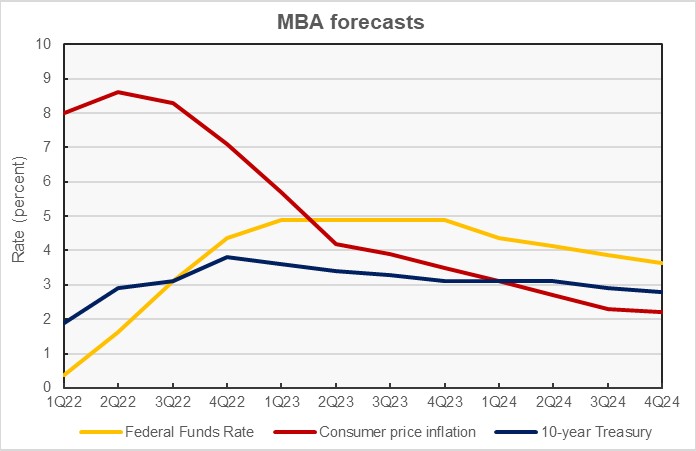

The MBA forecasts for two key interest rates are plotted in the next chart, along with that of consumer price inflation for reference.

The new forecast for the Federal Funds rate is unchanged from last quarter’s forecast through the end of 2023. However, the current forecast calls for the Fed to begin cutting rates in Q1 2024, one quarter earlier than predicted last quarter.

The chart shows that a rate inversion between the 10-year Treasury and the Fed Funds rate began in Q3 2022 and is expected to persist through 2024. This inversion is often an indicator of an upcoming economic downturn.

Assessing apartment market data

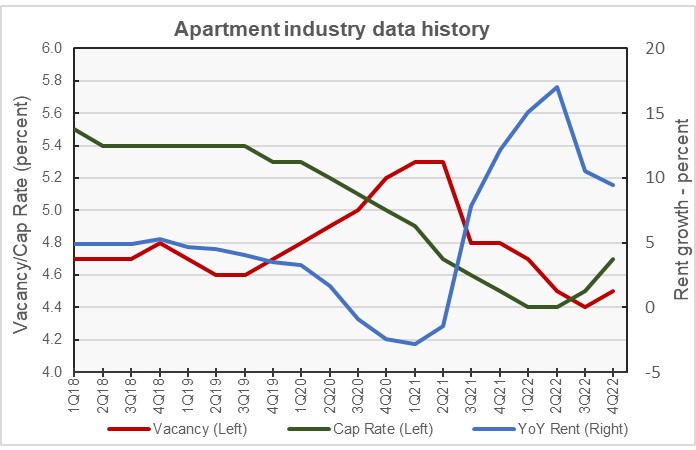

The report also includes historical data on closely tracked industry metrics. These are shown in the next chart, below. The data are plotted on different scales so that the relations between the changes in the metrics are more visible. The most recent data on these metrics is for Q4 2022.

The data quoted by the MBA, which is sourced from REIS, indicates that the vacancy rate reached its post-pandemic high point in early 2021 and has been falling until recently. The current MBA databook indicates that the vacancy rate rose in Q4 2022, the first rise since Q1 2021. A rise in vacancy rates is consistent with data being reported by other sources, although the timing of the rise varies by data source.

The MBA report shows the year-over-year rent growth rate has fallen recently after its post-pandemic surge. The year-over-year rent growth rate has declined in each of the last two quarters reaching 9.5 percent in Q4 2022.

The chart also shows the cap rate for multifamily property. A revision to last quarter’s data indicates that cap rates ticked up slightly in Q3 2022. That trend continued in Q4 with cap rates rising to 4.7 percent. However, the discussion in the databook indicates that commercial property trading data is thin and so some results are more than usually subject to future revisions.

The full databook contains data on mortgage originations and on holdings that has been previously discussed. It also contains information on lending for other commercial property types and on real estate sales activity. The report can be found here.