Newmark announces the sale of 316-unit, luxury multifamily property in Austin’s Hill Country

Newmark announces the sale of Estates at Bee Cave, a 316-unit luxury multifamily asset in suburban Austin. The property is located at 3544 South FM 620 Road in Texas’ Hill Country. Newmark Vice Chairman...

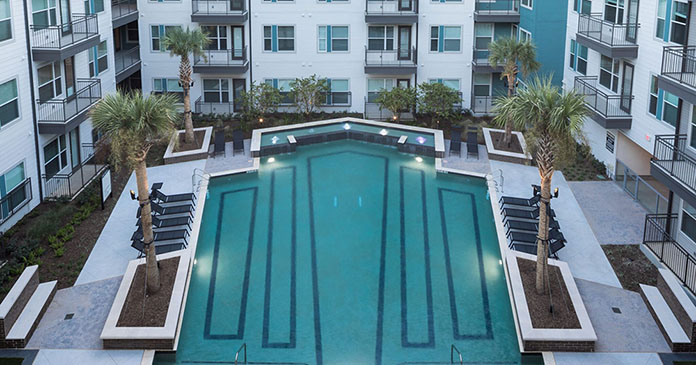

The Praedium Group acquires Lenox Grand Crossing in Houston, Texas

The Praedium Group, a national real estate investment firm, has acquired Lenox Grand Crossing, a newly constructed 330-unit multifamily asset located in Katy, Texas in the Houston MSA. Peter Calatozzo, Principal at The Praedium...

West Shore acquires asset in Fort Worth, Texas

West Shore LLC, a multifamily real estate investment firm, continues to expand with the acquisition of The Sovereign, a luxury apartment community in Fort Worth, Texas. This is West Shore’s fifth acquisition in Texas,...

TruAmerica Multifamily expands Texas footprint to San Antonio with acquisition of 270-unit apartment community...

TruAmerica Multifamily has grown its Texas portfolio to nearly 1,500 apartments in less than nine months with its first acquisition in San Antonio, the 270-unit The Estates at Canyon Ridge for $46.7 million. The Estates...

Institutional Property Advisors closes mixed-use asset sale in San Antonio

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of The Mosaic on Broadway, a 120-unit multifamily complex with 15,593 square feet of retail in San Antonio, Texas. “The Mosaic on...

Institutional Property Advisors finalize Northwest San Antonio apartment asset sale

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Axis at The Rim, a 308-unit apartment property in The Rim, a master-planned, mixed-use development in the Forest Crest neighborhood...

Berkadia arranges financing for July Residential’s acquisition of a 1,275-unit multifamily portfolio in Houston

Berkadia announces it has secured financing for July Residential’s acquisition of a 1,275-unit multifamily portfolio of communities located in Houston, Texas. The five assets in the property, all built between roughly 1976 and 1983,...

PCCP, LLC provides $70.7 million loan to Galium Capital for the acquisition of Millennium...

PCCP, LLC announced it has provided a $70.7 million senior loan to Galium Capital for the acquisition of Millennium High Street, a 340-unit Class A multifamily project with 26,304 square feet (sf) of ground...

Luxury Dallas mid-rise apartment building acquisition financed

JLL Capital Markets announced that it has arranged an acquisition loan for Alexan on Ross, a 292-unit, luxury, mid-rise, Class A+ multihousing community in the growing Ross Corridor Dallas, Texas. JLL worked on behalf of...

Seniors housing portfolio in the Dallas-Fort Worth area sold

JLL Capital Markets announced that it has closed the sale of an active adult portfolio consisting of two newly built, age-restricted (55+) multihousing properties totaling 360 units located in the Dallas-Fort Worth MSA in...

FCP and VaultCap Partners acquire again in Grand Prairie, Texas with acquisition of 100-unit...

FCP and VaultCap Partners have followed their July 2021 acquisition of Corey Place Apartments with the purchase of the adjacent 100-unit Prairie Ridge Apartments. The venture plans to combine the properties under a new name,...

Livingston Street Capital expands Texas footprint with acquisition of active adult portfolio totaling more...

An affiliate of Livingston Street Capital, a boutique private equity firm focused on commercial real estate investments throughout the U.S., has acquired a portfolio comprising two Active Adult (55+) multifamily communities totaling 402 units...

Knighthead Funding provides $59.5 million for mixed-use condominium development in Austin, Texas

Knighthead Funding LLC (Knighthead) has provided a joint venture between Austin-based developer Pearlstone Partners (Pearlstone) and New York City based ATCO with $59.5 million in financing for the construction of a mixed-use condominium development...

DLP Capital acquires 200-unit multifamily in Jonesboro, Arkansas

DLP Capital, a private financial services and real estate investment firm, announces the acquisition of Stadium Place, a 200-unit multifamily property, located in Jonesboro, Arkansas. The addition of the community, which will be renamed...

Marcus & Millichap completes multifamily asset sale in Dallas/Fort Worth Metroplex

Marcus & Millichap, a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced the sale of Rio Vista, a 246-unit apartment asset in the northeast suburbs of...