Unprecedented apartment supply is dampening favorable demand trends, according to RealPage Analytics. Many owners report lease-up demand does not feel strong at the property level, despite positive demand.

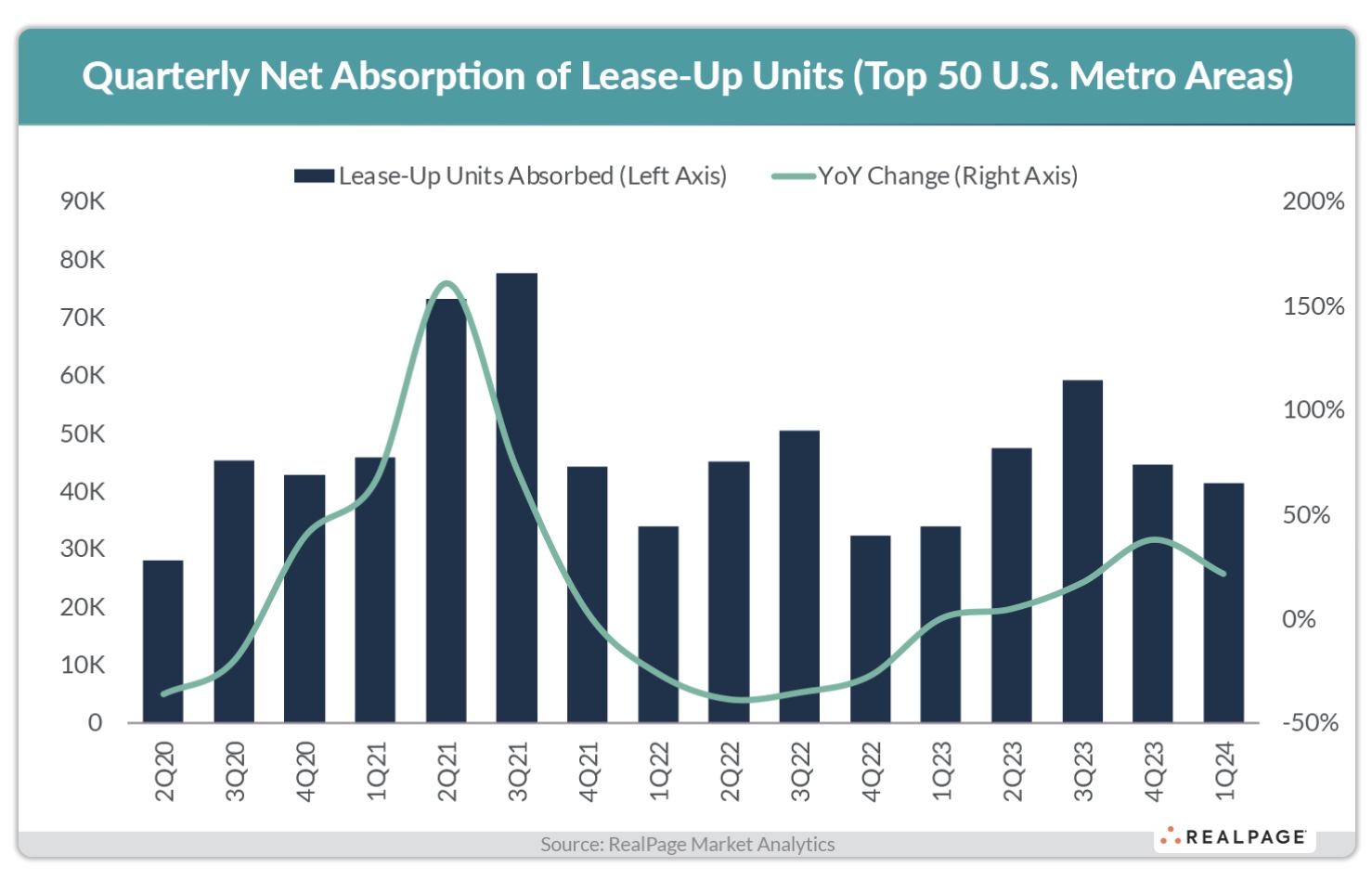

Year-over-year national apartment demand tripled in Q1 2024, but higher than average demand was still unable to keep pace with the unprecedented wave of supply that shows no sign of slowing this year.

This misalignment of new supply and net absorption has pushed average occupancies lower and helped drive the availability of lease concessions back to the peak of 2020. As supply levels continue to rise and competition increases, renters will be afforded many more unit options to choose from.

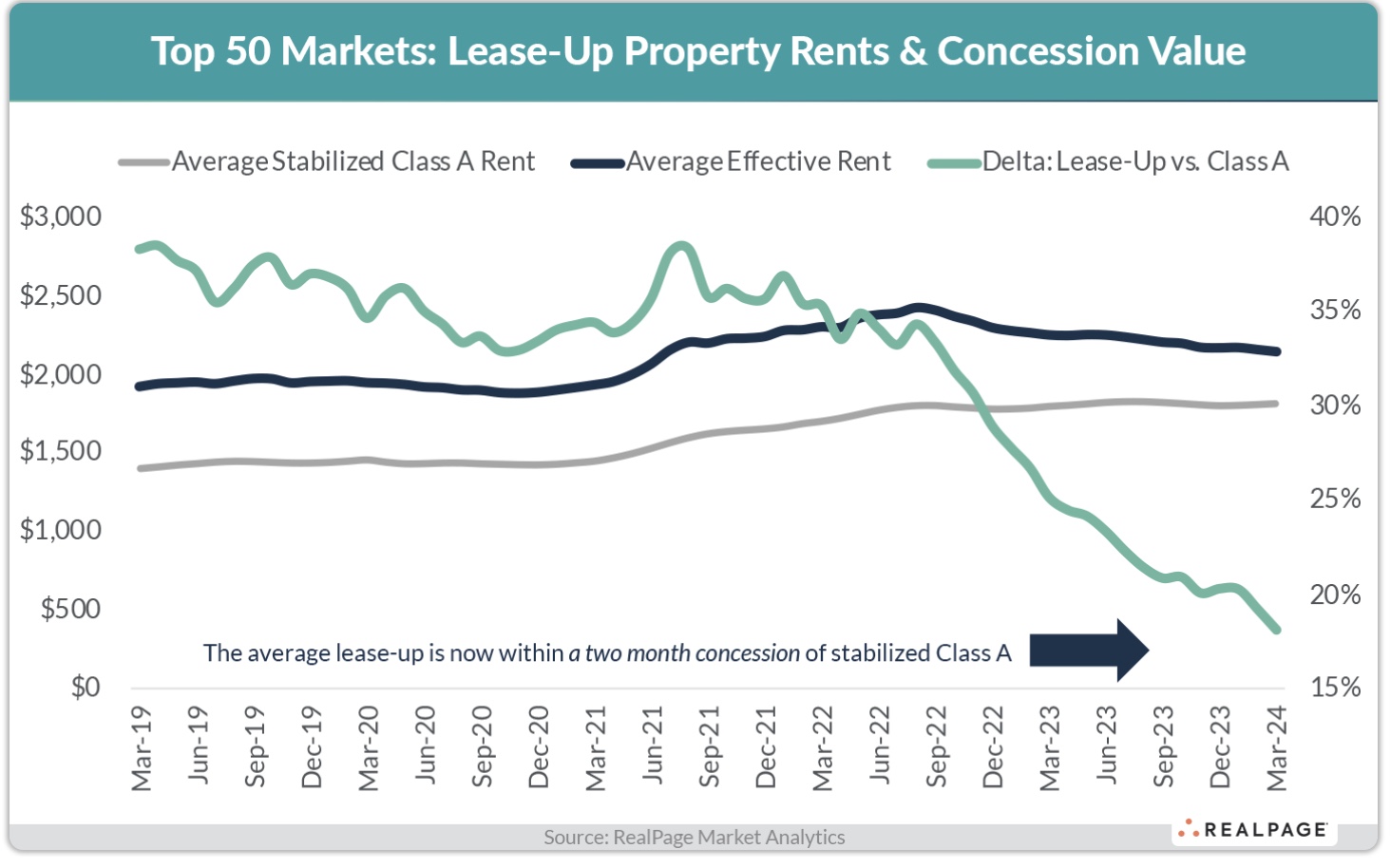

Last week we highlighted a possible trend of renters choosing to upgrade from B plus assets to new Class A units because of rent compression caused by hefty lease-up concessions. This week, RealPage predicts renters currently enjoying a Class A unit might be enticed to trade up to new luxury unit in a not-yet stabilized lease-up property, where demand trends are favorable.

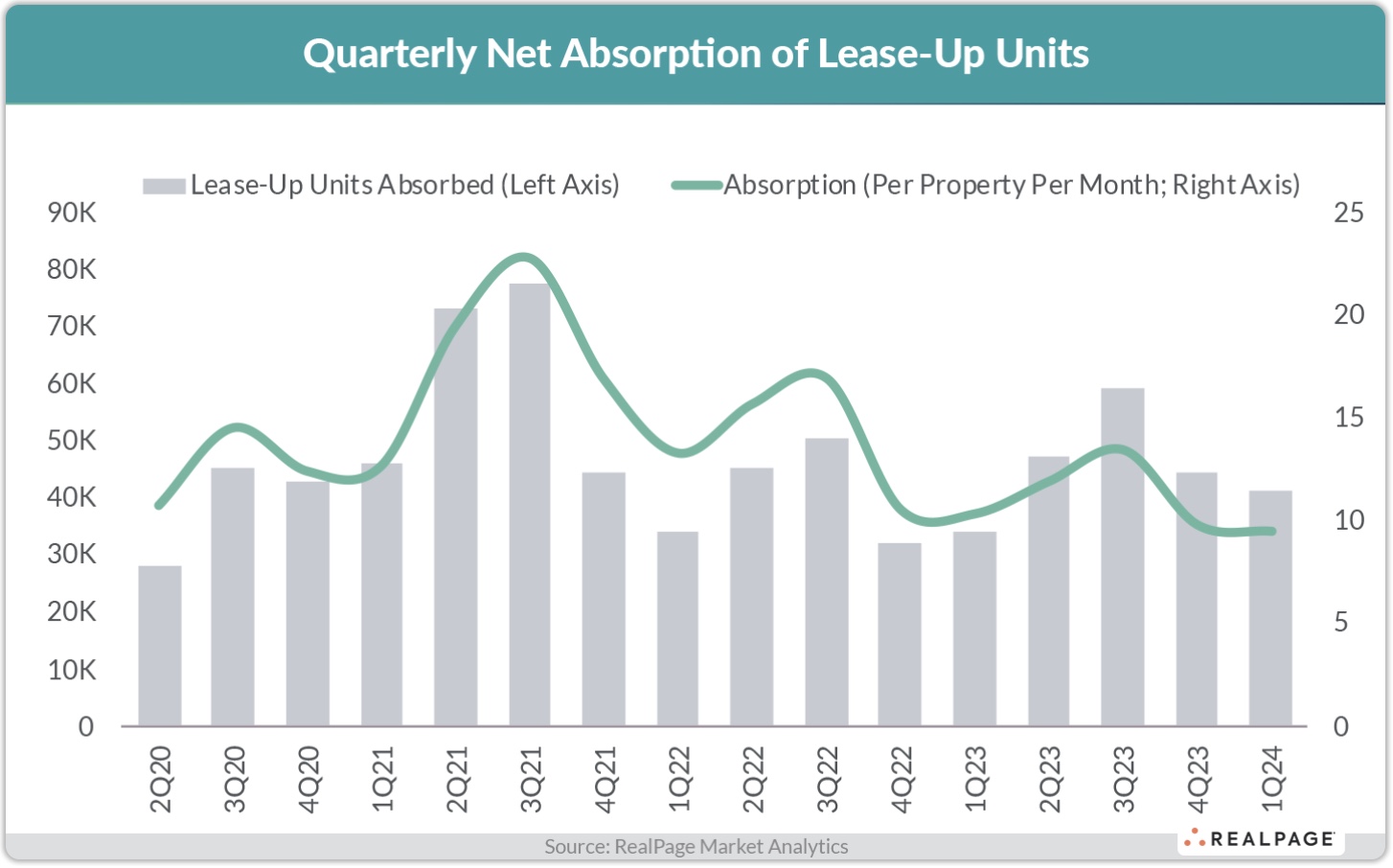

Among properties still navigating the initial lease-up phase, about 40,000 units were absorbed in 2024’s first quarter—20 percent more than volumes in Q1 2023.

The average lease-up community is executing about 10 to 11 leases per month, down 10 percent from last year, despite a 20 percent increase in overall absorption, according to RealPage Analytics data.

Even so, operators say lease-up demand at their properties does not reflect this positive data because competition from the wave of new supply is creating a disconnect between market level data and the leases that are filtering into their existing properties.

The disconnect, said RealPage, is resulting in weaker-than-average rent growth in lease-up properties under pressure to fill up as quickly as possible.

RealPage notes that while lease-up concessions haven’t gone up all that much recently, asking rents have been cut, causing a shrinking delta between Class A and lease-up rents.

“Because of that, there’s only a difference of two-months-worth of concessions between a Class A asset and a lease-up property,” said RealPage, adding that it’s not a huge leap to imagine someone choosing a lease-up unit over their current Class A property as competition increases.