The ugly had its way with the sub-prime mortgage market early this year, when many of that sector’s loans began to go sour. The real estate industry started to feel the full-squeeze effects of a credit crunch by early July.

Although defaults in the home-sales market haven’t spilled over into the multifamily and commercial real estate (CRE) arenas, the implosion of the conduits, which had been responsible for around 46 percent of all originations in 2006, are clearly a credit issue and have had a huge impact on CRE. And, more change is in the wind. “There are a number of things going on in the multifamily sector and some are creating demand and some are creating competition,” said Jamie Woodwell, Mortgage Bankers Association senior director for commercial and multifamily research, last month.

First, the single-family housing market has a ways to go on the downward slope, with more foreclosures on the horizon. Both the MBA and the National Realtors Association expect defaults on subprime home loans to peak in Q3 2008, while some pessimistic pundits predict the failed loan scenario could last through the end of the decade.

The increase in the jobless rate that rose to a one-year high of 4.7 percent last month, isn’t good news to any residential investor. Job loss, led by growing unemployment in the housing industries, which in February lost 11,000 jobs, could snowball as fallout from rising borrowing costs and declining home prices negatively impact consumer spending, causing other companies to cut back on hiring. It still adds up to a mixed bag for multifamily rental.

“Apartment occupancies are driven by employment, so layoffs are not good news. Jobs create households and households create apartment occupants,” said Howard Smith, chief operating officer of Green Park Financial, a multifamily lender focused on Fannie Mae Delegated Underwriting and Servicing (DUS) program. A soft job market and defaulted loans could lead to economic recession and declines in apartment rents and occupancies, reminiscent of the dot com bust seven years ago. Areas like Detroit and Cleveland already are feeling the pinch.

On the other hand, apartment fundamentals look strong, bolstered by the number of first-time home buyers who are opting to stay in their rental units until the dust settles in the for-sale housing market.”We’ve had strong property performance, strong price increases and a ready supply of capital. All have been big factors in the sector’s performance. We put out an article last January referring to the period as the ‘perfect calm,’ with all of those factors creating a great situation for commercial and multifamily real estate,” said Woodwell.

“Household formation often follows economic growth and job growth, and between 1995 and 2005, the U.S. added about 10 million households, which is a great thing. But, because of the move to home-ownership, there was no net increase in demand for rental property, either single or multifamily, so the rental markets went through a flat demand cycle. Since 2005, we’ve seen household growth again leading to demand for rental properties, and we’ve seen growth in that rental demand that we hadn’t seen in the previous decade. But, there have also been changes in supply. Given some of the disruption in the single-family market, the multifamily market is now facing increased competition from vacant single-family homes. So, you end with increased demand for, and increased supply of, rental properties,” he said.

But good news rules for multifamily, right now. The experts expect vacancy rates in the fourth quarter to average 5.9 percent, unchanged on a year-over-year basis from 2006, with the lowest vacancies, averaging around 2.7 percent or less, occurring in Northern New Jersey, Philadelphia, Pittsburgh, Minneapolis, Nashville and Los Angeles. Although the average 4.1 percent increase in rent that occurred in 2006 will be impossible to match this year, average rents are expected to increase 2.9 percent by the end of 2007 and 3.8 percent in 2008.

According to the NAR, multifamily transactions in the first seven months of this year totaled $46.3 billion, compared with $41.5 billion during the same period last year, with private investors making up half those purchasers and condo converters accounting for about three percent.

Look for apartments to be the winner in the commercial real estate space. Transwestern, a privately held, national commercial real estate firm with offices across the country, sees the ten-year siege of cap rate compression ending and price appreciation coming from improving cash flow, now that condo converters are out of the game. Investors that buy rental properties on fundamentals, but have been priced out of the market over the past four or five years, just may have their day in the sun. Cash is king, and institutional investors and those who use little or no leverage are in the driver’s seat. In addition, apartment developers and owners of existing product might benefit from postponed development projects now struggling for sponsorship and financing.

But, there’s still plenty of capital out there for multifamily deals that make sense, say DUS lenders like Green Park Financial and diversified investment banks like AFC Realty Capital. The deals simply are becoming tougher to close, with credit standards tightening and highly leveraged transactions becoming a thing of the past, as the lending industry returns to a focus on basic underlying real estate fundamentals.

“Some terms are no longer available. The interest-onlys, while not completely done away with, are certainly reduced,” said Smith, who expects his firm will close $1.3 billion in transactions this year.

Mezzanine financing is taking a bigger role as senior debt becomes a smaller piece of the financing pie. “Instead of having a one-stop- shop in terms of one lender who does all the capital needed, it’s back to the more traditional way of there being several different levels of capital, from first mortgage through the equity requirements, to get a deal done. Where first mortgage lenders used to stretch up to maybe 85 percent, now they’ve backed off a bit, so that space has been taken up by mezzanine lenders,” said Michael Sonnabend, a principal with AFC Realty Capital.

“There’s been a real ratcheting down of that aggressive style within the last couple of days and weeks,” adds AFC Realty Capital President Arthur Fefferman. “Many mainstream lenders have gone to the sidelines because their existing portfolio is full. They are struggling to get out of the deals they have and aren’t taking any new transactions until they sort things out.” Fefferman also sees a fairly significant change in the cost of capital.

“Construction financing lenders were providing capital at 150 to 200 basis points over LIBOR. Recognizing their situation, their spreads increased by at least 100 basis points on some transactions, primarily more leveraged ones. A specific example of that is conduits, which, for fixed rate multifamily, were historically more aggressive in rate and dollar than Fannie Mae. But, today the reverse is happening. Fannie Mae has stepped up to the plate and has become a much more rate-efficient lender. Fannie’s rates are more attractive and less costly than the conduits probably by about 50 basis points,” said Fefferman.

But even Fannie Mae and Freddie Mac increased their loan rates by 15 to 30 basis points, depending on the loan, in response to rate increases by the conduit lenders, while increasing their loan volumes by around 15 percent. Smith says much of that volume in the first part of this year was with specialty products like large structured finance transactions, seniors’ loans, and manufactured housing.

And, he agrees that the playing field is changing. “Clearly the CMBS lenders are out of the market right now as a group. There may be six to 10 that are still doing business, but they are doing business much more conservatively and at higher interest rates then they were previously. That’s given Freddie and Fannie a chance to go and get market share back, and it’s an opportunity for insurance companies, which are lending money out of their general accounts to do that, as well. We’ve seen some regional banks that don’t have a subprime problem also making other investment loans,” said Smith, who finds it ironic that, after suffering so much scrutiny and criticism from regulators and legislators, Fannie Mae today is one of the few entities that can actually help in the wake of the subprime turmoil. “Fannie Mae decided not to go into the subprime business. They didn’t think that fit the risk profile of their charter, so right there is evidence of some pretty good decision making,” said Smith.

He thinks the bulk of Fannie Mae’s activity as the year wraps will be focused on the standard flow refinance business, “depending on how much of that has been defeased from the business that was done 10 years ago. They also have an acquisition and rehabilitation product that they use with mezzanine debt that could be fairly active,” he said referring to Fannie Mae’s Mezzanine Moderate Rehab program geared for the affordable housing sector. “But I think they both will pale in comparison with structured finance stuff, like portfolio transactions, or like the Tishman Speyer buyout of Archstone-Smith,” he said.

Fannie Mae launched several new products recently. The Mezz-Mod Rehab program provides a new tool for owners seeking to increase operating performance of assets with material enhancements. Financing for value- add previously has been limited to small bank loans, which seldom provide long-term rate locks.

That program, geared toward affordable properties undergoing rehabilitation with cost of $5,000 to $20,000 per unit, combines a maximum 80 percent loan-to-value Fannie Mae DUS loan with mezzanine financing for a combined leverage up to 95 percent loan-to-value or loan-to-cost. The flexible mezzanine loan can be funded 100 percent at closing or through draws over the rehabilitation period. Eligibility requires that 60 percent of the units be affordable to families or individuals earning no more than 100 percent of area median income, a requirement most apartment assets can meet.

“Clearly there is an aging apartment stock nationally, and it’s got to be updated. This is one way of getting additional capital into the housing stock,” said Smith, who notes that value-add makes sense in today’s market, where new construction is hard to pencil. “With the high cost of construction and what you can charge in rent, there doesn’t seem to be much basis for being more active in new construction,” he adds.

Another Fannie Mae product, released last November, is the single- asset substitution program, allowing borrowers to replace the original Fannie Mae DUS-mortgaged property with another mortgaged property while keeping the existing DUS loan in place. The product offers borrowers an alternative to prepayment and the flexibility to hang on to attractive financing, an option that in the past was only available for a pool of loans.

Smith expects to close $1.3 billion in Fannie Mae DUS loans this year. And, while he says Green Park Financial still is a 50 to 80 percent loan-ta-value lender, the company’s debt service coverage (DSC) ratios are becoming increasingly conservative.

Several of the company’s recent deals highlight the typical and the unique. The $9 million refinancing for the 66-year-old, 426-unit Jetu Apartments in the northeast sub-market of Washington, D.C., represents a fairly normal deal, despite its seven-year term. The first six years of the loan are fixed at 5.75 percent and a seventh year floats at 240 basis points over LIBOR. The loan was underwritten to a 63 percent loan-to-value with a 1.43x DSC ratio and a seven percent cap rate. The property owner invested $1 million in 2001 toward capital improvements to upgrade the interior and exterior of the community that consists of one- two- and three-bedroom units.

The $24.4 million assumption and refinance loan for the seven-year- old, 418-unit Franciscan of Arlington apartments in Arlington, Texas, is an example of a transaction where the borrower acquired the property, assumed the existing loan, prepaid the debt and refinanced. Green Park Financial structured the loan as a ten-year term with full interest only and underwritten to a 72 percent loan-to-value with 1.20x DSC ratio and a 6.25 percent cap rate. At closing, occupancy at the property had increased to 92 percent.

Fefferman thinks AFC Realty Capital will close around $250 million of multifamily transactions this year, about the same as last year. “Largely, they will be for-sale residential,” he said, noting location is the key in that space. “Some for-sale markets are really in trouble and the pace of sales are challenged-Miami, Las Vegas and the Midwest, for other reasons such as the sluggish economy and auto industry,” he said, adding that lenders can no longer paint with a wide brush.

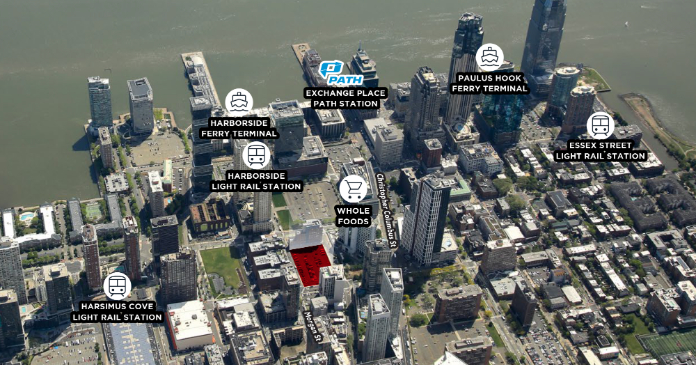

The markets Fefferman likes include Philadelphia, New York City and the Gold Coast of New Jersey, all locations where his company has for- sale projects working. One such deal is the conversion of a former Beaux Arts-style church in Harlem into a 22-unit condo development called Rhapsody on Fifth. Units are priced at $750 per sq. ft., or from $600,000 for ones to $1.5 million for the penthouse. “Harlem is one of the emerging markets,” said Fefferman. “Harlem is hot, and it’s defying the norm and quickly gentrifying. Given the fact it’s a good market, we were able to put together financing. That development, under construction with occupancy scheduled for January 2008, runs a cost of around $20 million, soup to nuts, and it’s about 50 percent sold out. Not only did we provide financing, but an AFC Realty affiliate is a joint venture partner on the deal,” he said.

AFC is partnering on a similar project, called Cherry Street West, in the Center City sub-market of Philadelphia to transform a parking lot, located within walking distance of a commuter rail line, restaurants and shopping, into the $40 million development of 43 townhouses, restaurants and shopping. The four-story, three- and four-bedroom townhouses are priced to sell from the $900,000s to $1.3 million. “We’re also providing $40 million in financing for a project in Jersey City-a 12-story mid-rise with about 100 condos. Again, we’re testing the market in this environment and, given its location, demographics and demand, a lender will stretch to do this transaction because the economics are solidly visible and attractive,” said Fefferman, who expects value-added acquisition financing, high- leverage refinancing and redevelopment deals will be the bulk of the loans in commercial real estate this year.