A large part of the problem is that banks are skittish about offering loans to anyone other than those with immaculate credit and rock solid employment. The prevailing fear is that prospective borrowers might fall into the same pattern of default and foreclosure.

According to real estate research and consulting firm First American CoreLogic, more than 11 million mortgages are “underwater”, meaning that the amount owed to the bank is greater than the value of the home. Meanwhile, foreclosures continue at a rate of more than 300,000 a month. RealtyTrac reports that foreclosure activity climbed in 75 percent of the U.S.’s major metro areas during the first half of the year.

Even all-time low mortgage rates don’t seem to help. Freddie Mac announced Thursday that the rate on a 30-year fixed home loan has dropped to 4.54 percent—the lowest level since 1971 when the agency began measuring the rate. Yet another disappointment has been the Obama Administration’s $40 billion Making Home Affordable program, which aimed to keep three to four million Americans who face foreclosure in their homes. In June, the government reported that 1.3 million homeowners have received trial modifications under the program. However, only 300,000 of those modifications had become permanent. And only a tiny part of the money earmarked for the program has been spent.

As each month passes, it becomes clearer that unemployment is the single greatest cause of high foreclosure rates and falling home prices. The correlation between cities with high jobless rates and extremely high foreclosures is stunning.

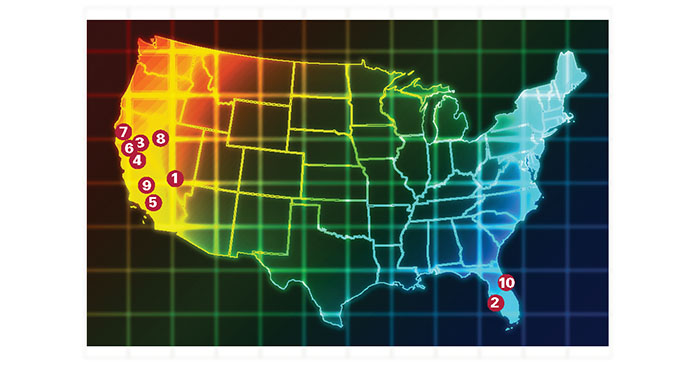

The 10 worst real estate markets in the country each had unemployment levels above 12 percent in June. Two cities in California, Merced and Modesto, had jobless rates above 17 percent, nearly twice the national average of 9.6 percent.

The foreclosure rates from RealtyTrac are based on the number of housing units out of 100 in a metropolitan area that received a foreclosure notice during the first half of the year. The national average for the six months was 1.28 out of 100. In the ten worst real estate markets, however, each city had a rate of over 3 out of 100. The highest rate was in Las Vegas at 6.6 homes per every 100.

Not so surprisingly, cities in Nevada, Florida and California, dominate the list of worst real estate markets. These are states that have been hit particularly hard by layoffs, especially in construction. California has also been firing state workers and has sharply cut what it pays state contractors. The gaming business in Nevada has been hurt by a drop in discretionary income among those likely to spend money in Las Vegas and Reno. Florida has a population made up of a large number of retirees, some of who had to return to work, or attempt to, because their savings was upended when the stock market fell in 2008-early 2009. The 10 worst real estate markets in America are:

1. Las Vegas-Paradise, Nevada

Unemployment Rate: 14.5%

Foreclosure Rate: 6.6%

2. Cape Coral-Fort Myers, Florida

Unemployment Rate: 13%

Foreclosure Rate: 4.98%

3. Modesto, California

Unemployment Rate: 17.3%

Foreclosure Rate: 4.59%

4. Merced, California

Unemployment Rate: 18.1%

Foreclosure Rate: 4.47%

5. Riverside-San Bernardino

-Ontario, California

Unemployment Rate: 14.4%

Foreclosure Rate: 4.37%

6. Stockton, California

Unemployment Rate: 16.5%

Foreclosure Rate: 4.37%

7. Vallejo-Fairfield, California

Unemployment Rate: 12.2%

Foreclosure Rate: 3.91%

8. Reno-Sparks, Nevada

Unemployment Rate: 13.6%

Foreclosure Rate: 3.76%

9. Bakersfield, California

Unemployment Rate: 15.7%

Foreclosure Rate: 3.67%

10. Port St. Lucie, Florida

Unemployment Rate: 13.4%

Foreclosure Rate: 3.05%

Author: Douglas A. McIntyre, Daily Finance