Alliance Residential, which opened its first regional office in Sunshine State just before the economy took a dive, is seeing some serious development activity after several years of patiently waiting for the battered market to recover.

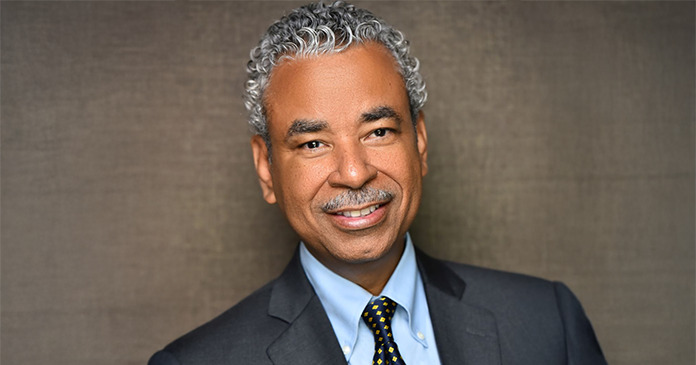

“It’s been a difficult two or three years here, but I think we’re at the beginning of an upward curve in the recovery and the start of the next cycle,” said Michael Ging, Alliance’s managing director for Florida, who opened the 10-year-old Phoenix-based multifamily real estate company’s easternmost office in Boca Raton in September 2007, when he joined the firm.

At that time, Alliance was looking to enter Florida more proactively. “I had been in discussions with the senior partners and we thought that it was good timing to open the office. Actually, it was bad timing,” he admitted, with a rueful chuckle. “The capital market and housing crisis began shortly afterward and it was a downhill spiral there for a while,” he said.

“I think we’re about at the bottom right now,” he said. According to most everything he’d seen and heard this fall, the for-sale housing sector still faces some value decline. “However, the apartment industry definitely seems stable and moving upward right now,” he said in September and reiterated in late November.

“Apartments are clearly poised to lead in the commercial real estate market moving forward from here,” said Ging, who closed on the construction financing for Broadstone Citrus Village, Alliance’s second development in Florida and first in the Tampa market, a week before Thanksgiving. U.S. Bank is providing the three-year, 60 percent loan-to-cost construction loan and Alliance’s equity partner in the deal is a pension fund, Ging said, who expects IRRs for the project in the mid-20 percent range, right about where institutional investors are looking to be today.

“We feel like rents are stabilizing and starting to increase,” he said, estimating that Class A effective rents have risen at least five percent since the trough a few years ago. “And occupancies have improved, especially in the sub-markets we’re in. So, we think we’re really underwriting at the bottom of the market today and expect to move upward from here.

“It would be a different story, if we had done this at the peak of the market and had to ride that downhill. Instead, we’re starting at the bottom moving upwards, and we feel good about that,” said Ging. He expects starting rents at Citrus Village at around $1.10 sq. ft., in line with today’s comps in the sub-market, most of which are approaching 10 years old.

Broadstone Citrus Village broke ground in November on the 17.7-acre, fully-entitled site Alliance acquired from multifamily REIT Post Properties last summer for $3.75 million. The deal had a very short fuse, with a 45-day due diligence window and a 30-day close, but Ging had been watching the opportunity for a while before it got to the negotiations stage.

“We had already spent a fair amount of time investigating the property two years ago,” Ging said. “Everything regarding the site plan, the building layout, the exterior design, the treatments, finishes, colors and architectural style are really set in stone,” he said of the plan that was designed in keeping with the historic character of the area.

Alliance is looking to embellish the previously planned interior finishes, adding more luxurious items from plumbing to lighting fixtures, granite counter-tops and 42-inch cabinets, thanks to the savings on costs for construction materials that have dropped some 30 percent since their peak, around the time the project was conceived by Post Properties.

“We’re seeing five percent or more off of our numbers,” Ging said of the overall price of construction since about mid-year. “A lot of subcontractors have become a bit weary of bidding on projects that have been going nowhere and, once you have a real project, they are really more focused on sharpening their pencils and working hard to get a better number for you,” he said.

Alliance was attracted to the opportunity to buy Post’s entitled property because the two companies specialize in the same level of upscale multifamily community. The location, a 20- to 25-minute drive to downtown Tampa, also appealed to Ging’s development team. The site is about 15 minutes due north of the airport and, even more importantly, about the same distance north of the Westshore business district, where the highest concentration of office employment in the Tampa area is located.

While he believes the echo boomer population is destined to turn the apartment sector into real estate’s star player in the years to come, Citrus Park doesn’t necessarily target that demographic. More of a suburban bedroom community for the Tampa area, the one-, two- and three-bedroom apartments that will feature nine-foot ceilings, 36-inch raised-panel kitchen cabinets, balconies with French doors, full-size washers and dryers, walk-in closets and black-on-black appliances in the kitchens, some of which will have islands, were designed to attract renters in their later 20s and early 30s—young couples and maybe young families.

Composed of 17 two- and three-story buildings, Broadstone Citrus Village’s layout is a traditional neighborhood design with on-street, parallel parking, in addition to some attached and detached garages. The apartment buildings feature stoops and porches fronting the sidewalks, fitting in with metro Tampa’s Citrus Park Overlay District’s master plan for connectivity between neighborhoods, providing seamless passage from one neighborhood to the next as a long-term vision.

The community is expected to deliver first units in late 2011, with construction complete in mid-2012. “We think the market will be on firmer footing by then and we’ll see more meaningful job growth and stronger household demand. We also should be in a good position, with little new supply in that market, to see a much stronger recovery period at that point,” Ging predicted.

His team, which focuses on acquisitions and development in Central and Southern Florida, while northern Florida market activities are supervised by Alliance’s regional office in Atlanta, also has a development deal in the works in Boca Raton—the $60 million Broadstone at North Boca Village, which he expects will begin construction next June. And Alliance just recently signed another contract on a deal in Broward County that is under strict a non-disclosure agreement.

Alliance has an agreement to purchase the infill redevelopment property, which is an old shopping center on Federal Highway in the north end of Boca Raton from the bank that foreclosed on the previous owner. When the deal closes next year, the old retail establishment will be demolished and the entire 18-acre site will be redeveloped. Broadstone at North Boca Village will include town-homes, three-story garden-style and two five-story, mid-rise buildings.

South Florida apartment fundamentals have been stable for several quarters in a row, Ging said, with strong occupancies throughout the market. And, with the nationwide change in attitude about the desirability of home-ownership and a dearth of new apartments coming online in the next several years, the future looks brighter than it has for a long time, he believes.

“I think one thing that gets overlooked a lot is the fact that so many apartments were converted to condos several years ago and did not come back as shadow rentals. So, on balance, we are below the inventory levels of rental housing that we had back in 2003 and 2004. And, especially in South Florida with the lack of available land, it’s unlikely we’re going to replace all the units that were converted any time in the next five or more years,” he predicted, adding that Class A apartments made up a significant number of those conversions. “I think that has a lot to do with why the remaining units we have are generally doing pretty well.”

South Florida was clearly the epicenter for the condo craze and was out ahead of the Orlando and Tampa markets. So, although those markets experienced a similar wave of overbuilding on the for-sale side and also had a lot of condo conversion activity, they entered the cycle later and most of those apartments that were going to come back as rentals did so in 2007 and 2008. “The markets have had time to absorb a lot of those ‘repartments’ in the past couple of years and, generally speaking, have stabilized,” Ging said.

He believes the the markets where he looks for development and acquisition opportunities promise continued improvement in rent growth and occupancy and forecasts for 2011 and 2012 and 2013 look very favorable for new developments just getting underway.

Looking forward five years, he hopes to have three to five new development starts each year in the Tampa, Orlando and South Florida markets. “Providing that the economy continues to improve along the way, our goal is to be one of the leading apartment builders in the state of Florida,” said Ging.

Author Peggy Shaw