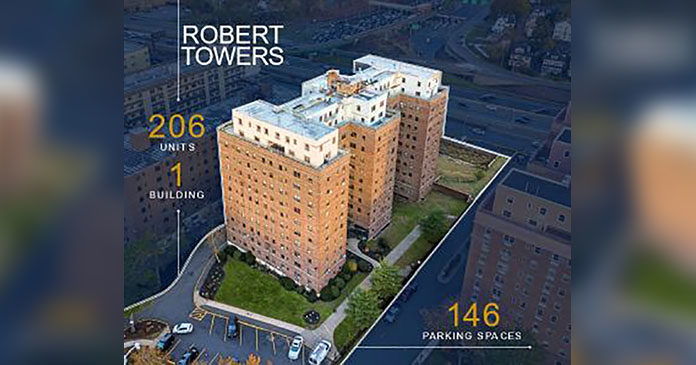

Marcus & Millichap has announced the sale of Robert Towers, a 11-story, 206-unit multifamily asset in East Orange, New Jersey. The property sold for $22 million, which equates to $106,796 per unit. Marcus & Millichap Capital Corp. (MMCC) arranged $19.8 million in acquisition financing.

“Leveraging our platform and process, we generated interest from over 100 investors from 15 offices across the country, created a competitive buying environment and generated 17 offers in 30 days, including five from out-of-market buyers,” says Fahri Ozturk, vice president investments in Marcus & Millichap’s New Jersey office.

“East Orange is going through a tremendous revitalization centered around its two NJ Transit train stations, East Orange Station and Brick Church Station, which provide commuters with direct access to Midtown Manhattan via a 25-minute train ride,” adds Richard Gatto of Marcus & Millichap’s New Jersey office. “East Orange offers investors the opportunity to invest in an urban market with strong metrics such as high demand, low vacancy, and strong cash flows with significant upside.”

Gatto and Ozturk represented the seller, Metropolitan America, and procured the buyer, EOA 206 LP. Eric Seidel, MMCC senior director, arranged 36 months of interest-only financing for the acquisition.

“Our clients requested high-leverage financing and additional proceeds for capital improvements,” says Seidel, “and having the property listed with our New Jersey office provided excellent transparency with the seller. There was a great deal of interest in the opportunity from lenders and ultimately a capital source was chosen that truly believed in our clients’ business plan and strategy to capitalize on the East Orange market.”

Built in 1950, Robert Towers is located at 60 S Munn Ave. in East Orange near the East Orange and Brick Church train stations, Interstate 280 and the Garden State Parkway. The property is 10 minutes from Newark International Airport.

“Rich, Fahri, and the entire Marcus & Millichap team did an outstanding job from start to finish,” comments Cliff Corrall, president and CEO of Metropolitan America. “Their comprehensive marketing plan quickly produced significant interest in the asset and their ability to arrange financing for the eventual buyer was key to closing in a timely and efficient manner. The professionalism and execution they exhibited during this process should be used as a model for how deals get done in this market going forward.”

About Marcus & Millichap

With over 1,800 investment sales and financing professionals located throughout the United States and Canada, Marcus & Millichap is a leading specialist in commercial real estate investment sales, financing, research and advisory services. Founded in 1971, the firm closed nearly 9,000 transactions in 2017 with a value of approximately $42.2 billion. Marcus & Millichap has perfected a powerful system for marketing properties that combines investment specialization, local market expertise, the industry’s most comprehensive research, state-of-the-art technology, and relationships with the largest pool of qualified investors.