An organization called Up For Growth has issued a report on housing underproduction in the U.S. along with their proposed approach for addressing the problem. Primarily, the group calls for easing restrictions on development so that medium and high density housing can be built along transportation corridors.

Well-known in the study of housing issues, the Technical Advisory Board for Up For Growth includes representatives from the Terner Center for Housing Innovation at U.C. Berkeley, the Harvard Joint Center for Housing Studies, George Washington University, the Wharton School Real Estate Department and the National Multifamily Housing Council.

Defining the problem

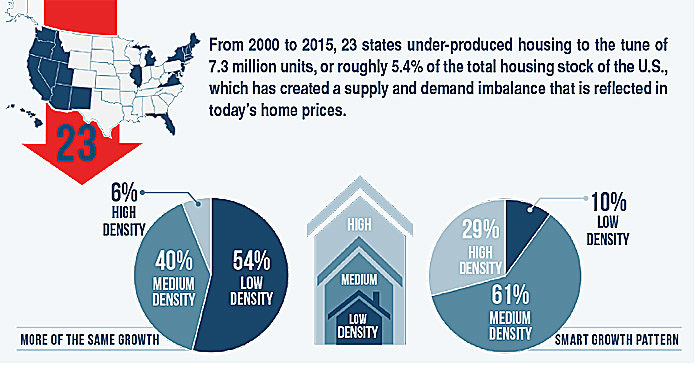

The report estimates the shortfall in housing construction by comparing the historical relationship between housing construction and household formation. It estimates that housing construction fell short by 7.3 million units between the years 2000 and 2015. Forty six percent of this shortfall is said to be in California and 10 percent in Florida. The 3,378,205 units perported missing in California represents 24 percent of the 2016 Census estimate for the total housing stock in that state. If accurate, this would be a massive shortfall.

The report attributes the shortfall to the recent recession and to “restrictive local development and land-use policies that reflect opposition to high-density, multifamily, urban growth in favor of low-density, single-family, suburban sprawl.”

Report authors present three scenarios for addressing the housing shortfall. The scenarios are dubbed, more of the same (MOS), smart growth, and max density.

MOS projects off current development patterns. It includes 54 percent single-family homes, 40 percent medium density development with multifamily buildings of up to 5 stories, and 6 percent multifamily towers of more than 5 stories. This scenario is criticized for the amount of land it would require, for its failure to fully leverage existing transportation resources, particularly mass transit, and for not generating sufficient property tax revenue to fully pay for construction, operation and repair of the required new infrastructure.

The smart growth scenario proposes that the housing shortfall be addressed through a construction mix of 10 percent single-family homes, 61 percent medium density multifamily and 29 percent multifamily towers. The high density housing would be clustered around transportation corridors. This scenario is said to require less land and to make better use of existing infrastructure than does MOS.

The max density scenario calls for no single family homes, 36 percent medium density multifamily and 64 percent multifamily towers. This is actually the authors’ preferred approach but they reject it as being politically unsupportable.

Assessing the options

The authors used the Regional Economic Model (REMI) to assess the economic impact of building enough units over a 20 year span in each of the scenarios to make up the shortfall.

A weakness of the report is that, while it provides the results from the model, it does not explain how they calculated their findings. For example, the model shows that Federal income tax revenue will be higher in some scenarios than others but it doesn’t say why. Is it because the workers for high rise construction are paid more than those who build single family homes, or are there some second order effects that make the difference?

The report suggests that GDP would be higher if the smart growth scenario was used instead of MOS. However, it also shows that property tax revenue would be higher in that case. Since property taxes are determined based on the cost of the property being taxed, this implies that the higher density housing in the smart growth scenario would actually be more expensive than the MOS housing. Having consumers pay more for housing may result in higher GDP, but it’s not a positive economic effect.

The report gives estimates for the number of jobs that would be created during the 20 year construction phase for both the smart growth and the max density scenarios but not for the MOS scenario. This seems an odd omission.

Assuming excess capacity exists in current infrastructure allows the authors to estimate a lower infrastructure expense for the smart growth scenario than for MOS. However, the infrastructure in many metropolitan areas is already under stress so there may not actually be much excess capacity. It would be interesting to know how much excess capacity was assumed for existing infrastructure in the smart growth scenario.

It would be useful to see the detail in order to understand what assumptions were made to formulate the resulting data.

The way forward

The authors conclude with changes that might facilitate gaining on the housing deficit through their smart growth scenario. The first is establishing “by right” approval for high density housing near transit stations so proposed developments would not be impeded by local opposition. Another is “impact fee recalibration” to set fees for high density housing developments to reflect their presumed lower cost of infrastructure service.

One facet the report fails to include is the market demand; demographic trends of those potentially inhabiting these communities or the will of the market. The current mix of housing exists because builders follow the market and because communities set their zoning regulations to maintain their local character. For a family with small children, a single family home is not interchangeable with a high rise flat.

The authors also omit the required political changes to make such a smart growth scenario possible. However, their report may be the opening statement in a conversation leading to the solution.