Enacted as part of the 2017 tax legislation, Opportunity Zones represent a brand-new incentive that could potentially bring billions of dollars in multifamily investment to distressed communities nationwide. With the release in October of proposed implementing regulations by the Treasury Department and the Internal Revenue Service, multifamily investors and developers can now begin to get projects off the ground.

The Economic Innovation Group, which helped spearhead the new program, estimates that there are currently more than $6 trillion in unrealized capital gains that could potentially be invested in Opportunity Funds. While it is unrealistic to expect all such gains to be deposited into funds, even a small fraction could add up to billions of dollars of investment capital.

Program potential

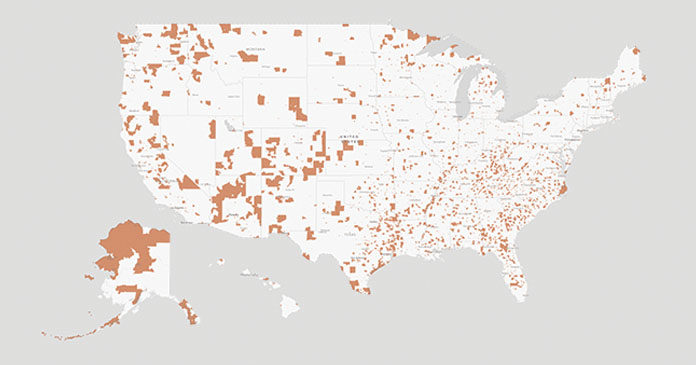

Under the new program, each state selected as much as 25 percent of its qualified low-income Census tracts as Opportunity Zones, with a minimum of 25 zones per state. In all, governors designated more than 8,700 qualified areas as Opportunity Zones through 2028. Investors and developers can now launch Opportunity Funds, defined as corporations or partnerships that hold at least 90 percent of their assets in qualified Opportunity Zone properties.

Investors that contribute capital gains into a fund within 180 days of an asset sale are eligible for three tax incentives:

- Sponsors may defer taxes on capital gains invested in Opportunity Funds to Dec. 31, 2026, or to the date an investment in an Opportunity Fund is sold, whichever is earlier.

- Capital gains invested in an Opportunity Fund for five years are eligible for a 10 percent basis step-up, and a 15 percent step-up for a seven-year hold.

- Post-acquisition capital gains on investments held in Opportunity Funds for at least 10 years are permanently excluded from taxable income.

Over the past several months, the National Multifamily Housing Council has worked with the Treasury Department to make the Opportunity Zones program as effective as possible. We were successful in ensuring that the regulations did not exclude multifamily housing as a qualifying asset, or prevent the use of tax incentives, such as Low-Income Housing Tax Credits, as part of a project. In addition, we secured a 31-month window to deploy Opportunity Zone capital for multifamily development.

While the initial round of proposed regulations doesn’t address every issue, it provides a positive roadmap and offers considerable certainty to investors. The Treasury Department and IRS are expected to release additional directives soon. Among the issues to be addressed: how proceeds from sales of qualifying assets held by an Opportunity Fund may be reinvested without penalty.

While NMHC continues to be engaged in Opportunity Zone regulations, we are also working with Congress to ensure that the rules promote multifamily investment. For example, the proposed regulations attempt to make it more economical to rehabilitate Opportunity Zone property by excluding the value of land from the rule requiring the basis of acquired Opportunity Zone property to be doubled.

While this represents a positive step, additional adjustments will likely be necessary to make deals viable, particularly those focused on preserving affordable housing. One option would be to require only a 20 percent investment in existing property. Akin to the rules governing rehabilitations under the LIHTC, such a proposal could make Opportunity Zones more attractive.

NMHC remains excited about the potential for Opportunity Zones to drive significant development of multifamily housing, and looks forward to working with both the multifamily community and policymakers to make this new program as effective as possible.

Authors: Matthew Berger is VP of tax and Dave Borsos is VP of capital markets at the NMHC.