The recently issued Commercial/Multifamily Quarterly Databook from the Mortgage Bankers Association (MBA) shows continued strength in originations of multifamily mortgages and growth in the total level of multifamily mortgage debt outstanding.

Strong seasonality continues

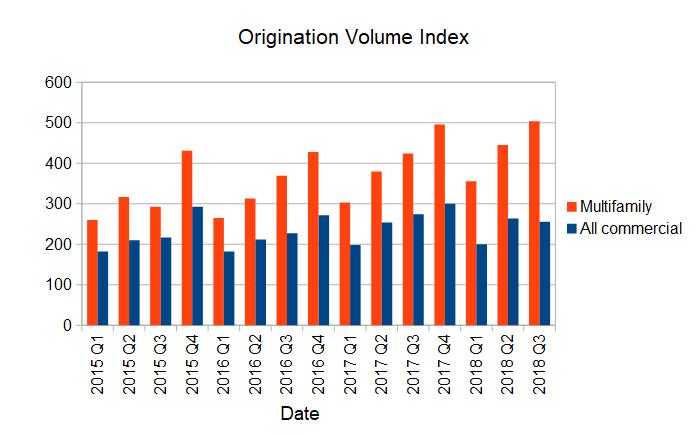

The first chart, below, plots MBA’s origination volume index for both commercial mortgages as-a-whole and for multifamily mortgage originations in particular. In addition to multifamily, commercial includes mortgage originations for office, retail, industrial, hotel and health care properties.

The index represents the volume of originations relative to the average quarterly volume in 2001. Therefore, a multifamily origination index of 500 means that origination volumes for multifamily mortgages are 5 time their levels in 2001. If the commercial origination index is 250, it does not mean that fewer commercial mortgages are being originated than are multifamily mortgages, it just means that the growth of the commercial mortgage market as-a-whole since 2001 has been much slower than that of the multifamily mortgage market segment.

The chart shows the strongly seasonal pattern of mortgage originations for commercial property types tracked by the MBA, particularly for multifamily originations. Since late 2015, each quarter of the year has had more originations than the previous quarter and also more than the same quarter of the previous year. This pattern continued for multifamily in Q3 with originations up 13 percent from Q2 and up 19 percent year-over-year. By contrast, commercial mortgage originations as-a-whole fell 3 percent from their Q2 levels and fell almost 7 percent from the year earlier level.

Who’s investing in multifamily mortgages?

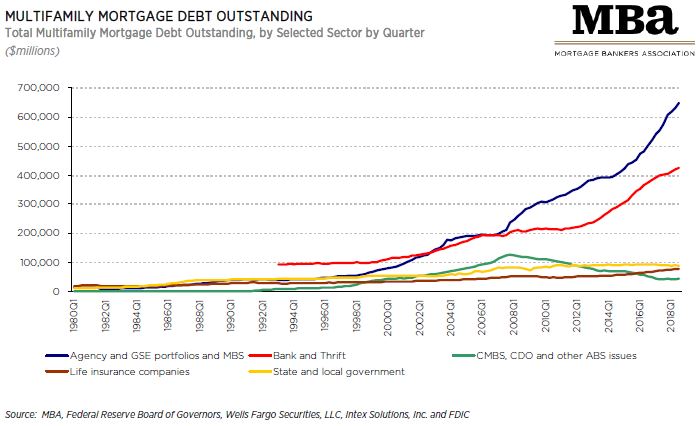

The MBA reports that total multifamily mortgage dept outstanding rose to $1.326 trillion in Q3, up $26 billion from the previous quarter. The largest part of the increase, $16.7 billion, is held by “Agency and GSE portfolios and MBS”, who together now hold nearly 49 percent of multifamily mortgage debt. The Agency and GSE’s (government sponsored entities) are organizations like Fannie Mae, Freddie Mac, etc.

That the GSE’s are playing a larger role in multifamily mortgage originations should come as no surprise to readers of the MHP blog. The benefit of the MBA report is that it puts their role in the context of the entire commercial mortgage origination market, not just the portion of the market funded through mortgage backed securities (MBS).

The final chart, below, was taken from the MBA report. It shows that agency and GSE portfolios and MBS supplanted banks and thrifts as the largest holder of multifamily mortgage debt in the early 2000’s. Since then, these two sources of funds have accounted for nearly all of the growth in multifamily mortgage debt while other sources of funds have stagnated.

There is much more in the report including a discussion of economic trends and of other segments of the commercial real estate mortgage market. The full report can be found here.