The Census Bureau released its monthly new residential construction report for May 2019. The report shows continued strength in multifamily housing construction.

Multifamily housing permits largely unchanged

The preliminary report for May shows that permits for buildings with 5 or more units were down by 3.7 percent from the revised April level, to 442,000 units on a seasonally adjusted, annualized basis. The April figure was itself revised down by 8,000 units or 1.7 percent. Compared to the year-earlier level, permits for buildings with 5 or more units were up 4.2 percent.

In addition, 37,000 permits were issued in May for buildings with 2 to 4 units, 17.8 percent lower than the revised figure of 45,000 units for April.

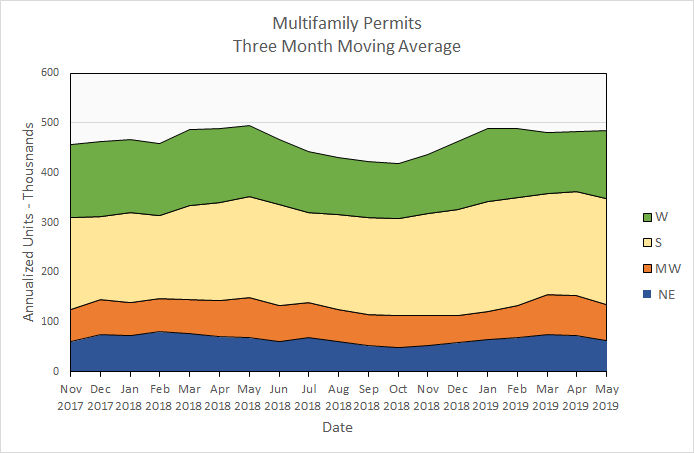

Regional data for multifamily housing is only reported for structures with two or more units. “Structures with 5 or more units” is not broken out as a separate category. Since the regional data is highly volatile and is frequently revised, it is examined here based on three month moving averages.

Nationally, the three-month moving average for multifamily housing construction permits issued in May was up 0.3 percent from the April level and was down 2 percent from the level of May 2018. This is shown in the first chart, below.

On a month over month basis, declines in permits issued in the Northeast and Midwest were balanced by an increase in permits issued in the South and in the West, resulting in the national number being nearly unchanged. The three-month moving average for permits in the South was 213,000, representing 44 percent of permits issued for the country as a whole.

Compared to year-earlier levels, the South was the only region to see an increase in permits issued, with a rise of 4.6 percent. The other three regions saw a decline in permits issued but none by more than 10 percent.

Multifamily housing construction starts surge

The May report on construction starts for buildings with 5 or more units showed an increase of 13.8 percent from the April level. April starts were at 436,000 units on a seasonally adjusted, annualized basis, the highest level since October 2017. In addition, both the March and April figures were adjusted upward, March by 10,000 units and April by 24,000, so this was a very strong report for starts.

Compared to year-earlier levels, construction starts for buildings with 5 or more units were also up by 13.8 percent.

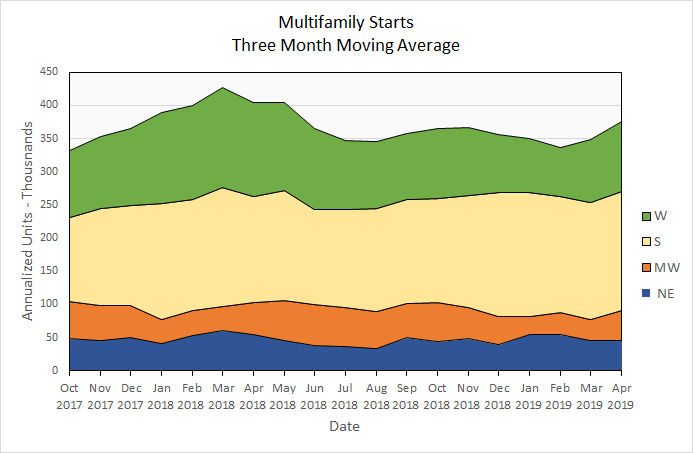

Multifamily housing construction starts (two or more units per building) were up 8.2 percent from their April levels for the country-as-a-whole, based on three-month moving averages. The West was the strongest region of the country in May with starts rising by 21,000 or 20 percent. The South also turned in a strong month with starts rising by 9.3 percent, while the Northeast was the weakest region with starts falling by 15 percent.

On a year-over-year basis, starts were almost flat, rising by 0.5 percent for the country-as-a-whole. However, the year-ago period was one of exceptional strength, so matching it in starts is a positive sign.

By region, compared to year-earlier levels, starts were up 18 percent in the South but were down in the other regions of the country. The Midwest saw the largest rate of decline with starts falling 27 percent.

The following chart shows multifamily housing starts by region for the last 18 months.

Completions crest

Nationally, completions of buildings with 5 or more units fell 18 percent this month from the April figure. However, both the March and April figures for completions were adjusted up from previous reports, April by 9,000 units. May completions were reported to be 319,000 units on a seasonally adjusted, annualized basis. Completions in May were down 11.4 percent from the strong level reported in May 2018.

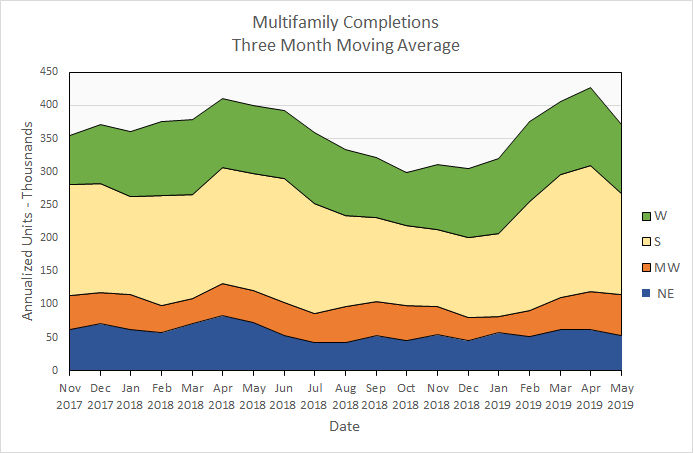

For the country-as-a-whole, multifamily housing completions (two or more units per building) were down 13.3 percent month-over-month when comparing three-month moving averages. The Midwest was the only region to see an increase in completions with a rise of 6.3 percent. All other regions saw completions fall, with the decline in the South approaching 20 percent.

On a year-over-year basis, the three-month moving average of completions was down by 7 percent. The Midwest region saw completions rise by 28 percent while the West saw a rise of 2 percent. Completions fell by 27 percent in the Northeast and 14 percent in the South, more than offsetting the gains in the other regions. Nationally, the three-month moving average for multifamily housing completions came in at 371,000 units on an annualized basis. While this level is down from recent highs, it is still in line with long term averages.

Completions by region for the past 18 months are shown in the chart below.

All data quoted are based on seasonally adjusted results and are subject to revision.