Income share agreement (ISAs) fund education. Upon completion, learners pay a percentage of their salary for a term.

Lenders correlate interest rate and pay-back period with borrower’s potential career outcome.

This may mean varying tuitions for majors moving learners away from personal fulfillment and toward serving society.

Learners can make these agreements with colleges, businesses or employers.

ISAs can be career accelerators as employers partner with employees on continuing training and education.

ISAs are directly between the lender and learner, and do not involve parents.

The U.S. Department of Education is also launching a separate pilot program where select colleges will take on students’ federal loan debt. Students will repay the institution for the loan balance, based on their future earnings.

Under the program, federal loans will be satisfied through an income-share agreement where learners agree to pay a certain percentage of their future income over a set period of time in exchange for funding of their educational expenses.

10 high-paying jobs that don’t require a 4-year degree

-

- Brickmason

- Plumber

- Steelworker

- Electrician

- Glazier

- Insulation contractor

- Sheet metal worker

- Equipment operator

- Carpenter

- Cement mason, finisher

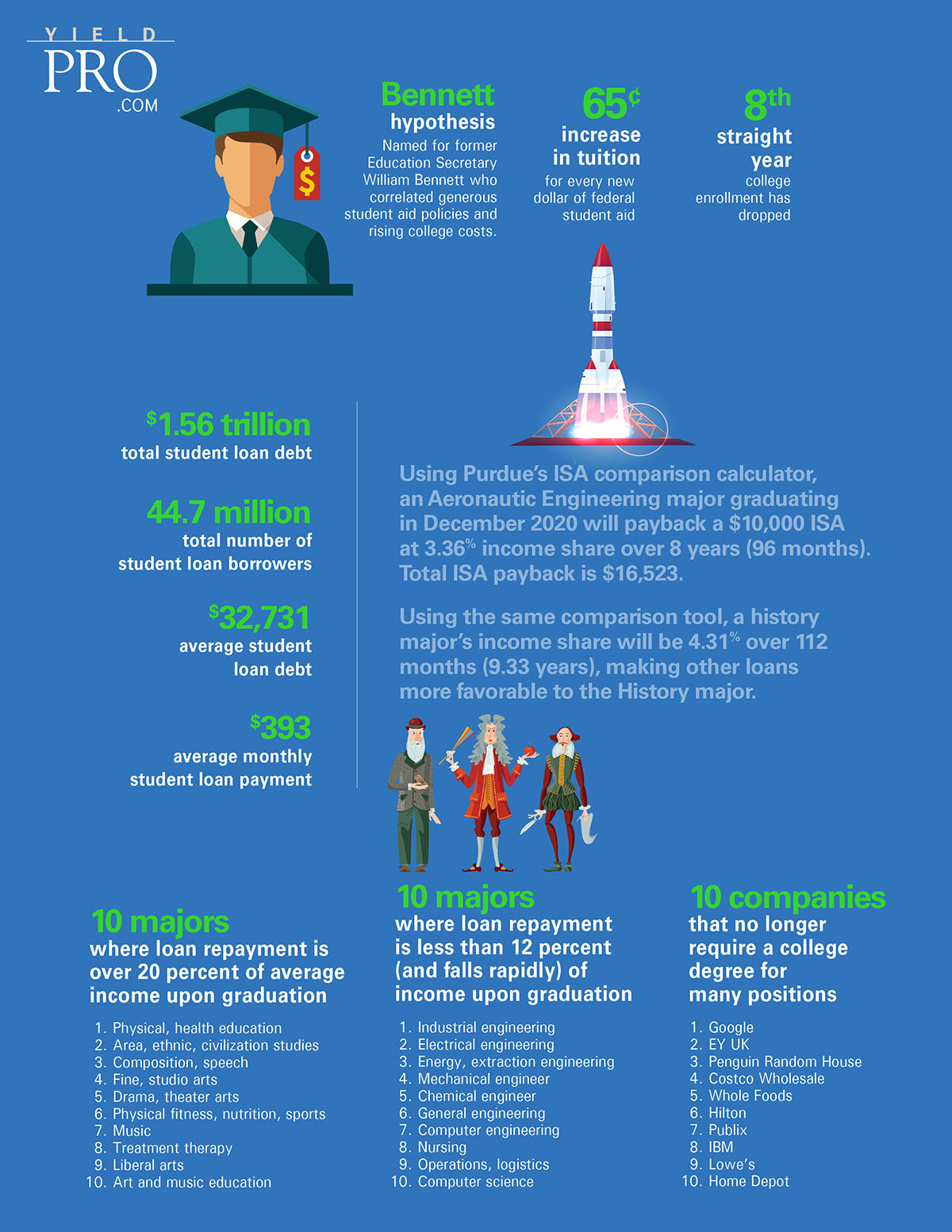

Bennett hypothesis

Named for former Education Secretary William Bennett who correlated generous student aid policies and rising college costs.

65¢ increase in tuition for every new dollar of federal student aid

8th straight year college enrollment has dropped

Using Purdue’s ISA comparison calculator, an Aeronautic Engineering major graduating in December 2020 will payback a $10,000 ISA at 3.36% income share over 8 years (96 months). Total ISA payback is $16,523.

Using the same comparison tool, a history major’s income share will be 4.31% over 112 months (9.33 years), making other loans more favorable to the History major.

- $1.56 trillion total student loan debt

- 7 million total number of student loan borrowers

- $32,731 average student loan debt

- $393 average monthly student loan payment

10 majors where loan repayment is over 20 percent of average income upon graduation

-

- Physical, health education

- Area, ethnic, civilization studies

- Composition, speech

- Fine, studio arts

- Drama, theater arts

- Physical fitness, nutrition, sports

- Music

- Treatment therapy

- Liberal arts

- Art and music education

10 majors where loan repayment is less than 12 percent (and falls rapidly) of income upon graduation

-

- Industrial engineering

- Electrical engineering

- Energy, extraction engineering

- Mechanical engineer

- Chemical engineer

- General engineering

- Computer engineering

- Nursing

- Operations, logistics

- Computer science

10 companies that no longer require a college degree for many positions

-

- EY UK

- Penguin Random House

- Costco Wholesale

- Whole Foods

- Hilton

- Publix

- IBM

- Lowe’s

- Home Depot