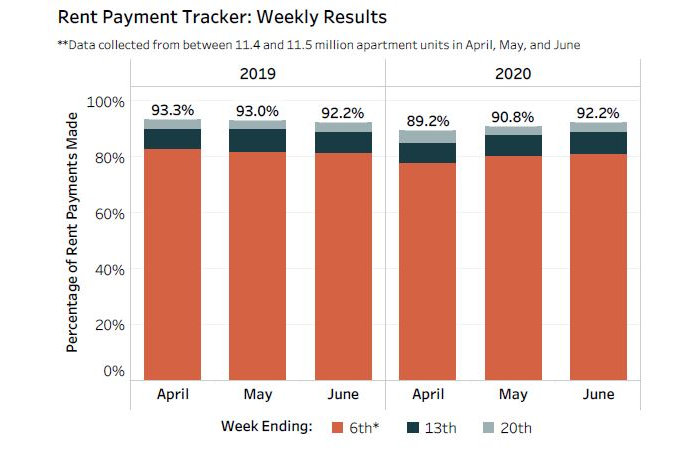

The NMHC rent tracker project has released its third reading on rent collections in the month of June. A total of 92.2 percent of residents had made a rent payment by June 20, 2020. This compares to 92.2 percent of residents who had made a rent payment by the same point in June 2019, and 90.8 percent who had made a rent payment by the same point last month.

Data sources

As in past reports, the data was collected from 11.4 million units managed using software from five major property management software providers. These companies are Entrata, MRI, RealPage, ResMan and Yardi Systems. Representatives of these companies attended the webcast accompanying the release of the data. Providing the operator’s perspective for this week’s webcast was Robert Grealy, senior vice president of operations at Kettler, a developer, owner and manager of multifamily housing.

Student housing, military housing and subsidized affordable housing are not included in this survey, although they may be included in the discussion accompanying the data release.

Kettler’s portfolio is regional, covering the area from Pennsylvania to Florida. The majority of the portfolio, about 75 percent, is in the Washington DC/Baltimore metro area. Most of the rest is in the Carolinas and Florida. About 50 percent of the portfolio is class A high-rise and mid-rise, 25 percent is class B and value-add, and 25 percent is LIHTC affordable.

The majority of Kettler’s affordable portfolio is in DC area and this portion has highest delinquency rate. Kettler saw their previous delinquency rate of 5 percent jump up to 6.5 percent delinquent in April. The class A and class B portfolios perform in the 2 to 3 percent delinquency rate range with the delinquency rate in the affordable portfolio running about 3 times higher. Delinquencies improved in May over April, and June’s performance appears to be coming in similar to that of May. Because of the shutdown of the courts, delinquent rent is building up which may result in a large bad debt wave in the second half of the year.

Kettler finds occupancy is strong in the DC area but is falling somewhat in other regions with a decline of about 50 basis points.

Market differences

Las Vegas and Los Angeles have been markets with relatively poor rent payment performance since the start of the COVID-19 pandemic. Greg Willett of RealPage said that this continues to be the case. He also said, “There is an interesting shift in momentum that we are seeing in the market over the course of the past couple of weeks and it is in the prices that are being paid on new leases.” While new leases had been signed at rents which had been 4 percent lower than year-earlier levels, recently rents for new leases have been coming in at the same level as the same time last year. Regional variations in this trend exist with actual rent growth in the Midwest and some sunbelt markets. On the other hand, “gateway” markets such as New York, Boston, San Francisco and Los Angeles are still seeing deep rent cuts.

Elizabeth Francisco of ResMan said that their data are showing vacancy rates of 8 to 10 percent, in line with expectations for this time of year. However, renewals are well behind historical trends. While renewals were typically running at 54 percent before COVID-19, current renewals for June are at 39 percent, July renewals are at 25 percent and August renewals are at 8 percent. At the same time, notices to vacate are not rising, which may indicate that renters are playing a wait-and-see game.

Jeff Adler of Yardi said that “leasing season, in general, is back”, that is, leasing related activity is picking up. He agreed with Francisco that renewals are down in some markets without a rise in vacancies, indicating that more renters are going month-to-month. He agreed with Willett that market weakness seems to be concentrated in the core cities and this is reflected in declining rents and occupancies. “The places that were locked down the hardest have been the slowest to come back,” he said.

Grealy said that new operating conditions may have affected leasing in the March-April time frame, but that demand is back. He said, “We are now having leasing activity in similar volume to this time last year.” He believes that virtual leasing is here to stay because a lot of prospects prefer it. However, Kettler has seen asking rents decline 5 percent over the last three months. Grealy expect rents to continue to be down as Kettler executes their strategy to get over-occupied in preparation for moving people out who are not paying the rent after the courts reopen.

When discussing the phased reopening of the economy, Grealy noted that, “Jurisdictions are changing their status, but conditions haven’t changed much on the ground.” This is causing Kettler to reevaluate how they reopen. Kettler is concerned about persistence of virus and its impact on operations.

While student housing is not tracked via the NMHC rent tracker, Chase Harrington of Entrata discussed how this sub-market is doing. He said that the payment performance in student housing has been good, but that this may be partly a result of housing payments being due at the start of the school term. Most school terms were underway before the COVID-19 outbreak. However, uncollected rent at the end of May stood at about 5 percent, while a 2 percent level would be more usual.

Harrington reported that student housing pre-lease numbers are actually out-performing last year. However, universities are still making plans for fall and it is not yet certain what mix of on-campus and virtual classes they will offer. However Harrington concluded, “We, as well as the student operators, are optimistic about the future of the fall.”

Brian Zrimsek of MRI observed that amenity and fee revenue is currently down. Credit card usage for rent payment is up and fees for this are being waived. He also noted, “May did see a pretty good dip in pricing. Our data shows about a 5 percent drop.” The data on leases shows that they are not getting longer. “We are seeing a big spike in 12 month terms, almost at the expense of 13 and 14 month terms”, he said.

Looking ahead

In discussing what metrics to watch through the summer, Grealy said that Kettler is following occupancy numbers closely. They are also tracking delinquency analytics and predictions of bad debts. Kettler is trying to forecast when will the worst effects from residents not paying the rent hit their properties financially.

Zrimsek noted that “Employment drives real estate.” Referring to the expiration of Federal unemployment benefit supplements he continued, “Watching what happens once all the safety nets are removed will inform us. We need to understand the longer term effects of COVID on things like willingness to take public transportation.” This may impact where people choose to live, especially in higher density markets.

Harrington said that Entrata has been watching lease expirations, renewals and month-to-months. Recently, more residents have been choosing month-to-month terms, indicating that they are taking a wait-and-see posture. This will complicate occupancy management down the line since little notice is given before vacating these units.

The next NMHC rent tracker report will be in July at a date to be announced later.