The Bureau of Labor Statistics (BLS) released its producer price index report for September 2020. It showed that the BLS price index of materials and components for construction was up 2.1 percent from August, seasonally adjusted. It was 4.5 percent higher than its year-earlier level.

By contrast, overall prices for processed goods for intermediate demand rose by 1.0 percent. Excluding food and energy, the price index for processed goods for intermediate demand was up by 1.3 percent for the month. The full index was 1.5 percent higher than its year-ago level.

For reference, the changes in these indices compare with a 1.4 percent rise in the all-items consumer price index (CPI-U) for the 12 months ending in September. The monthly increase in this index was 0.2 percent in September.

Yield Pro (PRO) compiled the BLS reported price changes for our standard list of construction commodities. These are commodities whose prices directly impact the cost of constructing an apartment building. The two right hand columns of the table provide the percent change in the price of the commodity from a year earlier (12 Mo PC Change) and the percent change in price from August 2020 (1 Mo PC Change). If no price data is available for a given commodity, the change is listed as N/A.

| Commodity |

12 Mo PC Change |

1 Mo PC Change |

| Softwood lumber |

81.2 |

27.4 |

| Hardwood lumber |

-1.4 |

1.7 |

| General millworks |

2.3 |

0.0 |

| Soft plywood products |

73.9 |

15.2 |

| Hot rolled steel bars, plates and structural shapes |

-8.4 |

-1.0 |

| Copper wire and cable |

7.3 |

3.1 |

| Power wire and cable |

5.1 |

4.6 |

| Builder’s hardware |

1.9 |

-0.1 |

| Plumbing fixtures and fittings |

1.8 |

0.0 |

| Enameled iron and metal sanitary ware |

3.2 |

5.3 |

| Furnaces and heaters |

2.4 |

-1.9 |

| Sheet metal products |

-0.4 |

0.0 |

| Electrical Lighting fixtures |

-0.4 |

0.2 |

| Nails |

1.3 |

1.6 |

| Major appliances |

2.6 |

-1.1 |

| Flat glass |

-0.7 |

0.0 |

| Ready mix concrete |

2.6 |

1.3 |

| Asphalt roofing and siding |

5.2 |

2.6 |

| Gypsum products |

0.5 |

0.0 |

| Mineral wool insulation |

0.2 |

-0.2 |

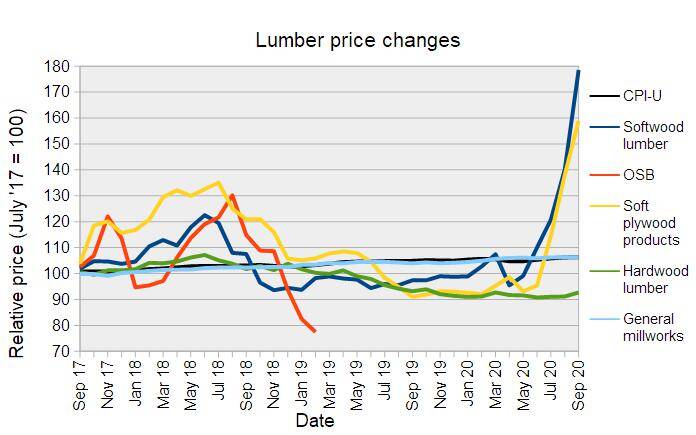

Softwood lumber prices, both for framing lumber and for plywood products, rose even more strongly in September than in earlier months. While the accelerating price of lumber shown by the Census report is remarkable, other, more timely, sources indicate that the worst might be over. NAHB’s tracking of lumber prices indicates that prices peaked in the middle of September and were easing by the end of the month. Still, futures prices for Spring 2021 deliveries remain higher than were lumber prices early in 2020. That lumber prices are being driven higher by sawmill capacity is indicated by the fact that prices for timber have been relatively stable. They are up only about 5 percent from the lows they hit in the spring, and are trading below the peaks they reached in early 2018.

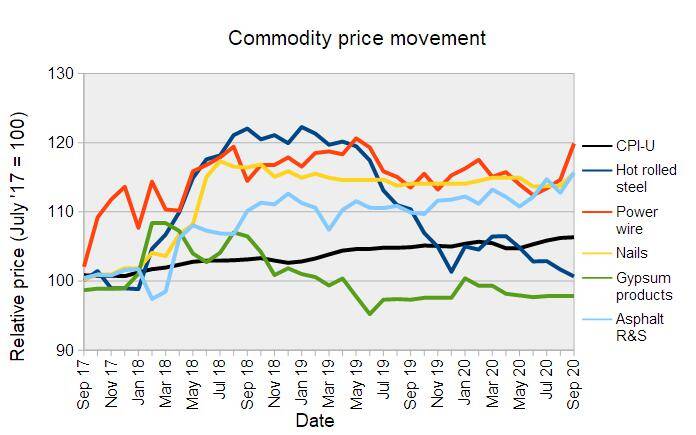

The second chart, below, shows the recent price history of several other construction materials. While the prices of many of these construction materials have been relatively stable in recent months, the prices for asphalt roofing and siding have been trending up and the price for power wire has ticked up recently. The latter is being driven by the price of copper, which dropped in mid-March when COVID hit, but which has since risen 42 percent from the low it reached then.

The second chart, below, shows the recent price history of several other construction materials. While the prices of many of these construction materials have been relatively stable in recent months, the prices for asphalt roofing and siding have been trending up and the price for power wire has ticked up recently. The latter is being driven by the price of copper, which dropped in mid-March when COVID hit, but which has since risen 42 percent from the low it reached then.

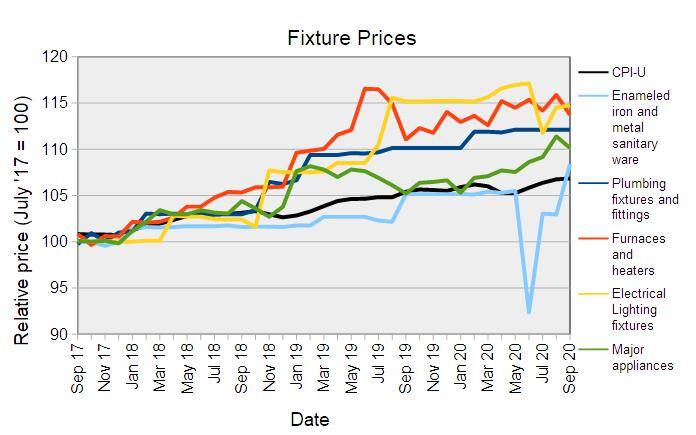

Price changes for several of the more finished goods from our sample are illustrated in the final chart, below. The general trend in the prices of these items has been steady growth at a rate that is somewhat higher than that measured by the CPI-U. However, the recent leader in price growth, major appliances, took a step back this month. The enameled iron and metal sanitary wear category now has the highest annual price increase of the goods represented in this chart.

Price changes for several of the more finished goods from our sample are illustrated in the final chart, below. The general trend in the prices of these items has been steady growth at a rate that is somewhat higher than that measured by the CPI-U. However, the recent leader in price growth, major appliances, took a step back this month. The enameled iron and metal sanitary wear category now has the highest annual price increase of the goods represented in this chart.

The full BLS report can be found here.

The full BLS report can be found here.