A new report from CBRE found that both the absolute dollar value of foreign investment in multifamily properties as well as foreign investment’s share of total investment fell during 2020.

Sizing up the deals

The CBRE considered real estate transactions of $2.5 million or more in compiling its figures. It looked only at direct acquisitions of individual multifamily properties or of portfolios of multifamily properties. It did not consider more indirect investments such as the purchases of REIT stocks or investment funds. The report focuses primarily on activity in the second half of the year.

Summarizing the investment activity

International investment in multifamily property fell 22 percent in 2020 to $9.7 billion. This represented 6.7 percent of all investment in multifamily property, down from the recent average of 8.6 percent.

For the second half of 2020, international investment in multifamily property was down only 5 percent from the same period one year earlier at $5.7 billion. This represented 6.4 percent of all investment during this period.

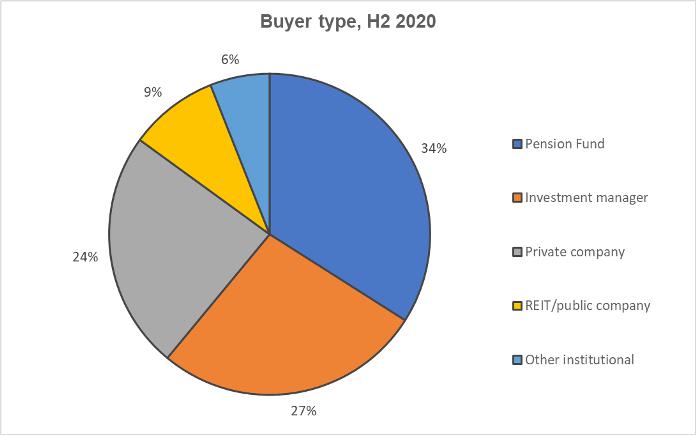

The share of international investment by buyer type is shown in the following chart. The three top types of buyers; pension funds, investment managers and private companies, each have significant shares of the market.

The top 5 cities for international investment were Washington D.C., Atlanta, Dallas/Ft. Worth, Phoenix and Seattle.

The share of international investment coming from Canada in H2 2020 reached 64 percent. For the full year, Canada’s share of international investment was 53 percent. Over the prior four years, Canada’s share of international investment varied between 36 percent and 61 percent, but it was always the largest single-country source of investment.

Foreigners are different

Compared to domestic investors, international investors in multifamily properties focused their investments more on mid-rise/high-rise properties than on garden-style properties. International investors put 68 percent of their investments into mid-rise/high-rise properties and only 32 percent into garden-style properties. The situation for domestic investors was nearly the opposite with only 31 percent of their investment going into mid-rise/high-rise properties and 69 percent going into garden-style properties.

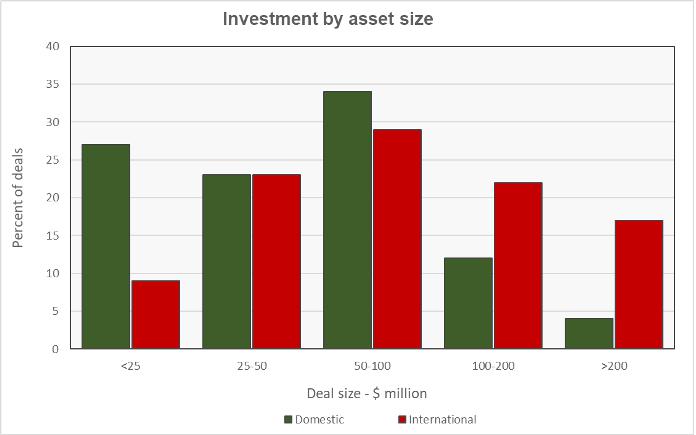

International investors also tend to purchase larger sized assets than do domestic investors. This is illustrated in the chart, below, which shows the portion of deals each investor type completed by the size of the asset purchased. Only 16 percent of the assets purchased by domestic investors were over $100 million in size. By contrast, 39 percent of the assets purchased by international investors fell into this size category.

The report contains additional information on the types of assets being purchased and on how international investment has changed over the years. The full report can be found here.