A report from Real Capital Analytics (RCA) said that multifamily property prices rose in the year to April as part of a general rise in commercial real estate prices.

Defining the index

Real Capital Analytics reports on what they call the Commercial Property Price Index (CPPI). The index is computed based on the resale prices of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price.

Prices hold up

RCA reported that multifamily property prices in April were up 0.7 percent for the month and were 7.6 percent higher than their levels one year ago. This compares to an 8.4 percent annual price increase for all commercial property types. Industrial properties saw the greatest price appreciation over the past 12 months, with an 9.4 percent rise. Office buildings within central business districts were the worst performing sector with a price decline of 4.9 percent for the year, although prices were up 3 percent on the year for all office buildings considered as a single asset class.

Taking the long view

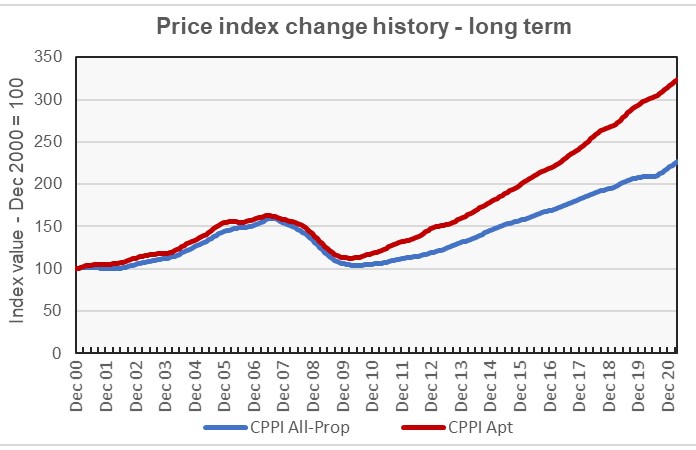

The first chart, below, plots the long-term changes in the RCA CPPI for multifamily properties. While the housing bust of 2007 had a significant impact on all commercial property types, including multifamily, the much sharper, but shorter, downturn due to COVID-19 caused only a slight ripple in the price appreciation curve for commercial property as-a-whole.

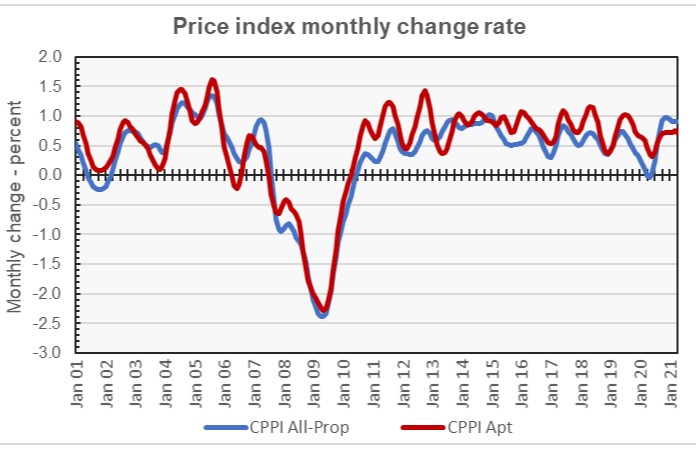

The second chart, below, takes the same data but plots it as the month-over-month change in the values of the indices. This chart makes clear that the impact of the COVID-19 inspired shutdowns on apartment prices were in the range that is seen from normal seasonal variations. While the month-over-month price changes for commercial property as-a-whole turned marginally negative in the April-May 2020 time frame, price appreciation for apartments as an asset class remained positive throughout the COVID-19 era.

Major metros lag

The RCA report provides data comparing the price changes of commercial property in 6 major metro areas* against those in the rest of the country. It does not separate out apartments prices from those of other commercial property types in this section. However, the comparison is interesting. RCA reported that the year-over-year price increase for commercial property in the 6 major metro areas was only 2.7 percent. The year-over-year price increase for commercial property in the rest of the country was 10.1 percent.

The full reports discuss all commercial property types. Access to the RCA report can be obtained here.

*The major metros are Boston, Chicago, Los Angeles, New York, San Francisco and Washington DC.