Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Sundown Village, a 330-unit multifamily property in Tucson, Arizona. The asset sold for $54.45 million, or $165,000 per unit.

“In 2020, Tucson was one of the nation’s leaders in rent growth, and the city’s multifamily vacancy rate was at its lowest level in 20 years,” said Hamid Panahi, IPA first vice president. “As these trends continue and the national economy improves, we expect that Tucson will be one of the nation’s leading multifamily markets in 2021.” Panahi, Steve Gebing and Cliff David, IPA executive managing directors, represented the seller, HSL Properties, and procured the buyer, APRA Capital. “Sundown Village is a unique investment opportunity in Oro Valley and a perfect addition to the APRA portfolio,” said Amit Patel, principal and co- founder of APRA Capital. “We see Tucson as a growth market with great potential and will continue to look for additional opportunities to expand our footprint throughout the metro.”

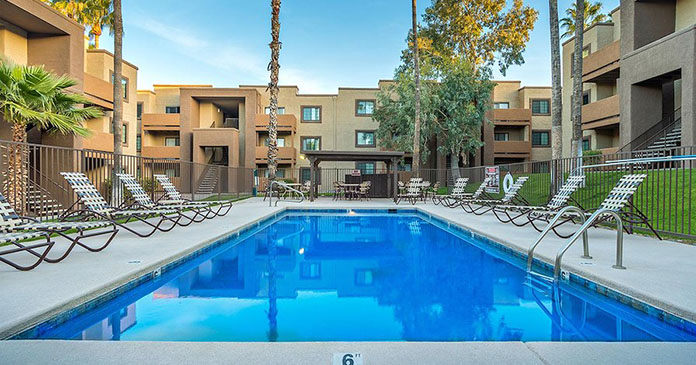

Built in 1984/1994 on nine acres, the community is close to Pima Community College and 10 miles from the University of Arizona. There are three shopping centers within a mile of the property and nearby businesses include Roche Pharmaceuticals, Honeywell, and Sanofi-Aventis. Community amenities include three swimming pools, a hot tub spa, barbecue and picnic areas, clubhouse and 24-hour emergency maintenance service.