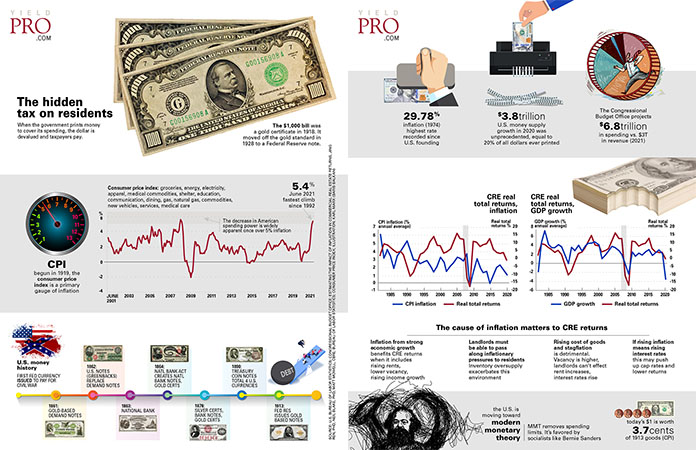

When the government prints money to cover its spending, the dollar is devalued and taxpayers pay.

The $1,000 bill was a gold certificate in 1918. It moved off the gold standard in 1928 to a Federal Reserve note.

Consumer price index: groceries, energy, electricity, apparel, medical commodities, shelter, education, communication, dining, gas, natural gas, commodities, new vehicles, services, medical care

CPI begun in 1919, the consumer price index is a primary gauge of inflation

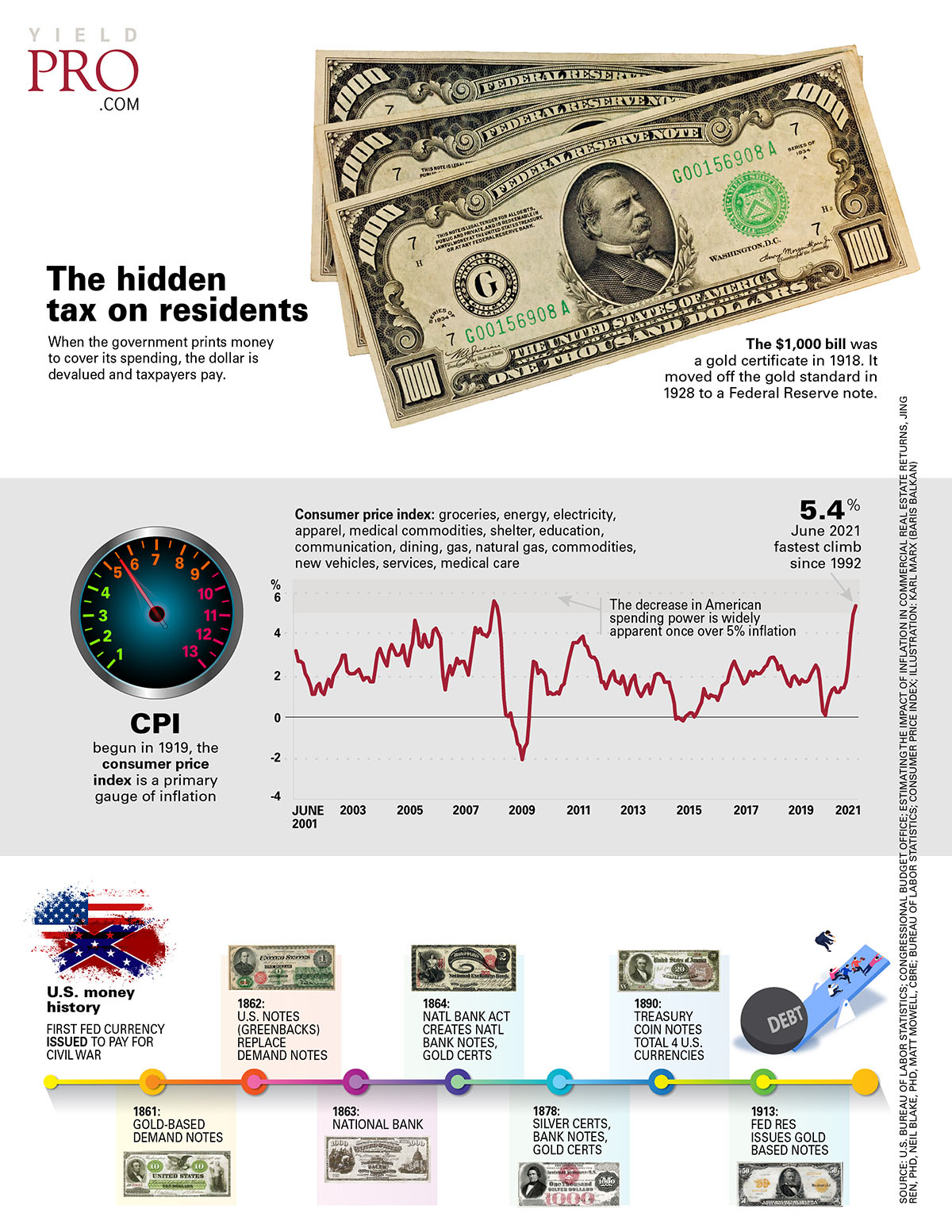

U.S. money history

First fed currency issued to pay for Civil War

- 1861: Gold-based demand notes

- 1862: U.S. Notes (Greenbacks) replace demand notes

- 1863: National Bank

- 1864: National Bank Act creates national bank notes, gold certs

- 1878: Silver certs, bank notes, gold certs

- 1890: Treasury Coin Notes total 4 U.S. currencies

- 1913: Federal Reserve issues gold-based notes

29.78% inflation (1974) highest rate recorded since U.S. founding

$3.8 trillion U.S. money supply growth in 2020 was unprecedented, equal to 20% of all dollars ever printed

The Congressional Budget Office projects $6.8 trillion in spending vs. $3T in revenue (2021)

The cause of inflation matters to CRE returns

Inflation from strong economic growth benefits CRE returns when it includes rising rents, lower vacancy, rising income growth

Landlords must be able to pass along inflationary pressures to residents Inventory oversupply exacerbates this environment

Rising cost of goods and stagflation is detrimental. Vacancy is higher, landlords can’t effect rent increases, interest rates rise

If rising inflation means rising interest rates this may push up cap rates and lower returns

The U.S. is moving toward modern monetary theory

MMT removes spending limits. It’s favored by socialists like Bernie Sanders

Today’s $1 is worth 3.7cents of 1913 goods (CPI)