JLL Capital Markets announced that it has arranged an acquisition loan for Alexan on Ross, a 292-unit, luxury, mid-rise, Class A+ multihousing community in the growing Ross Corridor Dallas, Texas.

JLL worked on behalf of the borrower, Internacional, to place the 10-year fixed-rate loan with a Northwestern Mutual.

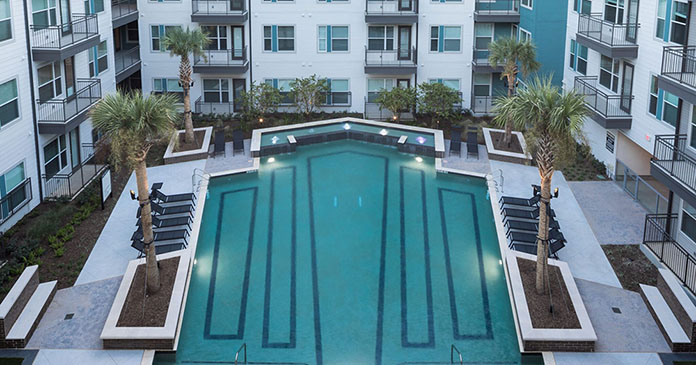

Alexan on Ross was completed in 2018 and is a highly amenitized property that includes a fitness center with strength training and cardio equipment, resort-style pool with cabanas, resident lounges and outdoor skyline terrace. The mix of studio and one- and two-bedroom units average 877 feet, which is the largest average unit side in the Ross Corridor. Units also feature stainless steel appliances; 10-foot ceilings; granite or quartz countertops; USB outlets; wireless built-in speakers; cabinetry with undermount lighting; full size washers and dryers; luxury spa shower and tub combinations; custom closets; and plank flooring.

The property is located at 4001 Ross Ave. in Dallas’ Ross Corridor, which is a trendy and rapidly transforming urban neighborhood minutes from both Downtown and Uptown Dallas. With a Walk Score of 82, the “very walkable” area is surrounded by galleries, restaurants and bars and entertainment options. This high barriers-to-entry market has a limited supply of multi-housing properties and houses an affluent renter-by-choice demographic.

The JLL Capital Markets debt team that represented the borrower was led by Senior Managing Director Mark Brandenburg and Associate Chad Russell.

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients—whether investment sales and advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.