Fannie Mae’s November economic and housing forecasts call for fewer housing starts in 2021 than in earlier forecasts. However, the forecasts for housing starts in 2022 were revised modestly higher.

Housing: less in the near term

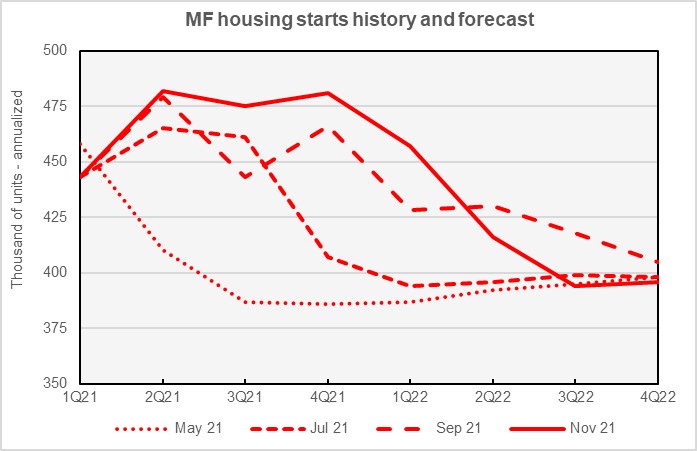

Fannie Mae now expects multifamily starts (2+ units per building) to be 470,000 units in 2021, up 21 percent from the number of units started in 2020. This forecast is down 4,000 units from the level forecast last month. The forecast for multifamily starts in 2022 is 416,000 units, unchanged from the level forecast last month.

The November forecast included projections for 2023 for the first time. Fannie Mae’s first estimate is that 398,000 units of multifamily housing will be started in that year, down 4 percent from the level they forecast for 2022.

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. The chart shows that Fannie Mae has repeatedly increased their projection for multifamily housing starts in the near term while making less dramatic changes to their longer-range forecasts.

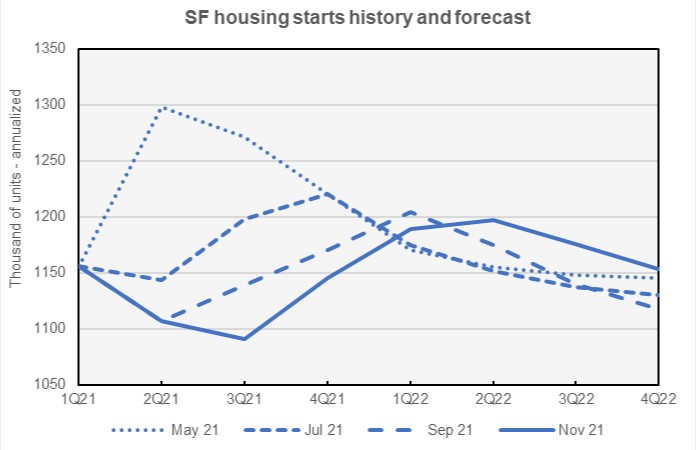

For 2021 as-a-whole, Fannie Mae now expects single family starts to be 1,125,000 units, down 14,000 units from the level forecast last month. Fannie Mae has reduced their forecast for single-family starts every month since May, when they were expecting 1,227,000 units to be started in 2021.

Fannie Mae’s raised their forecast for single-family starts in 2022 by 4,000 units to a level of 1,179,000 units. Their first look at 2023 projects 1,113,000 single-family units to be started that year.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts. The chart shows that Fannie Mae has reduced its near-term estimates for single-family housing starts while increasing its estimates for starts in later timeframes.

Fannie Mae sees material supply constraints, slower GDP growth and higher interest rates triggered by rising inflation as headwinds for housing providers over the next year or so.

Inflation forecast higher

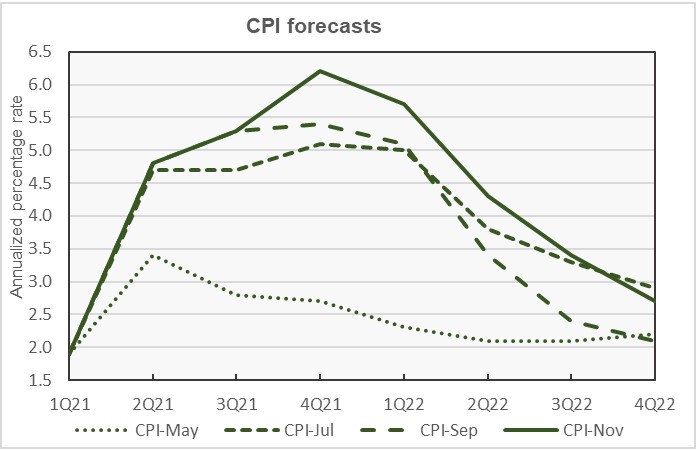

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Since prices moved sharply higher in May, forecasters have been debating how long the bout of inflation will last and how high prices will go. This is reflected in Fannie Mae’s forecast history as illustrated in the chart. More recent forecasts generally predict higher inflation for a longer period of time than did earlier forecasts.

Fannie Mae’s November forecast raised the predicted level of inflation in Q4 2021 from 5.7 percent (annualized) in October’s forecast to 6.2 percent. It raised the predicted level of inflation in Q3 2022 from 3.1 percent to 3.4 percent.

GDP growth forecast lower

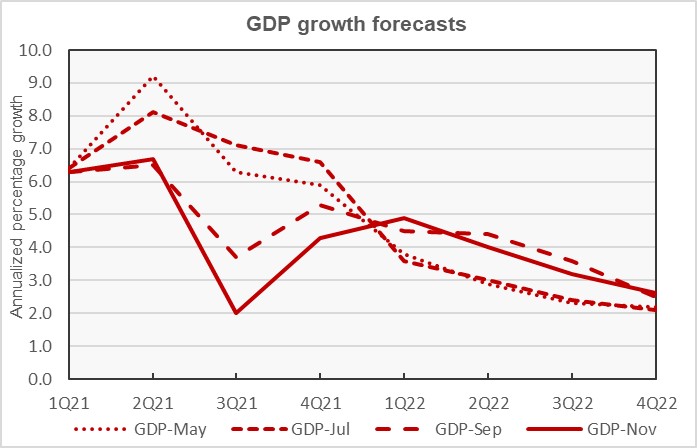

Supply chain problems and labor shortages are weighing on GDP growth. Fannie Mae’s November forecast predicts that these factors will slow economic growth more than they had anticipated in past forecasts. This is illustrated in the next chart, below, which shows the current forecast for GDP, along with three earlier forecasts.

Fannie Mae’s forecast for GDP growth in Q3 2021 was revised downward again this month, falling to 2.0 percent (annualized). This is down from the 2.2 percent forecast last month and the 3.7 percent forecast in September. GDP growth is expected to be 4.8 percent in 2021 before falling to 3.7 percent in 2022 and 2.1 percent in 2023.

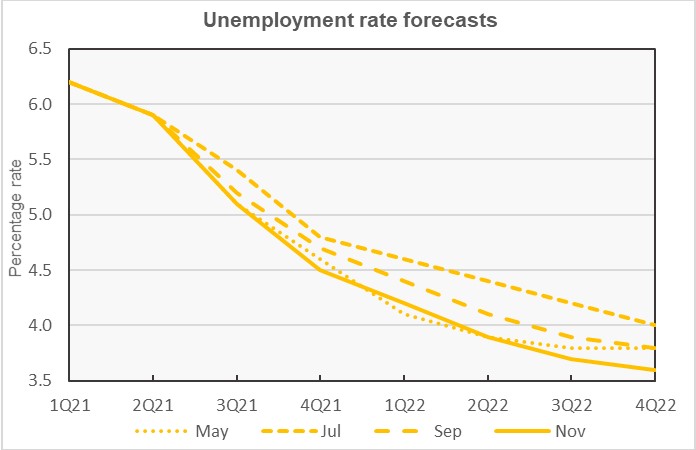

Unemployment forecast slightly lower

After anticipating slightly higher rates of unemployment in Fannie Mae’s late-summer forecasts, the November forecast is predicting the same average annual levels of unemployment for the whole years of 2021 and 2022 as were called for in the May and June forecasts. Average unemployment for the year 2021 is forecast to be 5.4 percent while average unemployment for the year 2022 is forecast to be 3.9 percent. Average unemployment for the year 2023 is forecast to be 3.7 percent.

This month, Fannie Mae’s Multifamily Market Commentary focused on the student housing segment. This segment weathered the pandemic better than many observers had feared and occupancy rates are currently at very high levels. However, declining birthrates in the United States and reduced numbers of students coming from foreign countries cloud the long-term prospects for this segment.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecasts.