A pair of reports, one from Trepp and one from the Mortgage Bankers Association (MBA) indicate that delinquencies on loans on commercial property continue to decline from the elevated levels they reached early in the pandemic.

Viewing multiple sources of funds

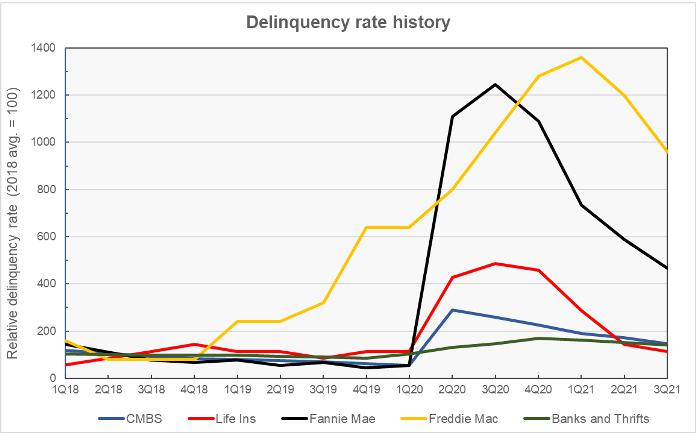

The MBA report covers commercial property lending by Fannie Mae and Freddie Mac as individual entities and also lending by issuers of commercial mortgage-backed securities (CMBS), life insurance companies, and banks and thrifts.

One point made in the MBA report is that the standards that these various lenders use in assessing whether to report a loan as delinquent vary widely. Therefore, the absolute delinquency rates reported by the different lenders are not directly comparable. With this in mind, the first chart, below, shows the relative delinquency rate history for the lenders covered in the MBA report. The data displayed is normalized so that the average quarterly delinquency rate for each of the lenders in 2018 is set to a value of 100.

The chart illustrates that the delinquency rates for most of the lender types leapt higher when the pandemic-related shutdowns started to be imposed in 2Q 2020. The exception to this is Freddie Mac, where delinquencies had been rising pre-pandemic. However, Freddie Mac had the lowest starting delinquency rate, with a 2018 quarterly average of only 0.013 percent. Loans from Fannie Mae and Freddie Mac, who dominate multifamily lending, are the farthest from returning to their pre-pandemic delinquency rates.

While the delinquency rate on CBMS loans rose less than did the rates on loans from most other sources, these loans had by far the highest average delinquency rate in 2018, with 3.32 percent of loans delinquent.

By the numbers, the reported delinquency rates in Q3 2021 were 4.86 percent for CBMS, 0.04 percent for life insurance companies, 0.42 percent for Fannie Mae, 0.12 percent for Freddie Mac and 0.69 percent for banks and thrifts.

Focusing on CBMS

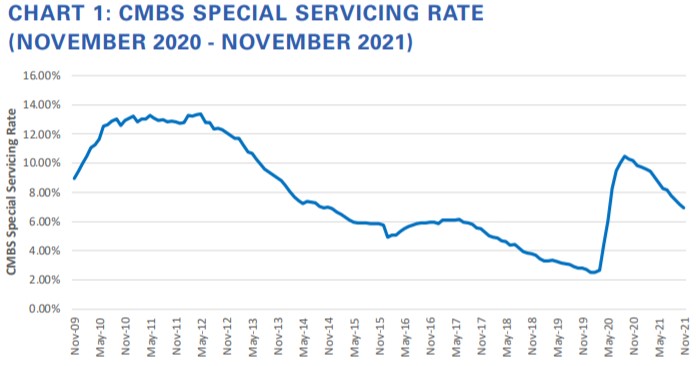

The Trepp report focuses on special servicing rates for the CBMS industry. The history of these rates over the past 12 years is shown in the next chart, below, which was taken from the Trepp report.

The chart shows the high percentage of loans which were under special servicing in the aftermath of the global financial crisis, and the generally steady decline in the special servicing rate since then. As with the MBA data, the Trepp data shows a jump in problem loans in the spring of 2020, followed by a steady decline since then. However, the MBA data shows that the CBMS delinquency rate now is less than 50 percent higher than its pre-pandemic level while the Trepp data shows that the special servicing rate is now 2 ½ times its pre-pandemic level.

Unlike the MBA report, the Trepp report also breaks out CBMS special servicing rates by category of industrial property. It found that the special servicing rate on loans on multifamily property in November was 2.16 percent. The special servicing rates for loans on other classes of commercial property were 0.59 percent for industrial, 2.97 percent for office, 13.08 percent for retail and 15.15 percent for lodging. The overall special servicing rate for all commercial property types was 6.95 percent.

The full MBA report can be found here, while the full Trepp report can be found here.