A new report from CoStar says that multifamily property prices continued their recent rise in October, although the rate of price gains has moderated recently.

CCRSI defined

The CoStar report focuses on a relative measure of property prices called the CoStar Commercial Repeat Sales Index (CCRSI). The index is computed based on the resale of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. CoStar identified 1,822 repeat sale pairs in October for all property types. These sales pairs were used to calculate the results quoted here.

Price performance mixed

CoStar reported that its value-weighted index of multifamily property prices increased 17.1 percent, year-over-year, in October 2021. The index was up 1.1 percent month-over-month.

The combined value-weighted index of non-multifamily commercial property rose by 11.7 percent, year-over-year, in October. However, the index fell 0.3 percent month-over-month. The other commercial property types tracked by CoStar are office, retail, industrial and hospitality.

Comparing property types

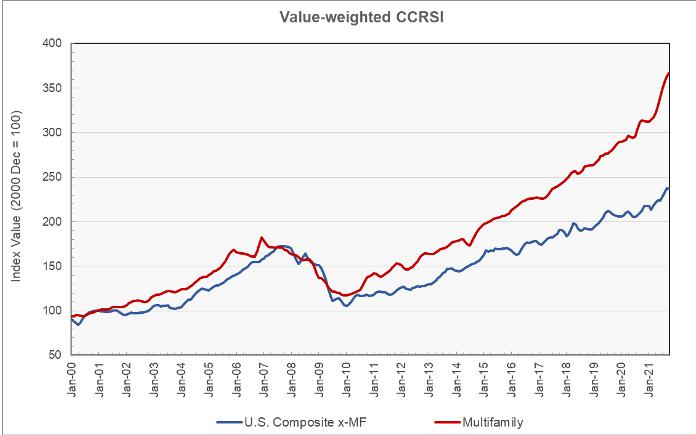

The first chart, below, shows the history of the value-weighted CCRSI’s since January 2000 for multifamily property and for all other commercial property considered as a single asset class. The indexes are normalized so that their values in December 2000 are set to 100. The chart show that both indexes are well above the peaks they reached at the height of the housing bubble in 2007. It also shows the strong growth in multifamily property prices in recent months.

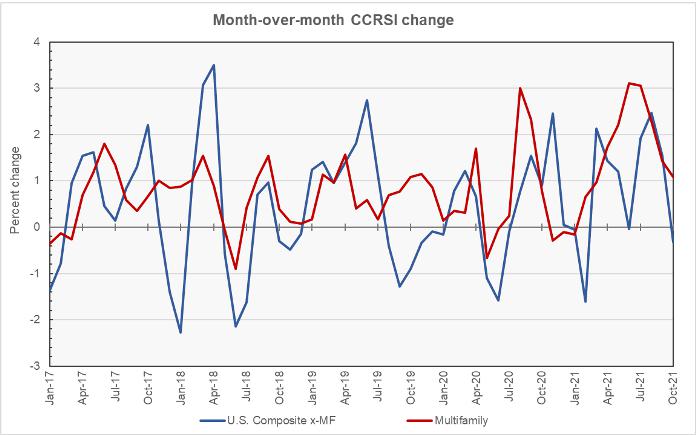

The second chart shows the month-over-month change in the value-weighted multifamily property price index and that for all other commercial property types since January 2017. The chart shows that the monthly price growth for multifamily property has generally moved into negative territory to a lesser degree and for shorter periods than has the price growth for other commercial property types over the time period illustrated. It also shows that the monthly rate of increase in multifamily property prices has been declining since reaching a recent peak last June.

Transaction volumes moderating

CoStar reported that number of repeat-sale transactions were down 14 percent in October from September’s volume. On a dollars basis, repeat-sale transactions were down 7.9 percent to $17.8 billion. However, transacted prices remained high relative to asking prices at 94.6 percent and average days-on-market remained relatively low at 218 days, both signs of good market liquidity.

The full reports discuss all commercial property types, but detailed data on each of the property types and regional data are only reported quarterly and so are not included in this month’s report. While the CoStar report provides information on transaction volumes, it does not break out multifamily transactions. The latest CoStar report can be found here.