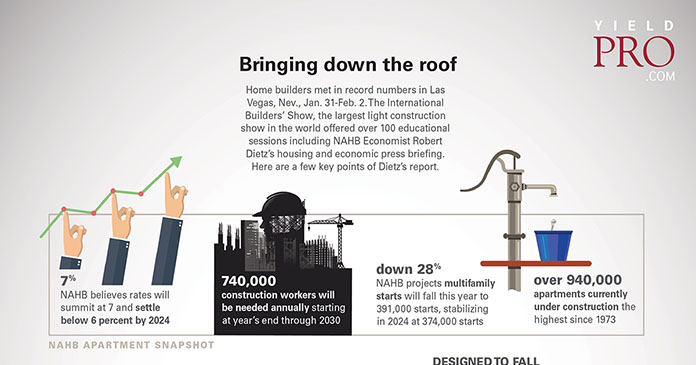

Home builders met in record numbers in Las Vegas, Nev., Jan. 31-Feb. 2. The International Builders’ Show, the largest light construction show in the world offered over 100 educational sessions including NAHB Economist Robert Dietz’s housing and economic press briefing. Here are a few key points of Dietz’s report.

NAHB apartment snapshot

- NAHB believes rates will summit at 7 percent and settle below 6 percent by 2024

- 740,000 construction workers will be needed annually starting at year’s end through 2030

- NAHB projects multifamily starts will fall this year to 391,000 starts, stabilizing in 2024 at 374,000 starts (down 28 percent).

- Over 940,000 apartments currently under construction—the highest since 1973

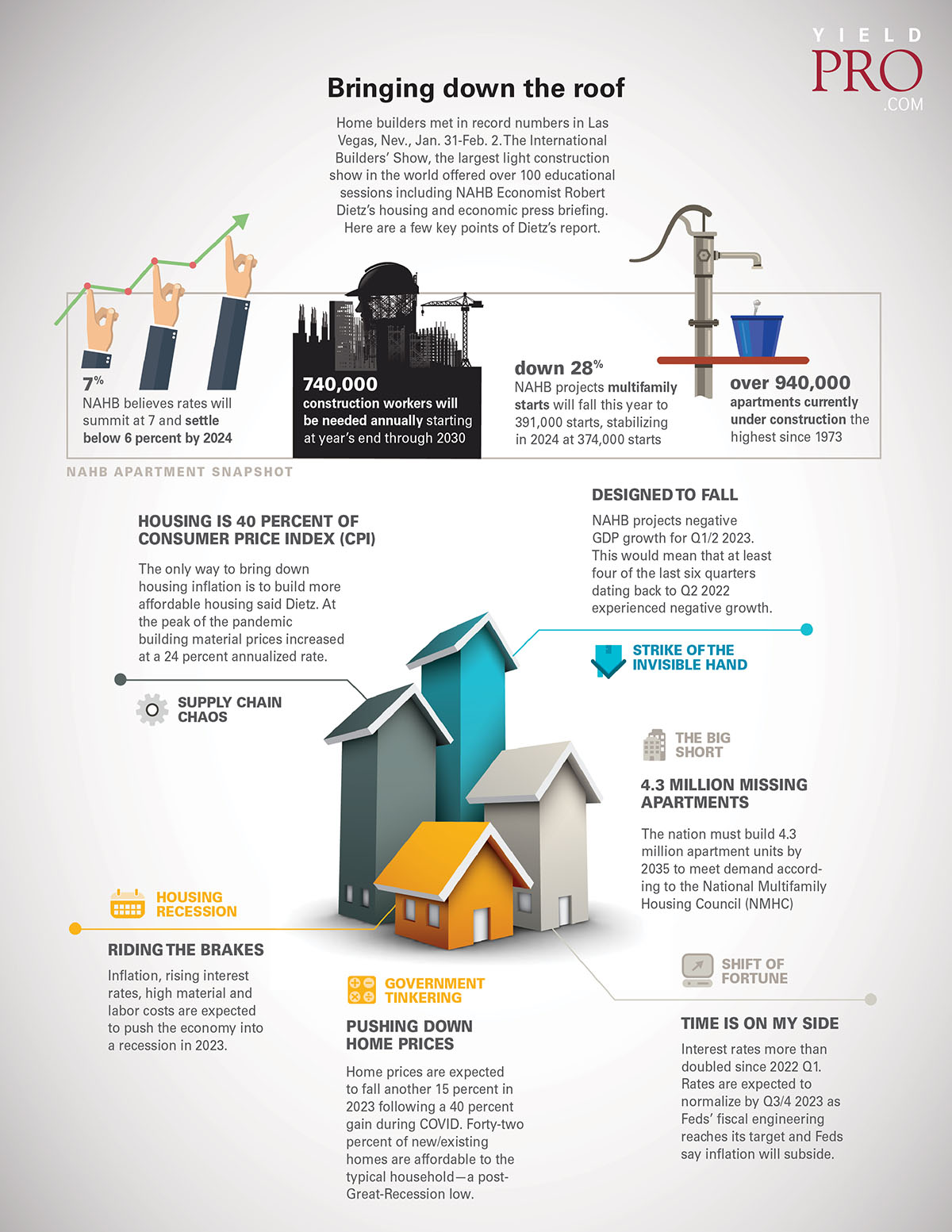

Supply chain chaos

Housing is 40 percent of Consumer Price Index (CPI). The only way to bring down housing inflation is to build more affordable housing said Dietz. At the peak of the pandemic building material prices increased at a 24 percent annualized rate.

Strike of the invisible hand

Designed to fall. NAHB projects negative GDP growth for Q1/2 2023. This would mean that at least four of the last six quarters dating back to Q2 2022 experienced negative growth.

The big short

4.3 million missing apartments. The nation must build 4.3 million apartment units by 2035 to meet demand according to the National Multifamily Housing Council (NMHC)

Housing recession

Riding the brakes. Inflation, rising interest rates, high material and labor costs are expected to push the economy into a recession in 2023.

Government tinkering

Pushing down home prices. Home prices are expected to fall another 15 percent in 2023 following a 40 percent gain during COVID. Forty-two percent of new/existing homes are affordable to the typical household—a post- Great-Recession low.

Shift of fortune

Time is on my side. Interest rates more than doubled since 2022 Q1. Rates are expected to normalize by Q3/4 2023 as Feds’ fiscal engineering reaches its target and Feds say inflation will subside.