Here’s the multifamily housing industry take

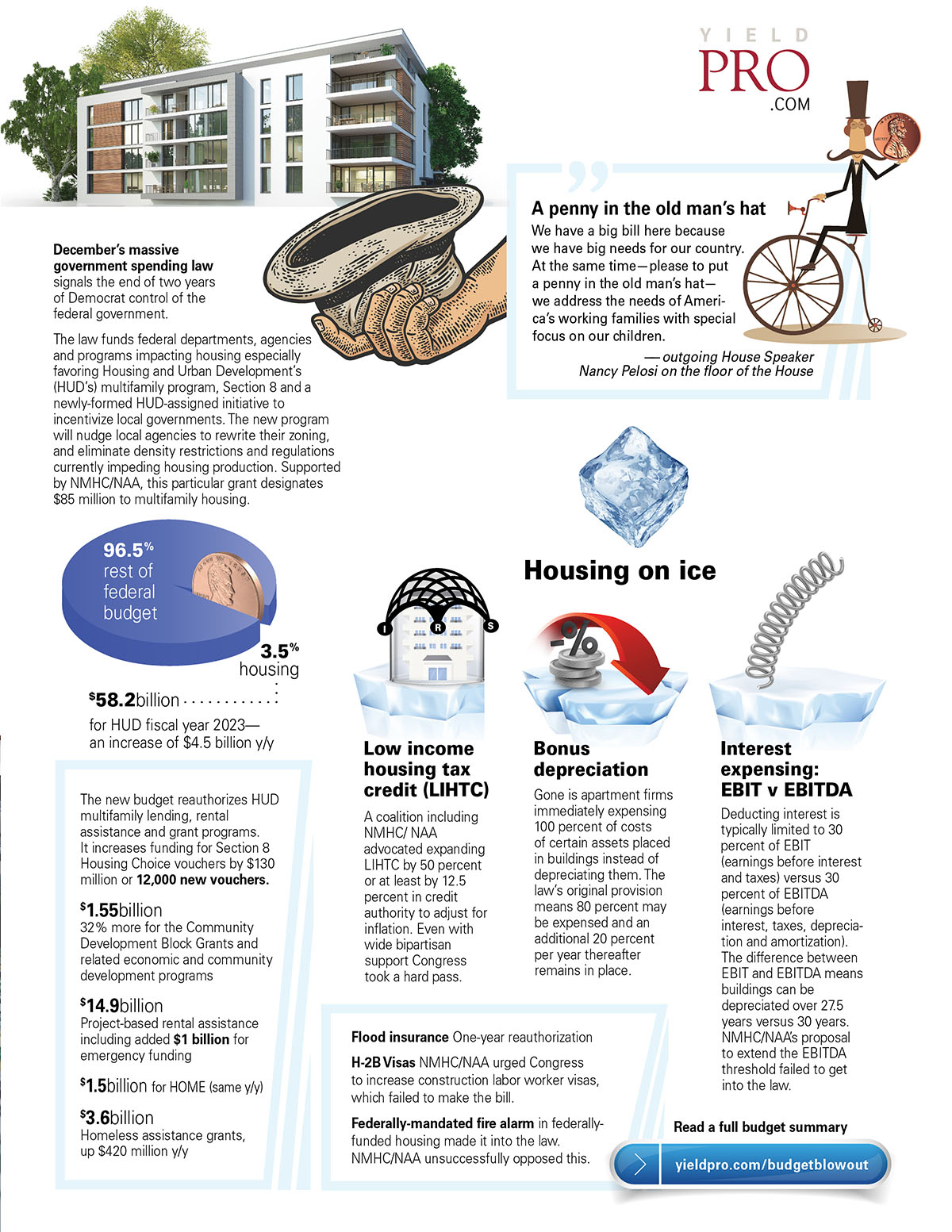

December’s massive government spending law signals the end of two years of Democrat control of the federal government.

The law funds federal departments, agencies and programs impacting housing especially favoring Housing and Urban Development’s (HUD’s) multifamily program, Section 8 and a newly-formed HUD-assigned initiative to incentivize local governments. The new program will nudge local agencies to rewrite their zoning, and eliminate density restrictions and regulations currently impeding housing production. Supported by NMHC/NAA, this particular grant designates $85 million to multifamily housing.

A penny in the old man’s hat

We have a big bill here because we have big needs for our country. At the same time—please to put a penny in the old man’s hat—we address the needs of America’s working families with special focus on our children.

—outgoing House Speaker Nancy Pelosi on the floor of the House

The new budget reauthorizes HUD multifamily lending, rental assistance and grant programs.

It increases funding for Section 8 Housing Choice vouchers by $130 million or 12,000 new vouchers.

$1.55 billion

32 percent more for the Community Development Block Grants and related economic and community development programs

$14.9 billion

Project-based rental assistance including added $1 billion for emergency funding

$1.5 billion

for HOME (same y/y)

$3.6 billion

Homeless assistance grants, up $420 million y/y

Flood insurance one-year reauthorization

H-2B Visas NMHC/NAA urged Congress to increase construction labor worker visas, which failed to make the bill.

Federally-mandated fire alarm in federally-funded housing made it into the law. NMHC/NAA unsuccessfully opposed this.

Housing on ice

Low income housing tax credit (LIHTC)

A coalition including NMHC/ NAA advocated expanding LIHTC by 50 percent or at least by 12.5 percent in credit authority to adjust for inflation. Even with wide bipartisan support Congress took a hard pass.

Bonus depreciation

Gone is apartment firms immediately expensing 100 percent of costs of certain assets placed in buildings instead of depreciating them. The law’s original provision means 80 percent may be expensed and an additional 20 percent per year thereafter remains in place.

Interest expensing: EBIT v EBITDA

Deducting interest is typically limited to 30 percent of EBIT (earnings before interest and taxes) versus 30 percent of EBITDA (earnings before interest, taxes, depreciation and amortization). The difference between EBIT and EBITDA means buildings can be depreciated over 27.5 years versus 30 years. NMHC/NAA’s proposal to extend the EBITDA threshold failed to get into the law.