JLL Capital Markets announced that it has arranged $10.5 million in construction takeout refinancing for Park Place at Jordan Downs, an 80-unit affordable housing development in Southeast Los Angeles, California.

JLL represented the borrower, BRIDGE Housing Corporation, to secure the 17-year, fixed-rate Fannie Mae loan. The loan will be serviced by JLL Real Estate Capital, LLC, a Fannie Mae DUS lender.

Built in 2022, Park Place is both a rent- and income-restricted at consist of 30 percent, 40 percent, 50 percent, 60 percent and 80 percent AMI. The property is a part of the Housing Authority of the City of Los Angeles’ (HACLA) multibillion-dollar plan to redevelop the Jordan Downs public housing development. Upon completion, the entire development will have nearly 1,600 new affordable and market-rate apartments, some of which will be owner occupied. The complex will include more than 150,000 square feet of commercial space, a large community center and several public parks.

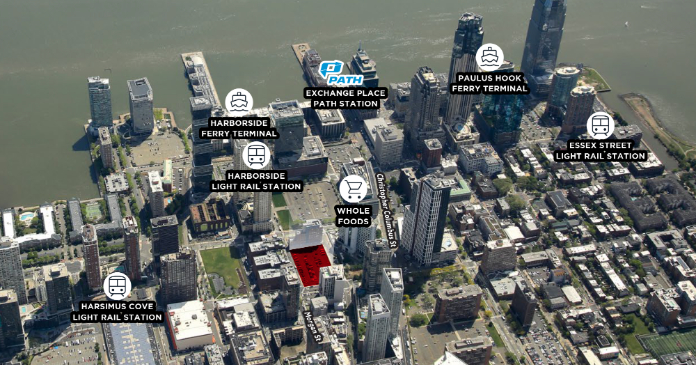

The property is situated at 2062 East 99th Place in the Watts neighborhood of the Southeast Los Angeles submarket.

The JLL Capital Markets Debt Advisory team was led by Senior Director Anson Snyder.

Agency/GSE lending and loan servicing are performed by JLL Real Estate Capital, LLC, a wholly owned indirect subsidiary of Jones Lang LaSalle Incorporated.

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients—whether investment and sales advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.