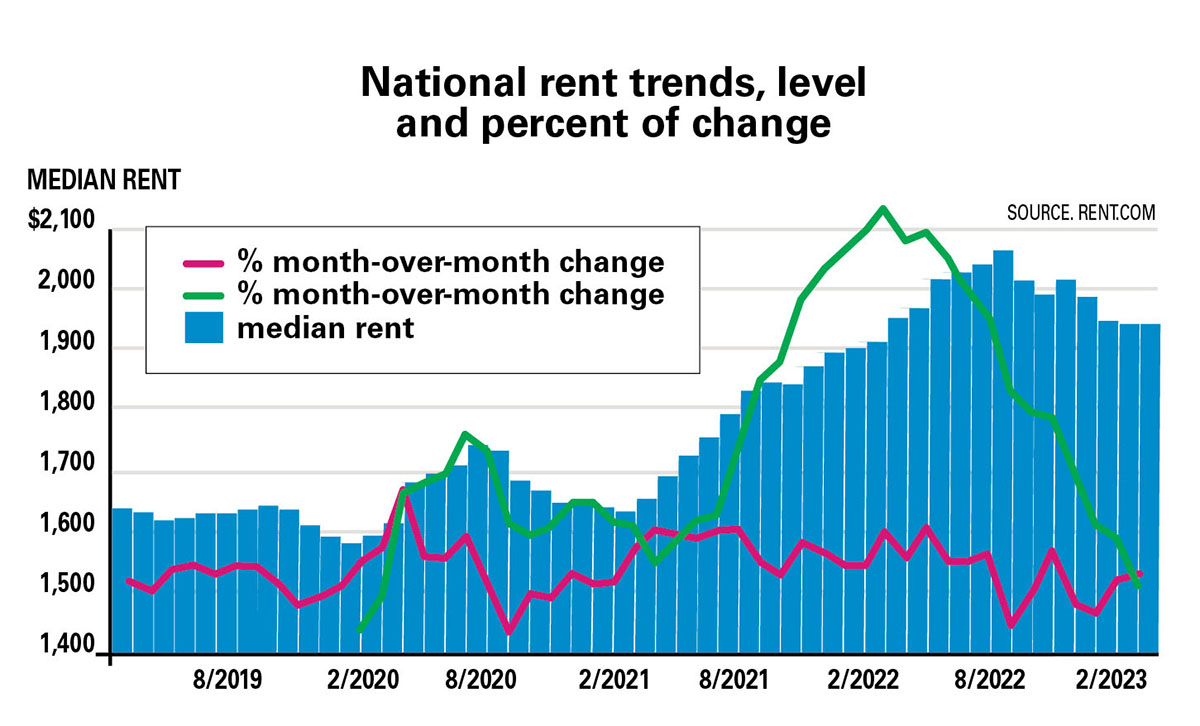

Yearly rent growth turned negative for the first time since the beginning of the COVID era. March rent levels dipped 0.40 percent following eight months of decelerating growth, and six months of single-digit growth that followed double-digit increases which lasted for nearly a year from October 2021 to September 2022. Yearly growth was last posted negative three years ago, in March 2020.

Monthly rent changes remained largely unchanged, dipping 0.01 percent from February to March. Monthly prices have decreased each of the last four months and six of the last seven months. March’s change was the lowest decrease over that time.

The national median rent is now $1,937—the exact same price posted in February when rounded to the nearest dollar. That month’s price was the lowest median rental price since February 2022 when rents were $1,904. Prices peaked in August 2022 at $2,053, and are down 5.63 percent since then. Since March 2021, rents have grown 17.11 percent, an annual growth rate of nearly 8.56 percent that increased rents by $283 on a monthly basis.

Broad trends across the rental industry, including increased vacancy rates, new inventory, a cooling housing market and demand below seasonal norms are driving price slowdowns. Let’s look at where rent prices stand today.

National rent trends

March rent prices declined by nearly half a percentage point. This marked the first yearly rent price decrease in 36 months and follows six consecutive months of single-digit increases. The slowdown is significant given an 11-month period from October 2020 to September 2021 that sustained double-digit rent increases.

Rent prices stayed even on a monthly basis, recording a $1,937 rent level in both February and March. The -0.01 percent change is the smallest decline since prices began to moderate in September 2022. Prices have fallen month-over-month in six of the last seven months, averaging a nearly one-percent drop each month from September through February. November was the only exception, rising 1.23 percent.

March and February’s price is the lowest since February 2022 when the median rent was $1,904. Prices peaked in August 2022 at $2,053.

State rent trends

Despite the yearly decrease in rents at the national level, more than 80 percent of state-level markets posted positive yearly rent growth. Among the 19 states that saw growth greater than five percent, 17 are located in the Midwest or South. New Hampshire and New Mexico were the only states outside those regions.

Median rents were up on a monthly basis in nearly 60 percent of state-level markets. Colorado saw the largest monthly increase at 4.39 percent, followed by Alabama, Oregon and Minnesota—which all saw monthly increases above two percent. Thirteen states registered monthly increases of less than one percent.

New Hampshire saw the biggest declines month over month at -3.31 percent. Louisiana and Connecticut each saw monthly decreases above two percent while another 10 states registered monthly decreases greater than the national average.

Only South Dakota saw a yearly increase above 20 percent, at 24.44 percent growth. Nine other states calculated growth between 10 and 20 percent, along with another nine that clocked in between five and 10 percent. Sixteen states saw positive rent growth of less than five percent.

Among the 10 states with the highest year-over-year rent growth, all demonstrated increases above 10 percent:

- South Dakota (+24.44 percent)

- Mississippi (+18.73)

- New Hampshire (+15.40)

- North Dakota (+14.44)

- Arkansas (+13.71)

- Alabama (+12.73)

- Iowa (+12.32)

- Florida (+11.82)

- Delaware (+10.67)

- Nebraska (+10.10)

Year-over-year state decreases

Just over 18 percent of state markets in this study were down year over year. Of the eight states that saw yearly decreases, three of were in the West, with Nevada, Washington and Idaho seeing the steepest declines. Rents in Idaho have declined for the sixth straight month.

Of the remaining five states, three are in the South including Virginia, Maryland and Texas. Kansas was the only Midwestern state to see a yearly decrease, while Massachusetts was the only Northwestern state with a slight one percent drop.

- Nevada (-4.12 percent)

- Washington (-4.07)

- Idaho (-3.95)

- Kansas (-2.36)

- Virginia (-1.66)

- Massachusetts (-1.02)

- Maryland (-0.95)

- Texas (-0.84)

Metro areas rent price trends

Among the 50 most populous metropolitan areas, Raleigh-Cary, N.C. saw the most significant yearly rent increase for the third month in a row at 16.58 percent. Three other metros—Cleveland, Ohio, Charlotte, N.C. and Indianapolis, Ind. — all registered yearly increases above 10 percent. Among the 10 largest gainers, eight were from the South or Midwest for the second month in a row. Riverside, Calif. and Denver, Colo. also saw significant yearly increases at 7.22 and 6.97 percent, respectively.

In total, 14 metros observed price declines. Eleven of those states are in the Midwest or South, including the six metros with the highest yearly declines. Rents also declined in the Sacramento, Calif., Las Vegas, Nev. and Phoenix, Ariz. metros.

These metros have experienced the greatest increase in rent prices y/y:

- Raleigh-Cary, N.C. (+16.58 percent)

- Cleveland-Elyria, Ohio (+15.28)

- Charlotte-Concord-Gastonia, N.C.-S.C. (+13.03)

- Indianapolis-Carmel-Anderson, Ind. (+10.50)

- Nashville-Davidson-Murfreesboro-Franklin, Tenn. (+9.62)

- Columbus, Ohio (+9.40)

- Kansas City, Mo. (+8.08)

- Riverside-San Bernardino-Ontario, Calif. (+7.22)

- Denver-Aurora-Lakewood, Colo. (+6.97)

- St. Louis, Mo.-Ill. (+4.16)

Excerpt Jon Leckie, rent.com