Fannie Mae’s June economic and housing forecast predicts that the expected economic downturn will occur slightly later than did other recent forecasts. It also predicts a higher level of multifamily starts in 2023 but a lower number of multifamily starts in 2024.

Multifamily housing starts forecast higher

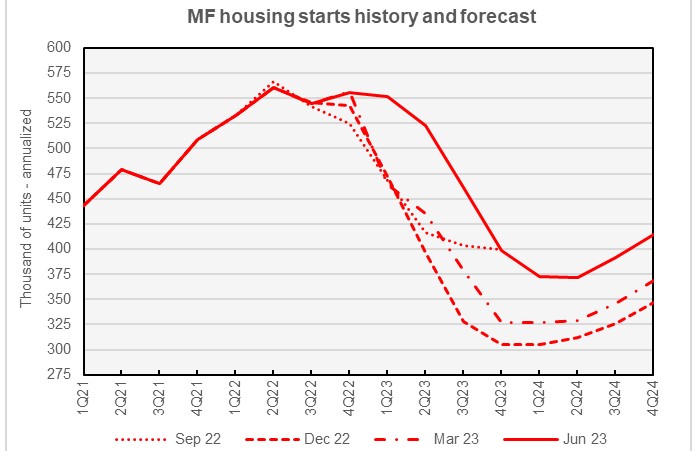

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The chart shows that the forecasters have been surprised by the strength in multifamily housing construction in 2023. The June forecast for multifamily starts is significantly higher for every quarter of 2023 and 2024 than was either the March forecast or the December forecast. The predicted downturn in multifamily starts during the expected contraction of the economy later this year is also less deep in the latest forecast than in forecasts from March or December.

The current forecast calls for the lowest annualized rate of multifamily housing starts (2+ units per building) during the downturn to be 372,000 units in Q2 2024. This is one quarter later and 5,000 units lower than was predicted in last month’s forecast.

Compared to last month’s forecast, the predicted number of multifamily starts in 2023 was revised upward by 5,000 units to 483,000 units. The predicted number of multifamily starts for 2024 was revised downward by 6,000 units to 388,000 units.

Single-family starts shows strength

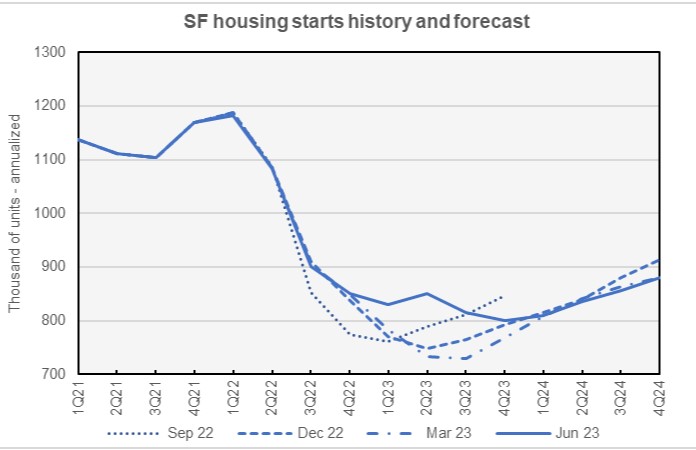

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae’s forecasters raised their predicted numbers for single-family starts in the period from Q2 through Q4 2023. However, they lowered their forecasts for single-family starts for every quarter of 2024.

Fannie Mae now expects single-family starts to be 824,000 units in 2023, up 9,000 units from the level forecast last month. Fannie Mae now expects single-family starts to be 845,000 units in 2024, down 7,000 units from the level forecast last month.

Later GDP downturn, later recovery

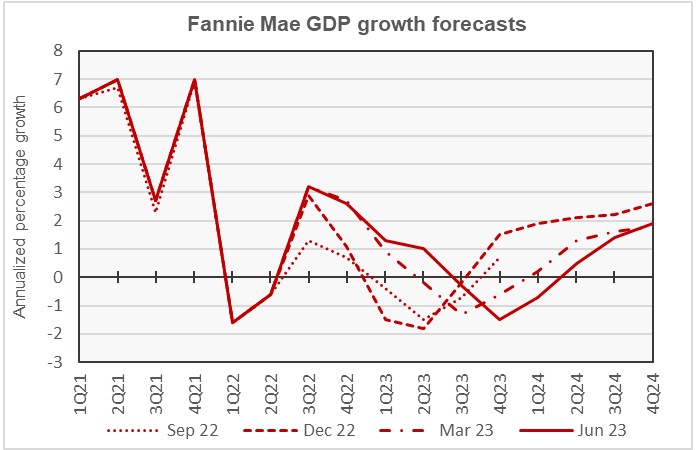

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

Fannie Mae’s forecasters have once again slightly delayed the date of the expected recession compared to recent forecasts. They still expect the first quarter of negative GDP growth to be Q3 2023 but, compared to last month’s forecast, they have reduced the size of the economic contraction they expect in that quarter from -1.2 percent annualized to -0.3 percent annualized. Positive GDP growth is expected to return in Q2 2024, but the rate of growth forecast for every quarter of 2024 in this month’s forecast is lower than that predicted last month.

The full year forecast for GDP growth for 2023 was revised upward by 0.3 percentage point to 0.0 percent. The full year forecast for 2024 was revised downward by 0.4 percentage points to +0.8 percent.

Inflation forecast edges lower

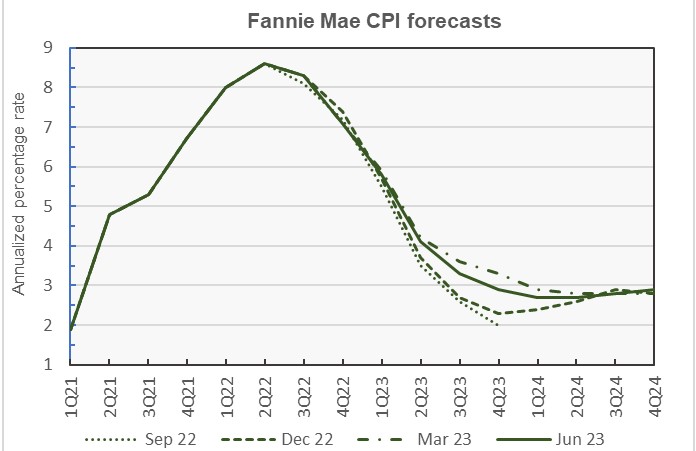

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

The current Fannie Mae inflation forecast predicts a steady decline through Q2 2024 in headline CPI inflation, which peaked in Q2 2022 at 8.6 percent year-over-year. The forecast then predicts a 0.1 percentage point rise in the CPI inflation rate in each of Q3 and Q4 2024. However, the current forecast predicts that the core CPI inflation will continue to fall through the end of 2024, implying that the rise in headline CPI inflation may be due to increases in volatile food and energy prices as the economy returns to growth.

Looking at whole-year forecasts, the forecasts for year-over-year headline CPI growth in Q4 2023 was revised downward from last month’s level by 0.1 percentage points to 2.9 percent. The Q4 2024 was also revised downward by 0.1 percentage points to 2.9 percent.

Employment growth: job losses come later

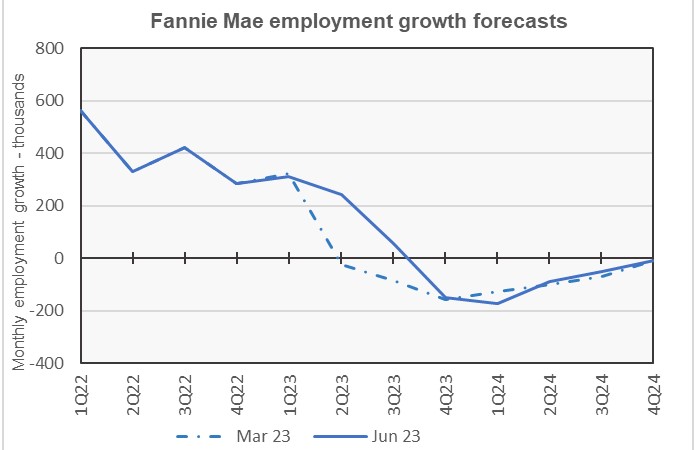

The next chart, below, shows Fannie Mae’s current forecast for the employment growth, along with the forecast from 3 months earlier. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth.

Compared to the recent forecasts, Fannie Mae’s June employment growth forecast calls for job losses to begin one quarter later. The first quarter with declining employment levels is now expected to be Q4 2023. Predicted employment gains forecast for 2023 are now the highest for any of the Fannie Mae’s forecasts issued after they switched to revised U.S. population estimates in February 2023.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2023 was revised upward from a gain of 600,000 jobs to a gain of 1.4 million jobs. The employment growth forecast for 2024 was left unchanged at a loss of 900,000 jobs.

The Fannie Mae forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.