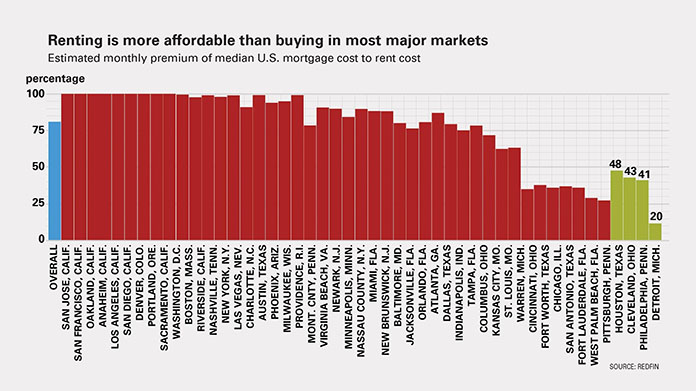

The average monthly mortgage costs 25 percent more on average than renting across the nation’s 50 most populous cities with just four exceptions: Detroit, Philadelphia, Cleveland and Houston. Of these cities, in Detroit it costs 24 percent less to buy than rent—the most significant differential where the median mortgage is $1,296 and average rents fall at around $1,697 according to a recent analysis by Redfin.

Comparatively, in Philadelphia it’s cheaper to buy than rent by 7 percent, followed by Cleveland (where it costs 4 percent less to buy over rent) and Houston (where it costs 1 percent less to buy over rent).

A multi-generational housing shortage, onerous regulations and a decimated middle class have made California the tops in the nation for renting having a cost advantage. It is double the cost to own than to rent in the state’s major metros of San Jose, San Francisco, Sacramento, Anaheim and Oakland. And the housing shortage—particularly in California—shows no relief in sight.

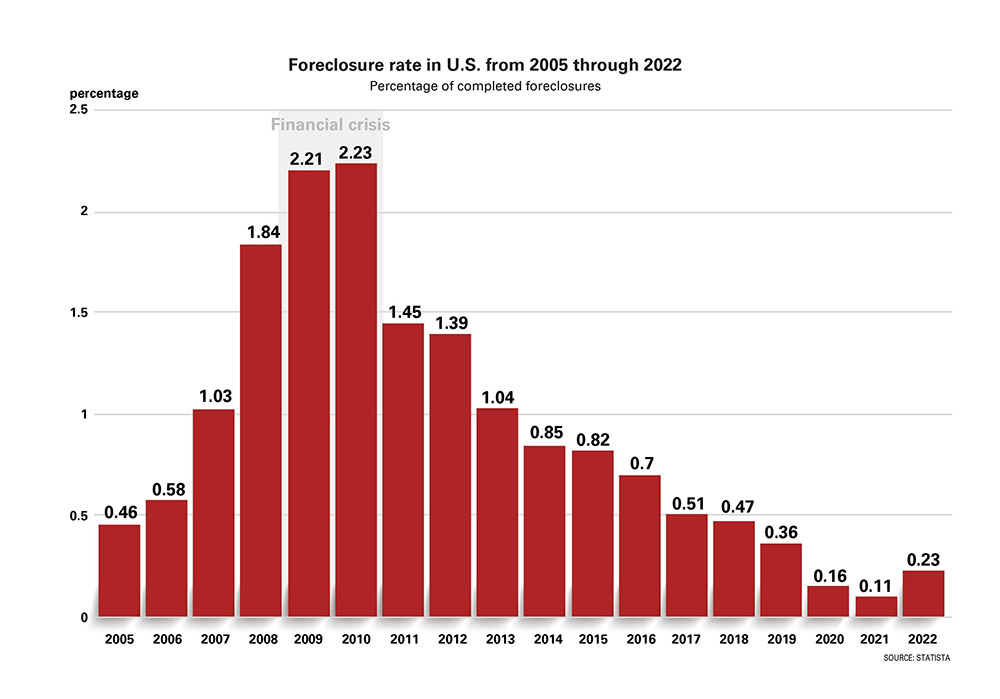

Interest rates continue to tick upward, hitting 7 percent for a 30-year fixed rate in June according to Bankrate data, making renting even more affordable since the study was conducted in March. At the same time, areas such as Cleveland and Detroit don’t experience the highs and lows of places like Phoenix and Miami, making property values more constant.

Mortgage rates would need to fall back down to 3 percent in order for the equilibrium to shift back in favor of buying, giving renting a 7 percent benefit.

A June report released by Redfin found that 91.8 percent of U.S. mortgages are at an interest rate of 6 percent or below, with 82.4 percent below 5 percent and 62 percent below 4 percent. With mortgage rates on the rise, fewer current homeowners will opt to sell to avoid reentering the mortgage market. Without additional for-sale housing inventory, the bubble in U.S. home prices could continue to grow further, building a generation of renters.

Notes on the study: The analysis assumed a 5 percent down payment, homeowner’s insurance rates equal to 0.5 percent of purchase price and 1.25 percent annual property tax rate absent actual tax records, and 6.5 percent mortgage rate. Homes values were drawn off data from Redfin and rental rates from Freddie Mac, PMMS.