American credit card debt remains at record-breaking heights according to fresh government data as consumers turn to plastic amid stubbornly high prices on everyday items and housing.

U.S. credit card debt was $986 billion in the first quarter of this year according to the latest report on household debt from the Federal Reserve Bank of New York. The balance total was the same as the previous quarter’s record high, but $145 billion more than the same time last year—a more than 17 percent jump.

“That the debt level remained unchanged is noteworthy since it bucks decades-long historical trends,” Matt Schulz, chief credit analyst at LendingTree, wrote recently. “This report marks the first time since 2001 in which credit card debt didn’t fall in the first quarter.”

“That lack of a decrease may not bode well for Americans’ credit card debt numbers for the rest of the year,” he added. “Thanks to rising interest rates, stubborn inflation and myriad other economic factors, it’s likely just a matter of time before credit card balances surpass $1 trillion for the first time since the New York Fed began tracking.”

Normally, credit card balances dip in the first quarter of the year, in part because people use their tax returns to make payments, according to credit reporting agency Trans-Union. But its recent data also show that balances remain high, at about $917 billion, a nearly 20 percent hike year-over-year.

“As inflation rose to near 40-year high levels, many consumers have used credit to help manage their budgets, leading to record- or near-record high balances,” Michele Raneri, VP of U.S. research and consulting at TransUnion, said in a press release. “It remains to be seen whether these balances will continue to grow in the near-term, or if growth will slow as consumers moderate their pace of borrowing and if lenders more closely scrutinize consumers and potential risk when determining to whom they lend moving forward.”

The two reports put in stark relief the effect that persistent inflation has had on American consumers over the past year as prices for essential goods and services, such as fuel and food, surged to record highs.

They also underscore the impact on everyday borrowers of the U.S. Federal Reserve’s aggressive campaign to hike interest rates to try to tame inflation and could signal a continued economic slowdown as consumers’ spending power weakens.

Combined with other types of debt, such as mortgages, auto and student loans, and retail cards, the sky-high credit card debt helped push the overall U.S. household debt balance above $17 trillion for the first time according to the New York Fed’s data.

In another concerning sign, more people are starting to miss payments on their credit cards, according to the Fed’s report, released May 15. “Transition rates into early delinquency for credit cards and auto loans increased by 0.6 and 0.2 percentage points, following similarly sized increases for the past year,” the report said.

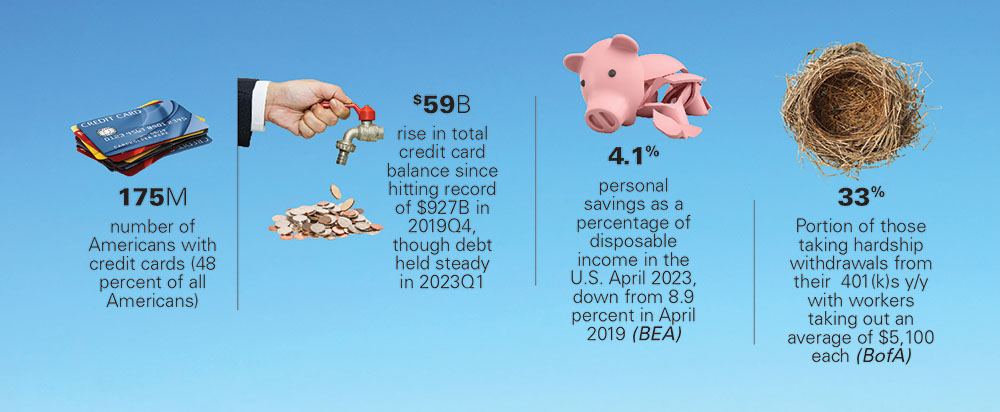

Though inflation has been moderating in recent months, prices for some things, including housing, remain historically high, further squeezing consumers’ wallets. Even before the May reports were released, the Consumer Financial Protection Bureau predicted that the national balance would continue to rise. “Given the trends for the 175 million Americans with credit cards, the CFPB estimates that outstanding credit card debt may continue to set records and could even hit $1 trillion,” CFPB Director Rohit Chopra wrote in an April blog post.

“High inflation is certainly contributing to Americans’ high credit card balances, along with record high interest rates,” said Ted Rossman, a credit card senior industry analyst at personal finance company Bankrate, according to CBS News. “More than a third of U.S. adults have more credit card debt than emergency savings, the highest since we started tracking this in 2011.”

With the Fed approving another interest rate hike earlier in May, credit card rates are now at high levels, making debt more difficult to pay down. “These increases are meant to combat the highest inflation readings in decades, so they are well-intentioned, but there are significant consequences for borrowers,” Rossman wrote in a Bankrate article after the Fed’s announcement.

Excerpt Emma Loop, Washington Examiner