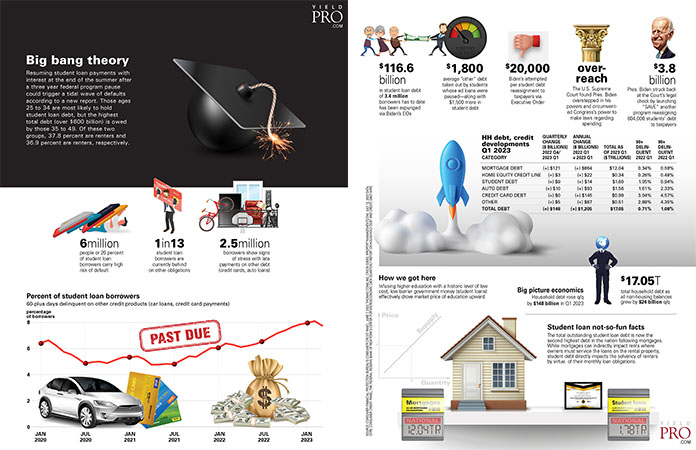

Resuming student loan payments with interest at the end of the summer after a three year federal program pause could trigger a tidal wave of defaults according to a new report. Those ages 25 to 34 are most likely to hold student loan debt, but the highest total debt (over $600 billion) is owed by those 35 to 49. Of these two groups, 37.8 percent are renters and 36.9 percent are renters, respectively.

6 million people or 20 percent of student loan borrowers carry high risk of default

1 in 13 student loan borrowers are currently behind on other obligations

2.5 million borrowers show signs of stress with late payments on other debt (credit cards, auto loans)

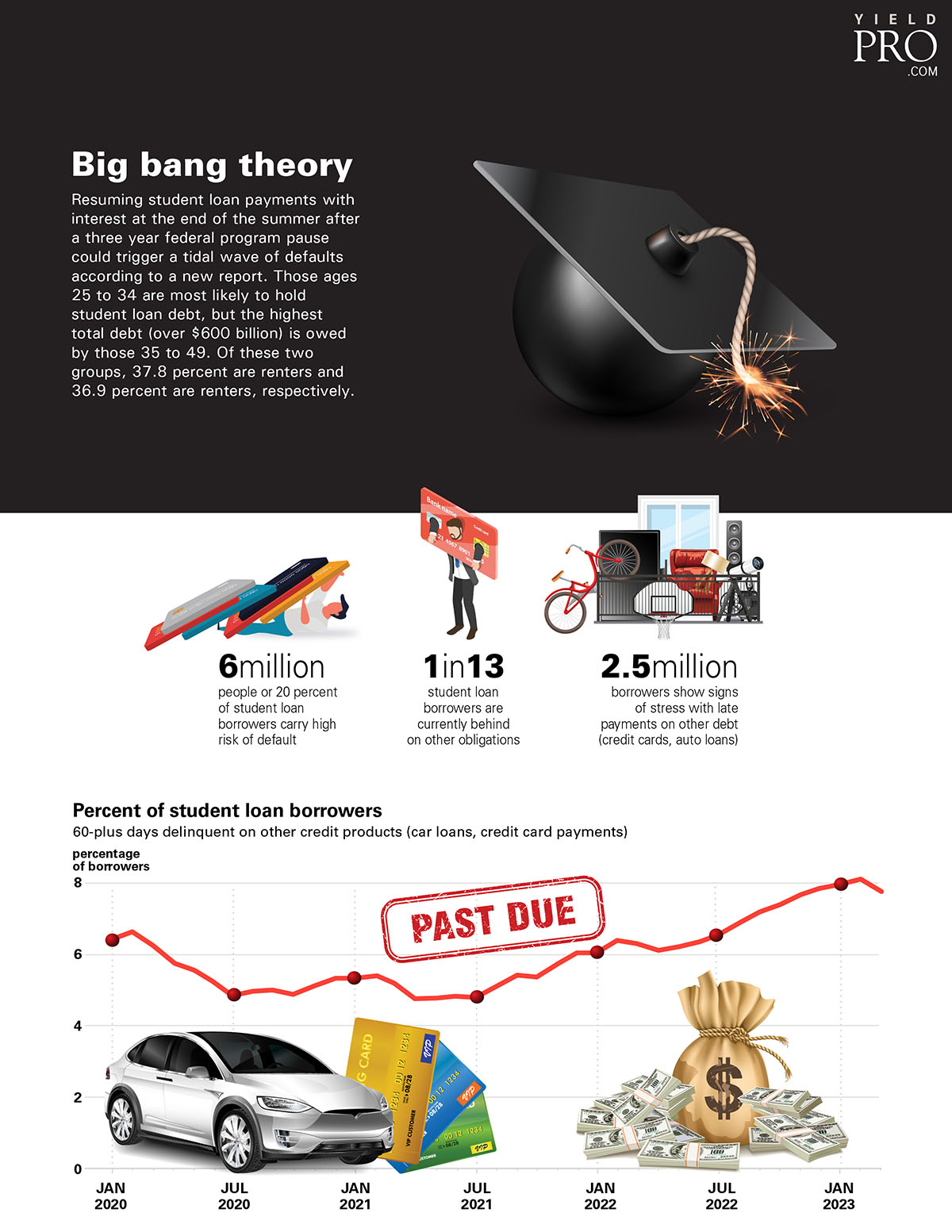

$116.6 billion in student loan debt of 3.4 million borrowers has to date has been expunged via Biden’s EOs

$1,800 average “other” debt taken out by students whose ed loans were paused—along with $1,500 more in student debt

$20,000 Biden’s attempted per student debt reassignment to taxpayers via Executive Order

Over-reach. The U.S. Supreme Court found Pres. Biden overstepped in his powers and circumvented Congress’s power to make laws regarding spending

$3.8 billion Pres. Biden struck back at the Court’s legal check by launching “SAVE” another program reassigning 804,000 students’ debt to taxpayers

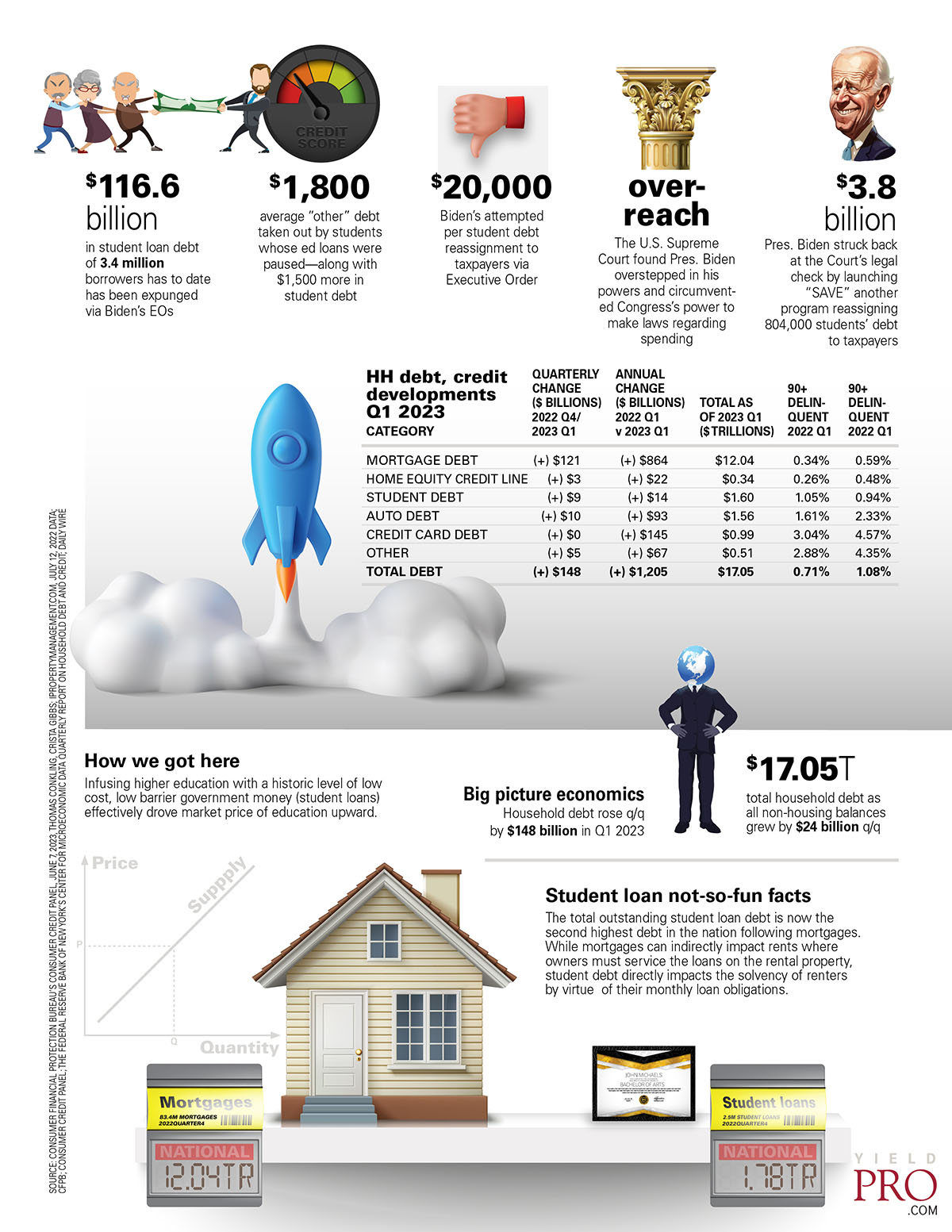

How we got here

Infusing higher education with a historic level of low cost, low barrier government money (student loans) effectively drove market price of education upward.

Big picture economics

Household debt rose q/q by $148 billion in Q1 2023

$17.05 trillion total household debt as all non-housing balances grew by $24 billion q/q

Student loan not-so-fun facts

The total outstanding student loan debt is now the second highest debt in the nation following mortgages. While mortgages can indirectly impact rents where owners must service the loans on the rental property, student debt directly impacts the solvency of renters by virtue of their monthly loan obligations.