A new report from Yardi Matrix has highlighted rent growth and high supply amid low sales and price declines.

Real estate is a lot like the weather: A momentary appearance of sunshine usually hides a storm on the horizon.

That seems to be the conclusion from Yardi Matrix, a national commercial real estate analytics and research firm, in their new sectors-specific report “U.S. Multifamily Outlook: Summer 2023,” published June 28.

Yardi Matrix data revealed that the fundamentals for multifamily “remain strong” with ongoing demand, continued rent growth and nearly 1 million new deliveries expected over the next two years. But property values and sales prices have plummeted in 2023, and the high cost of debt has reduced demand and is also expected to lead to more defaults in the months ahead.

The good news

Despite a shaky economy that appears poised to enter a recession, national multifamily rents increased through the first five months of 2023, with the average U.S. monthly rent reaching an all-time high of $1,716. Large metro areas with forecasted annual rent growth between 3.1 percent and 3.7 percent include Central Jersey (3.7 percent), Austin (3.3 percent), Charlotte (3.2 percent) and Oklahoma City (3.1 percent).

“Multifamily risk is some of the lowest in the industry, as opposed to office or retail,” said Doug Ressler, manager of business intelligence at Yardi Matrix. “And that’s because of the fundamental fact that people need housing and there’s a shortage of housing that won’t be corrected in the next five or six years.”

The national housing crisis has no doubt fueled multifamily demand, which has been boosted by an annual drop in home sales and higher mortgage rates, which reached 6.5 percent in March 2023, up 230 basis points from March 2022. The number of available single family homes has continued to decline, Ressler said, as homeowners are choosing not to sell amid high interest rates, creating a housing crisis that multifamily is poised to capitalize on and reap higher rents from—especially in the high-end lifestyle segment of the sector.

“While healthy demand will enable those units to get filled over time, the short-term impact will be strong competition for renters in the high-end lifestyle segment,” the report concluded. “Asking rents in renter-by-necessity properties rose 4.5 percent year-over-year through May but only 0.6 percent for high-end lifestyle properties.”

Potential risks ahead

However, it’s not all sunny skies for landlords as higher multifamily rents are expected to be constrained by a wave of new supply entering the market later this year and in 2024.

More than 1 million units were estimated to be under construction in the first six months of 2023, with more than 430,000 units expected to be delivered by the end of the year (and an additional 450,000 delivered in 2024). Markets expected to see the highest number of new units this year include Austin (22,310 units), Dallas (21,769), Miami (18,571), Atlanta (15,611), New York (15,510) and Phoenix (13,592), according to Yardi Matrix.

“It’s going to give the consumer a lot better options to choose from,” said Ressler. “When you look at where the new supply is coming, it’s coming in only 25 major markets where we’re seeing it grow.”

As rents grow and new supply stays channeled to only a handful of large cities, the uncertainty on the capital markets front could create additional challenges to the positive fundamentals highlighted earlier.

Capital markets weigh in

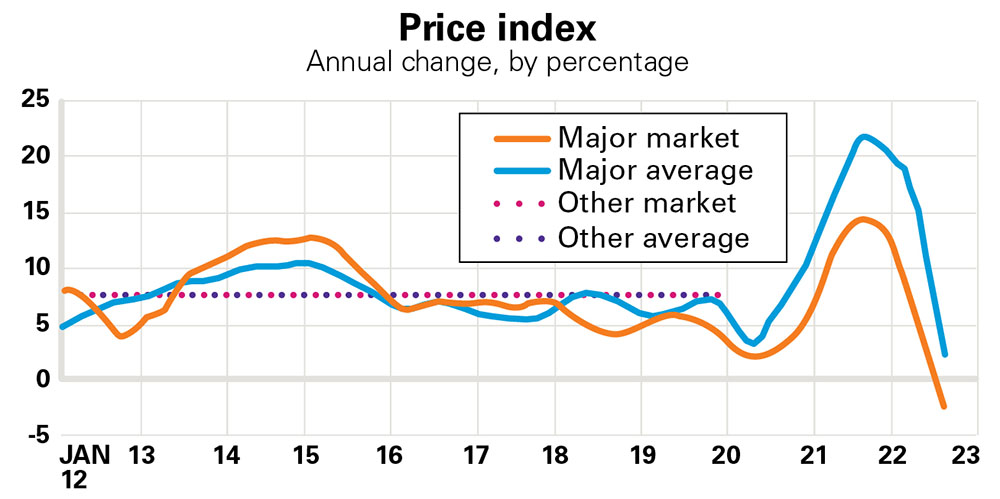

The fastest interest rate increase by the Federal Reserve in 40 years has combined with a pullback in liquidity by the national banking sector in recent months to inject pricing uncertainty into a multifamily market that has seen transactions and mortgage origination volumes plummet in 2023.

“The capital markets, long the strength underpinning the multifamily market, are turning into an Achilles’ heel,” the report stated. “Property fundamentals are strong, but the increase in capital costs has injected pricing uncertainty into the market and made it difficult to complete a transaction of any kind.”

Further, the pace of multifamily transactions is roughly 70 percent slower in 2023 than in recent years. Only $23 billion in sector sales were completed by mid-June, compared to $194.7 billion in 2022 and $226.5 billion completed in 2021, according to Yardi Matrix.

Lagging sales volumes have consequently impacted unit prices: The average price-per-unit for multifamily is down 15 percent through May 2023, falling from an average of $210,000 in 2022 to $181,000 in 2023.

“It’s more of a wait-and-see in what the market will do, what the Fed will do,” said Ressler. “The market is anticipating two more rate increases from the Fed. People are saying, ‘Let’s wait until it calms down before we look at transactions again.’”

Even the ever-dependable government-sponsored entities (GSEs) space is failing to provide cover for the multifamily transactions. Fannie Mae, Freddie Mac and Ginnie Mae issued $20.1 billion of bonds through mid-June, compared to $55.4 billion in the first half of 2022, according to the report.

Moreover, while loan defaults for multifamily bonds currently stand below 1 percent, these defaults are expected to rise over the next 18 to 24 months as property owners assess their portfolios. CMBS special servicing rates are increasing for multifamily owners, according to the report.

Despite the headwinds, Ressler said that interest rate clarity and a flow of new supply will help stem the bleeding by this point next year and dispel some of the clouds overhead.

“We expect transactions to pick up steam again in the second quarter of 2024,” he said.

Excerpt Brian Pascus, Commercial Observer