New government incentives and shifting market dynamics could make it worth U.S. real estate owners’ time—and money—to move forward with office-to-residential conversion projects.

With the shift to hybrid work models, there is much more unused office space available that, if converted to residential use, could help mitigate the dearth of affordable housing in the US market. To date, the economics of such a shift is not supported by the differing pricing dynamics in these two asset classes.

But a variety of developing factors may make conversions more attractive and feasible for investment. The Deloitte Center for Financial Services predicts that office-to-residential conversions could become profitable within the next five years. We estimate that around 14,700 affordable units in central business district (CBD) areas across the country can be added by 2030, assuming approximately 20 percent of converted sq. ft. can be earmarked for affordable housing.

Estimates suggest that there is just shy of one billion sq. ft. of available office space in search of tenants in the United States, nearly 1.5 times the amount from the end of 2019. With a shortage of nearly three million homes, the U.S. housing sector has emerged as a likely recipient of the unused downtown office space.

So far, the U.S. commercial real estate industry has been slow to respond: Between 2016 and 2021, there were, on average, 31 housing conversions from office products per year, totaling 188 projects.

And while many Americans are still working from home, at least part of the time—a trend that will likely continue—only 217 conversion projects are in the immediate pipeline for completion.

Government and business leaders appear to be taking notice. Some political leaders at the local and state levels have put forward legislation or called for action specifically supporting office-to-housing initiatives. These actions could provide incentives for real estate developers to provide Americans with clean, affordable, and safe places to live. Here are some of the initiatives in the works so far:

At the end of 2021, Chicago’s La Salle Central TIF district had a balance of $197 million in tax increment financing that they planned to make available to developers, with a priority on underutilized space. These would include those prime for conversion from commercial to residential space.

Washington, D.C. launched a $2.5 million, 20-year tax abatement program for owners who add at least 10 housing units and change a building’s use in the downtown D.C. area, and of those units, 15 percent must be set aside for affordable housing.

California set aside $400 million in incentives for office-to-affordable housing conversions. The state already had more than 50 applicants and roughly $105 million allocated as of early March 2023.

City governments have provided these types of incentives for conversion projects before. In the early 1990s, New York City passed the 421-g tax abatement program, incentivizing 13 million sq. ft. of downtown Manhattan conversions. And Philadelphia passed its own abatement program in 1997, resulting in 180 building conversions.

Could it pay off? Yes, but not right away

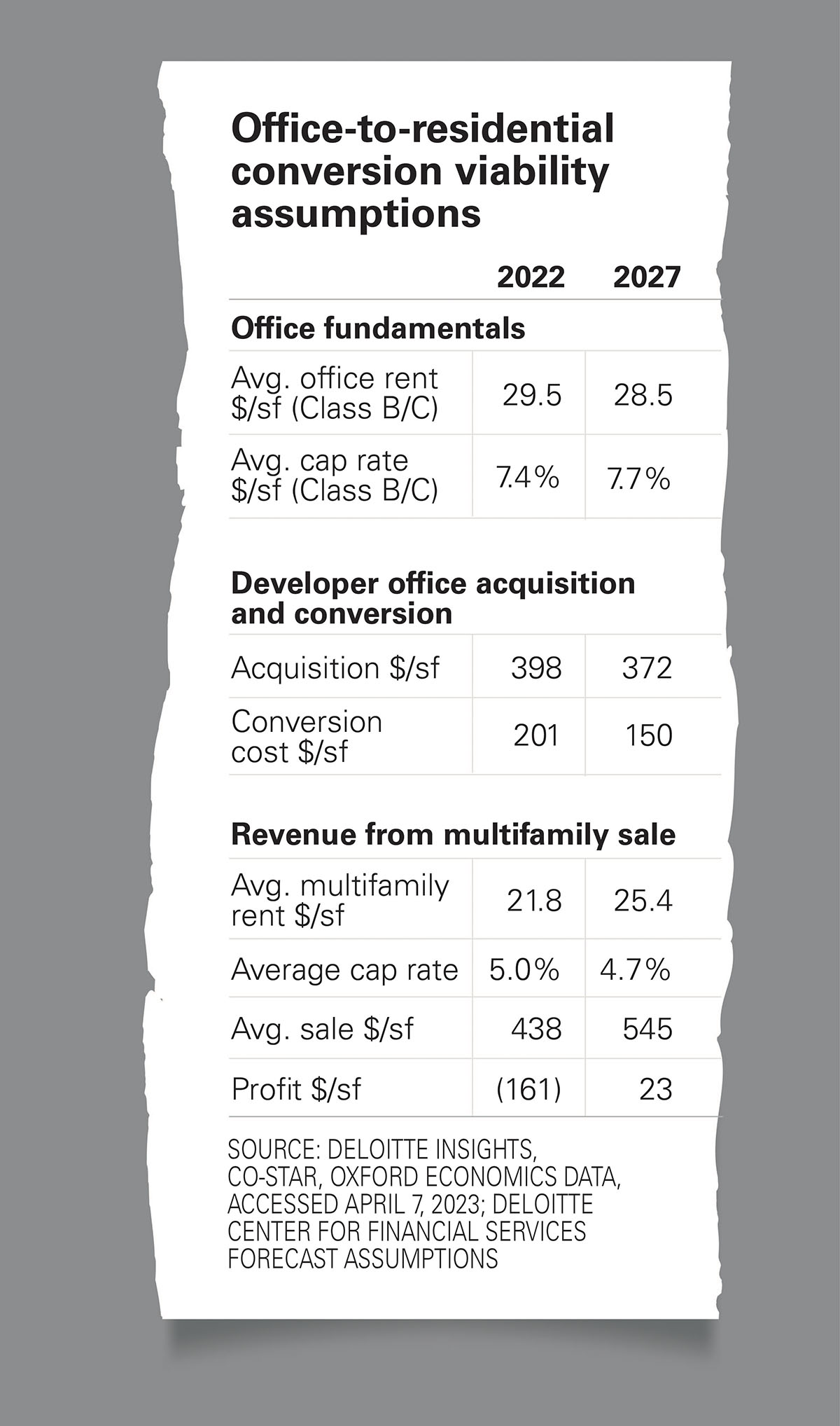

When considering these types of conversions, one of the biggest challenges owners and developers face is whether—and when—their investments will pay off. We anticipate that, by 2027, shifts in rents, valuations, acquisition costs, and conversion costs, in addition to added government-backed incentives, could allow developers to achieve a net profit on conversions of underutilized office space in favor of residential space.

Layout aside, two valuation assumptions could deter developers in the near term: comparable rent and high vacancy. The median asking rent for an apartment unit in the United States is around $22 per sq. ft. (psf) With U.S. office rents still averaging $37.38 psf, a 41 percent pricing concession in addition to an amortized cost of conversion is a tough pill to swallow. Additionally, developers would be unlikely to convert a building with a below-average vacancy that is still operating best as an office building.

Over the years, high conversion costs may have deterred developers from converting underutilized office buildings into affordable residential buildings. However, since 2020, several new government-enabled incentives have been announced to provide supply-side solutions to help address both the shortage of affordable housing and the increasing number of vacant office spaces. Several regions are making progress in developing tax policies that will make these conversion projects feasible, with several developers already moving at the opportunity:

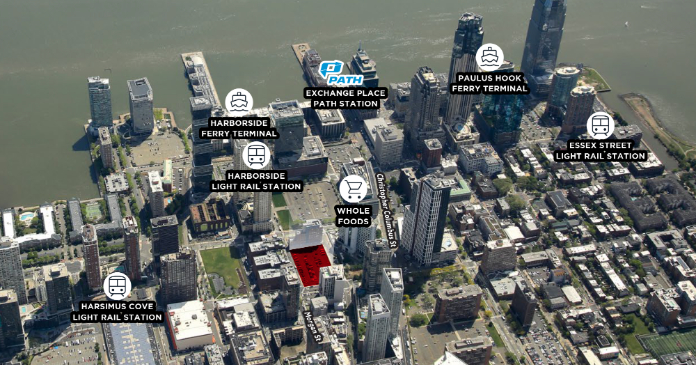

25 Water Street, New York City. The biggest conversion project in the country to date will transform a former office building into 1,300 new apartments over the next two years. The building was purchased in December 2022 for $250 million, and the developers closed on a $536 million loan to finance the redevelopment.

One Wall Street, New York City. This conversion was completed in February 2023. The 1.25 million sq. ft. building now holds 500 housing units that have recently gone up for sale.

4750 Wilshire Boulevard, Los Angeles. Construction started earlier this year to turn the former 144,300 sq. ft building into a mixed-use opportunity. The plan is to convert the top two floors into 68 housing units while retaining 30,000 sq. ft. on the ground floor for continued office use. Developers also plan to add amenities such as fitness centers and pools.

A combination of some of the benefits provided by local governments can make the math work for conversions at scale. In particular, government incentive programs can help make conversions more feasible by easing restrictions around zoning and density, providing direct financial subsidies and tax abatements, and waiving off or redistributing infrastructure upgrade costs to a longer time horizon.

Real estate owners can help jumpstart progress through collaborations

Currently, real estate owners face financing issues due to elevated interest rates. But they don’t have to go it alone. Public/private collaborations with lenders focusing on community development, government agencies, and impact funds may help with this transformation. Affordable housing remains at the top of agenda for the federal government, with $213 billion planned in government incentives to support affordable housing under the $2.25 trillion infrastructure plan. Proposed legislation was modeled after the 2022 Revitalizing Downtowns Act, which aims to provide tax credits for such conversions.

More centralized land use planning, inclusionary zoning, and state-level initiatives can make way for more market-rate developments with designated affordable housing that can help address the affordable housing gap. Distress in the office sector could lower valuations in the next two to three years. This may provide an opportunity for collaborations among developers, government bodies, and lenders to prop up the affordable housing shortfall and revitalize downtowns. Stronger relationships between developers and local and state municipalities could be what’s needed right now, especially in addressing the dearth of affordable housing in the U.S.

Sidebar

What’s behind our prediction? By filtering the estimated total inventory of CBD (central business districts) office buildings in the United States with asking rents less than $35 per sq. ft. (psf) with at least 30 percent vacancy, we estimate that approximately 170 million sq. ft. of CBD office space is viable for conversion. We considered any buildings with a class A designation to be unlikely for future conversion, as vacancies are unlikely to persist in the long term due to flight-to-quality tenancy trends supporting occupancies in this class profile.

Therefore, of the total CBD space assessed viable for conversion, class B and C products totaled 70 million sq. ft. and were used in this conversion feasibility model.

The Deloitte Center for Financial Services forecasted rent declines for Class B and C office assets, coupled with shifts in cap rates to the mid to high 7 percent range, which would price Class B and C offices at approximately $372 psf by 2027. This is down 6.6 percent from today’s prices, or a trajectory of—1.4 percent compounded annually. As hard and soft costs could abate with inflation-reduction efforts over the coming years and added benefits of increased government incentives, potentially offsetting conversion costs by as much at $55 psf, we assume the cost to convert could near $150 psf on average over the same time frame, down from $213 psf at the end of 2021.

Offsetting these costs of acquisition and conversion for developers are the anticipated increased implied value of new residential assets upon completion.

Assuming continued multifamily rent growth and corresponding compressions in cap rates, multifamily assets could trade for approximately $545 psf in 2027, up from $438 psf at the end of 2022. Multifamily properties would need to sustain a 3 percent compounded annual growth rate for rents over the next five years to achieve these valuations.

Assuming this valuation growth trajectory, 2027 would be the first year in which revenue from the sale of residential assets could be expected to offset the costs of acquisition and conversion.

Authors Kevin Richards, Tim Coy, Parul Bhargava, Deloitte