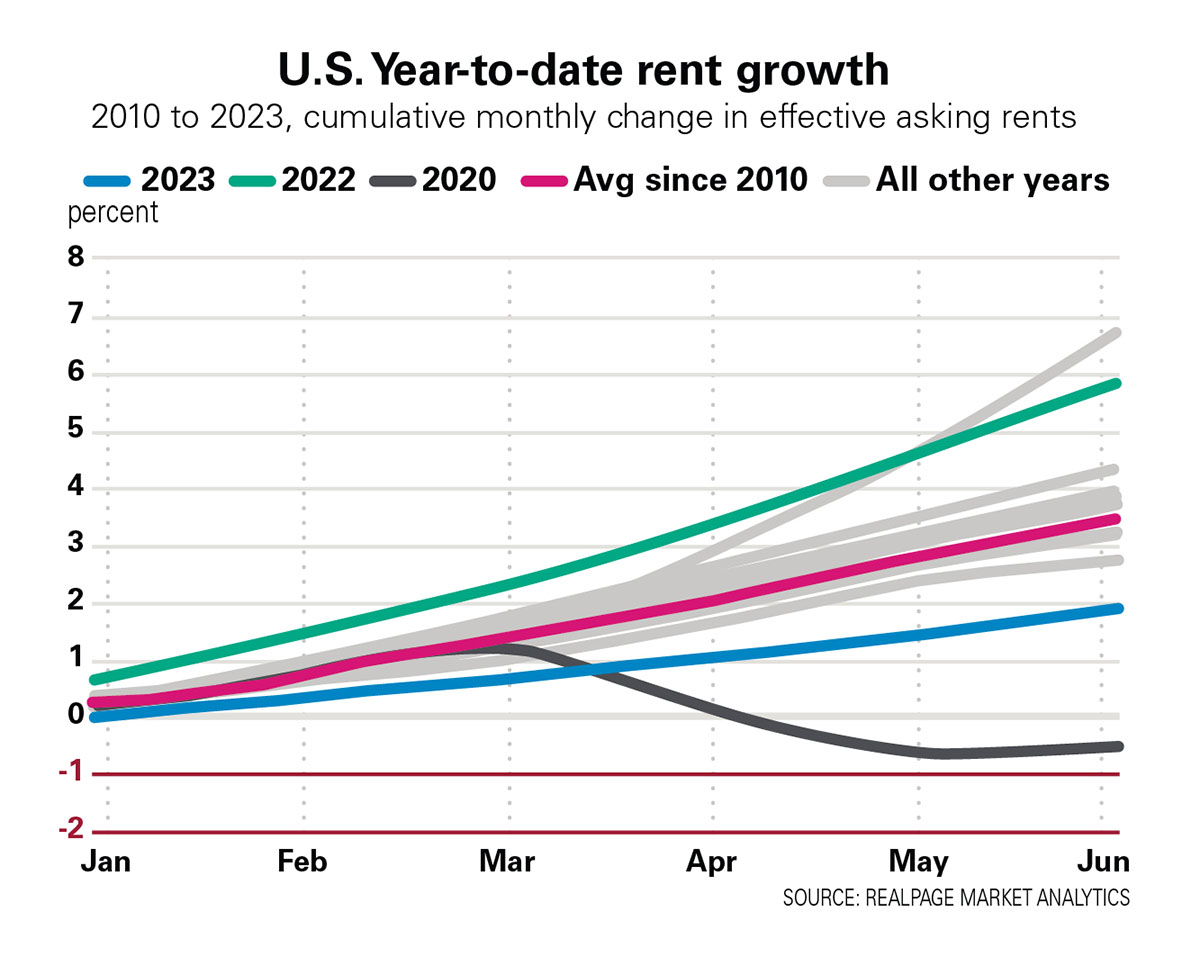

The number of people looking for an apartment this year has returned to a more normal pattern from the high rent, high occupancy days of 2022, according to RealPage Analytics.

“Demand for apartments appears to be normalizing as expected,” said RealPage SVP and Chief Economist Jay Parsons, “but not enough to keep pace with new supply, which will peak later this year and well into 2024.”

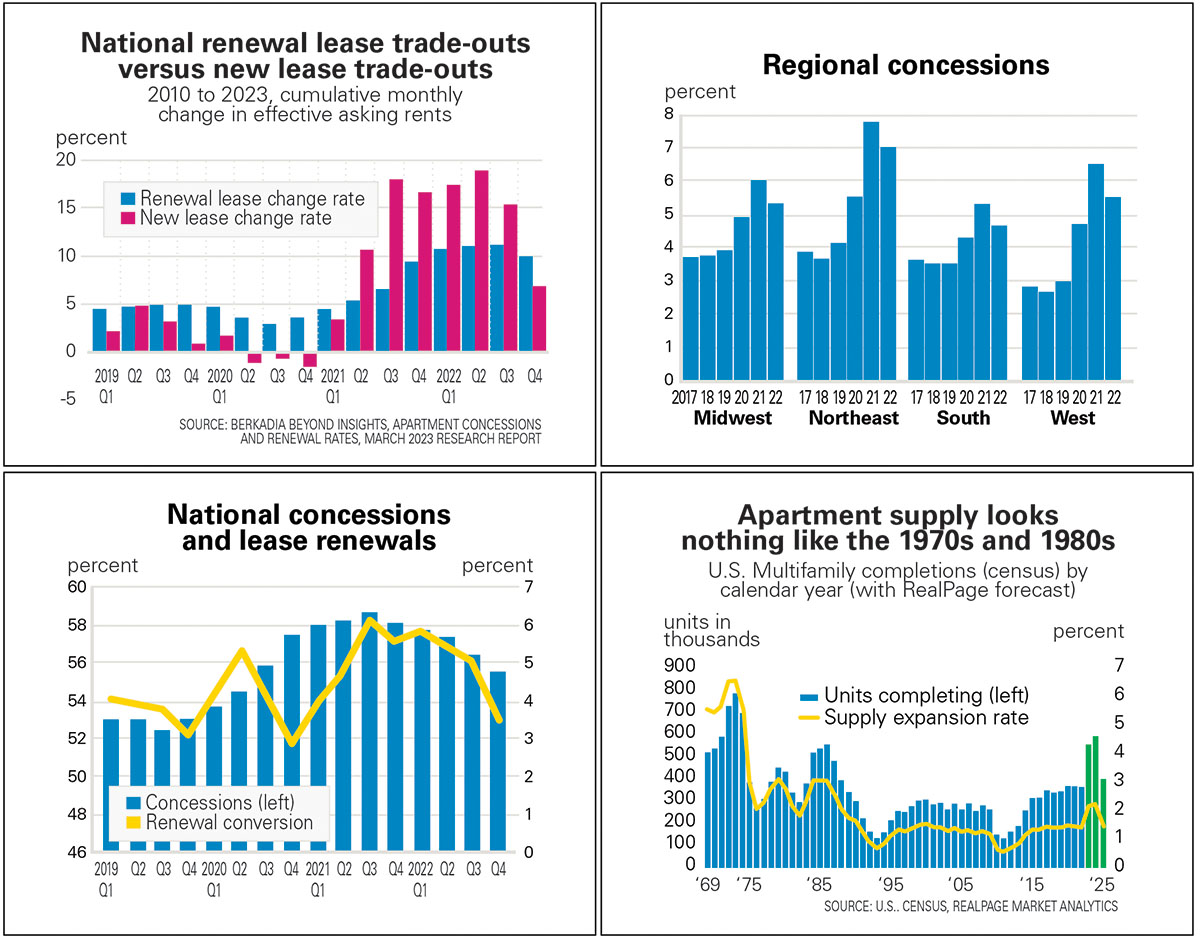

Parsons notes that the downward pressure on rent growth from the expected deluge of supply is forcing property managers to compete for renters for the first time since the pandemic began.

Beyond concessions

The traditional way to boost occupancy rates in tough times is with concessions. But discounted rent or one-month-free offers don’t translate to increased revenue, higher renewals or long-term solutions to resident turnover issues.

Although 87 percent of landlords say they are putting a greater focus on retention and renewal this year, 24 percent lack a formal resident retention plan and insights into their residents’ expectations, according to Zego, which pegs average cost of resident turnover at $3,976 per unit.

Savvy apartment operators are employing various strategies and using new technologies to reduce turnover costs and boost lease-up in newly constructed properties.

One involves the use of tech-powered incentive optimization, which offers cash back to residents who pay their rent in a timely manner. A downloadable mobile app from Stake Network Inc. enables apartment managers to set the rate of award (cash back) for their residents who pay on time. The software also allows managers to shift the award level as needed and integrates with most property management systems. Operators using the app report outperforming the market by 5 percent.

Others include resident reward perks, the use of influencers and programs like Rentgrata, a peer-to-peer marketing strategy that rewards residents who agree to answer prospective renters’ questions about the property and what it’s like to live there. According to the company, 36 percent of apartment searchers who speak with a resident through Rentgrata end up signing a lease.

Residents want what they want

Kesha Fisher, Greystar senior director overseeing the company’s California assets, points out that fewer people are buying homes these days, thanks to inflation and higher interest rates, but they still value the feeling of community that comes from owning a home in an American neighborhood. While they are willing to live in an apartment, their expectations have changed dramatically.

“Today we are dealing with a spoiled resident demographic, accustomed to highly amenitized buildings, so we look for something that will set our new developments apart.

“Building-wide wifi with speeds of at least 10Mbps is the most important. We build it in during construction so that when residents move in the wifi works automatically. We simply add the monthly cost to their bill. Next is having one mobile application for everything,” she said.

Top shelf amenities and perks are what it takes to fill newly developed communities, but just as important is satisfying residents so that they renew expiring leases.

“Renters expect events, food trucks, something happening at their building all the time and we must deliver to make it worthwhile for them to live there,” said Fisher.

Gardening and yoga classes, barbecues and music events are just some of the activities that renters expect.

The tech advantage

The advent of new technology has enabled onsite staff to focus on providing residents with special experiences.

Nicole McLemore, national director of marketing operations at Lincoln Property Company has seen dramatic changes in the evolution of the multifamily customer experience and the use of technology.

“Ten to 20 years ago, great customer service was about creating that person-to-person connection—and then technology changed all that,” she said.

Her company’s first technology initiative was switching from paper to online leasing, rent payment systems and maintenance requests. The digital transformation proved mutually beneficial, giving prospects and residents more options and helping onsite teams rid themselves of heavy paper binders.

“But making the tech transition has been hard,” said McLemore.

When the number of online applications exploded, thanks to the use of tech, AI handled the increased traffic. Today, AI agents are available to answer prospective renters’ questions 24/7. Chatbots schedule tours and send email quotes after the tour is completed. And, with self-guided tours becoming more common, apartment hunters are receiving a streamlined leasing journey at that gives onsite teams more time to personalize follow-ups and deal closings, welcome new residents and provide living experiences that will entice renters to renew their lease.

Jennifer Staciokas, marketing director of Western Wealth Capital, thinks the most important piece of a renewal strategy is the tech stack, beginning with property management software right-sized to each company, along with the right person or team to manage the program.

“Key are the integrations required and the CRM system that manages all communication with both leads and clients for applicant screening and keeping the team accountable, now that leasing is becoming more challenging,” she said.

The goal of the CRM is to eliminate the guesswork for multifamily marketers and leasing teams.

“We supplement our CRM with AI and our in-place, lead-nurturing automation. Currently, we are using Chatbot, voice bot and AI collections at five of our properties with the highest delinquencies.

“We find that tension is created when managers have to reach out to past due tenants, so we are automating that friction point in the hopes that delinquencies will decrease with less human-to-human contact,” she said.

The system automates through text message, email and eventually voice AI, while Staciokas can see what’s happening in real time on her dashboard.

“I can see residents responding and wanting to know their past due balance and how they can pay, if there is a payment plan or anything we can offer them to get them back in good standing. The downside is the more systems that onsite staff needs to manage, the more training they need,” she said.

Greystar has adapted to technology and the changing demands of residents. “We realized we don’t need three leasing agents onsite to backfill our units, since the majority of our deals remain stabilized between 93 and 95 percent occupancy.

“Instead, we employ someone onsite that is focused on the resident and maintenance experience, making sure both are done right, tracking online reputation and handling resident events. We used to call that onsite person a concierge, but since they don’t book your airline tickets or make reservations, we now call them lifestyle or resident services coordinators,” said Greystar’s Fisher.

Similarly, Lincoln Property Company refers to the renters at its communities as neighbors. “We renamed them neighbors to make everything more personable and help them feel at home in the place they spend the most time,” said McLemore.

Fischer agrees that building bonds among neighbors is a proven data point that can reap renewal rewards.

The future is centralized

Fisher thinks centralization will become ever more important to creation of a positive resident experience.

“You’ve got to remove some of the administrative burden from the onsite staff—those monotonous things like coding invoices and final accounting statements. Those things can be centralized, so we are looking at using a resource center to do our normal accounting duties and an area maintenance manager to oversee the maintenance teams at four or five buildings so that onsite team is completely focused on providing resident experience,” she said.

She expects that centralized leasing will evolve in the multifamily industry as the costs of running a building increase.

AvalonBay (AVB), the fourth largest owner of apartments in the nation, embraced this concept in 2007, with the launch of its Customer Care Center in Virginia Beach, Va., as a separate business unit, one of the first centralized service centers in the multifamily space. The center provides enhanced customer service to AVB residents more effectively and at lower operating costs.

In April, the REIT extended these services to Gables Residential, a Midwest-focused REIT, and will handle all Gables’ customer service and account inquiry support, billing, legal and eviction support, delinquency notification, payment and security deposit processing services across the entire Gables portfolio of more than 25,000 units. Gables and AVB will separately handle property management and operational functions for their respective portfolios.

“We are excited to extend the capabilities at our Customer Care Center to support Gables portfolio, leveraging the investments we have made in our centralized infrastructure, as well as creating a new revenue source for AvalonBay,” said AVB CEO Benjamin Schall in a press release.

Meanwhile, surveys continue to suggest that residents are much more likely to take rent increases in stride when they have an outstanding living experience, and they will even recommend your property to their friends, if they are happy living there.

A cue from hospitality

Nichole Oswald, regional property manager for RPM Living, believes multifamily has a lot to learn from the hospitality industry when it comes to customer experiences, design, technology and services and even how apartment companies brand themselves.

“The goal is to be an all-inclusive residence like a hotel that caters to renter’s wants and needs without having to sacrifice on customer service or quality. This goal should encompass the entire renter journey, so apartment searchers are able to know what experience they are going to have as a resident from their first contact with the community,” she said.

Resident and staff experience are intertwined, but Oswald believes employee experience takes precedence. “If you have happy employees coming to work, they usually will provide better service,” she said.

In today’s labor market, the National Apartment Association estimates that onsite employee turnover at multifamily properties is as high as 70 percent and J Turner Research found that the more often a community experiences turnover of onsite personnel, the lower the satisfaction score for the property.

Dissatisfied residents are directly linked to short staffing and are less likely to renew their lease when onsite teams are not focused on providing outstanding resident experiences, according to Grace Hill, which also found that residents who are happy with their community’s onsite staff are six percent more likely to renew.

“This is where training and empowerment of employees comes in, said Oswald.

“Hospitality does an amazing job at training teams to focus on brand image and experience,” she said, adding that there are limitless opportunities for multifamily operators to take advantage of how the hospitality industry does business and leads the way in customer service.

Author Wendy Broffman