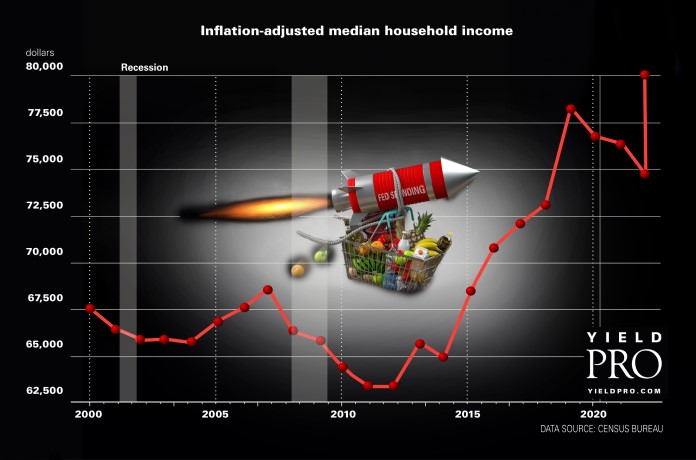

Called the invisible tax, inflation wreaked havoc with resident income in 2022 according to new reports by the Census Bureau. This marks three straight years where the nation’s standard of living has fallen due to rising prices across all categories. Real median household income for 2022 has now been reported by the federal agency to fall to $74,580—down 2.3 percent from the 2021 estimate. Real median household income has fallen 4.7 percent since its peak in 2019.

Median 2022 earnings for all workers fell 2.2 percent year over year to about $48,000 after adjusting for inflation. Full time workers’ earnings dropped 1.3 percent to about $60,100. The total number of workers rose 2.8 million. The number of full-time workers jumped by 4 million hitting 121.4 million.

Last year did seem to end on an upward note. Wage growth for the average worker began to surpass inflation at the end of 2022 according to the Atlanta Fed Wage Tracker. Household incomes rose as more workers found jobs, simultaneously elevating consumer spending. Inflation has ebbed as the Fed hiked interest rates, now at a 22 year high, with the intention of slowing the economy. Inflation in August 2023 was 3.7 percent, down from 9.1 percent in June 2022 but up from 3.2 percent in July 2023.

The national poverty rate in 2022 was 11.5 percent or 37.9 million people (four person household living on $30,000/annually) according to the agency. This was relatively unchanged year over year. The official poverty measure does not include what the household pays in taxes, or noncash government aid (tax credits, housing subsidies, free school lunches). One measure that does include those factors found the portion of those in poverty rose to 12.4 percent, linking the increase to the end of pandemic-related enhanced tax credits for children. By this unofficial standard the poverty rate for children more than doubled in 2022 to 12.4 percent.

Inflation is caused when there is more money circulating for the same amount of real goods and services, pushing prices upward. This higher cost of goods and services reduces the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is referred to as a hidden tax because it leaves taxpayers less well-off due to higher costs and tax bracket creep while increasing the government’s spending power.

Recent surveys show that Americans rank cost of living as the top problem facing the country today.