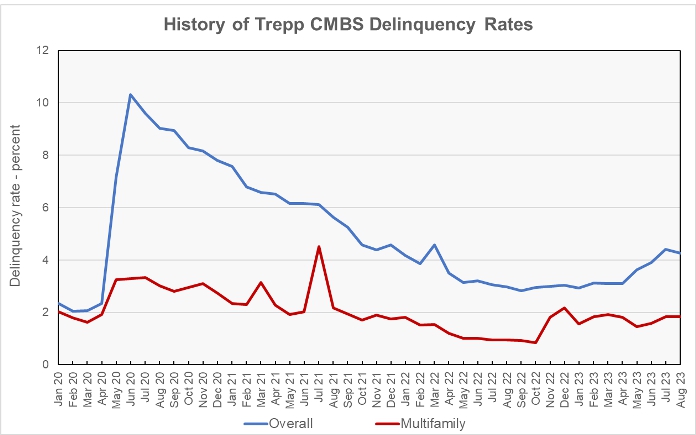

Trepp reported that delinquency rate for multifamily commercial mortgage-backed securities (CMBS) loans was effectively unchanged in August, moving up 1 basis point. The delinquency rate for the overall CMBS market fell for the first time since March.

The history of the overall and multifamily CMBS delinquency rates as reported by Trepp since January 2020 is illustrated in the chart, below.

Lodging CBMS delinquency rate falls

For delinquencies, Trepp focuses on loans that are 30 or more days delinquent. The current CMBS delinquency report provides data through August 2023. While it only looks at CMBS loans, it breaks out results by the type of property covered by the loans.

The delinquency rate on loans on multifamily property was 1.84 percent, up from 1.83 percent in July. One year ago, the delinquency rate on CMBS loans for multifamily property was 0.95 percent.

Trepp found that the overall delinquency rate of CMBS loans in August was 4.25 percent, down from last month’s rate of 4.41 percent. In its commentary, Trepp noted that the decline was a result of the decline in the delinquency rate on loans for lodging properties. That decline was driven by a status change on the large loan on one hotel.

The report noted that loans that are past their maturity date but are still current on their interest payments are not counted as being delinquent. However, if they were included, the overall delinquency rate on CMBS loans would rise to 5.01 percent from the 4.25 percent reported above.

Your property type may vary

The other property types whose CMBS loan delinquencies were examined by Trepp were industrial, lodging, office and retail.

Lodging CMBS delinquencies had the largest percentage change in the month, falling from 5.85 percent to 5.31 percent. The delinquency rates for loans on all other property types rose marginally for the month. Delinquencies on CMBS loans for office properties rose to 5.07 percent from July’s level of 4.96 percent. Delinquencies on CMBS loans on retail properties rose to 6.87 percent from last month’s level of 6.86 percent. Industrial CMBS delinquencies rose from 0.31 percent to 0.33 percent.

The full Trepp report can be found here.