Federal Open Market Committee (FOMC) met this week and decided to keep the Fed Funds rate unchanged. However, the Federal Reserve’s updated forecasts for key economic metrics projected that interest rates will start to come down in 2024 at a steeper rate than had been projected in their last forecast.

The FOMC meets 8 times per year but only releases an economic forecast at 4 of the meetings. The Fed forecast presents estimates for economic metrics by year through 2026, and a “longer run” forecast which reflects their view of the output of the economy if operating at equilibrium. The consensus Fed forecast is developed by the combining the forecasts of 18 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast, although their individual ideas of what that policy is may vary.

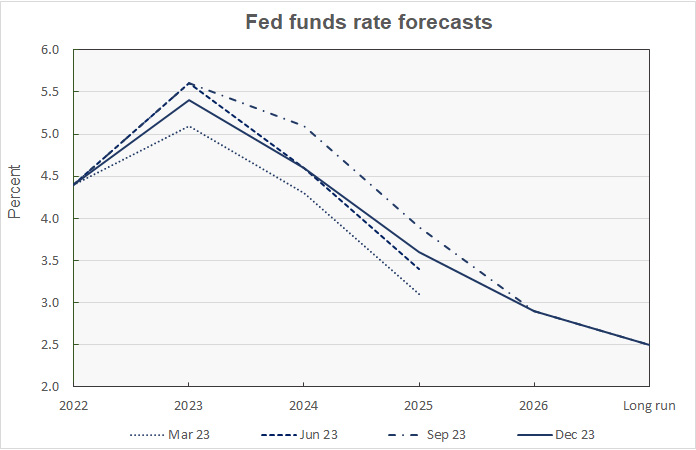

Interest rates decline advanced

The headline news coming out of the recent Fed meeting was their decision to again keep interest rates unchanged. However, they lowered their estimate of the appropriate Federal Funds interest rate for year-end 2024 by 0.5 points to 4.6 percent, reversing the change made at the September meeting. They also made a slight downward revision to their GDP forecast for 2024 indicating that they think that the economy will slow without having them raise interest rates again.

The Fed now predicts that the appropriate Federal Funds rate for 2025 will be 3.6 percent, down 0.3 percentage points from their last projection. The Fed’s prediction of the appropriate Federal Funds rate for 2026 is 2.9 percent, unchanged from the September projection.

A history of the forecasts for the Federal Funds rate is given in the first chart, below.

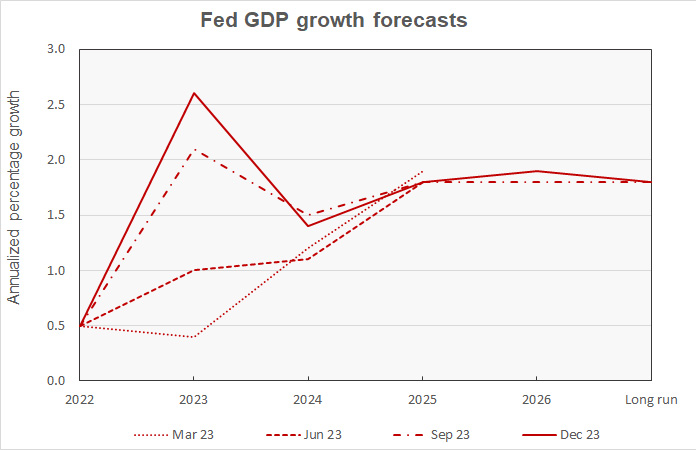

2023 GDP surprises, again

Fed’s current forecast for GDP growth in 2023 was raised again, rising 0.5 percentage points to 2.6 percent. However, the Fed lowered its 2024 GDP forecast to 1.4 percent, down 0.1 percentage point from their last projection. The Fed’s GDP forecast for 2025 was left unchanged at 1.8 percent while the GDP forecast for 2026 ticked up to 1.9 percent.

Unlike the September meeting where the near-term GDP forecasts were sharply revised, at the December meeting most of the GDP forecasts saw only minor revisions. Oddly, the forecast for 2023 saw the sharpest revision. This was presumably due to the surprising strength of the U.S. economy in Q3, which caught most forecasters by surprise.

Recent Fed GDP forecasts are illustrated in the next chart, below.

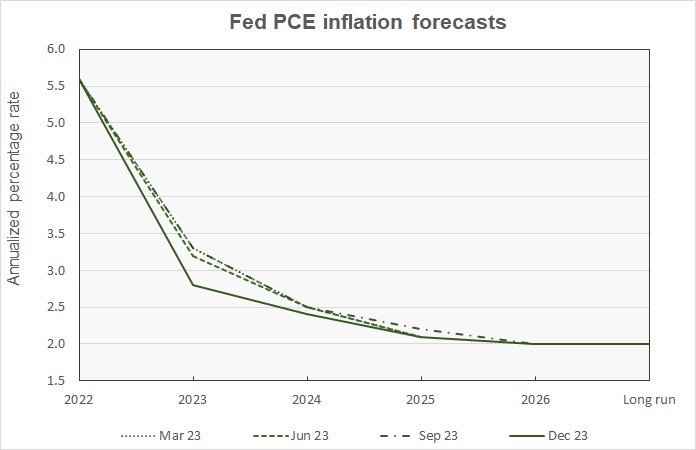

Inflation outlook nearly unchanged

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than the more familiar Consumer Price Index (CPI). The Fed now expects year-end PCE inflation in 2023 to come in at 2.8 percent, down 0.5 percentage point since their September forecast. The PCE inflation forecasts for 2024 and 2025 were lowered a notch each to 2.4 percent for 2024 and to 2.1 percent for 2025. The Fed still expects to achieve their target rate for PCE inflation of 2.0 percent in 2026.

The history of the Fed’s recent PCE inflation forecasts is shown in the next chart.

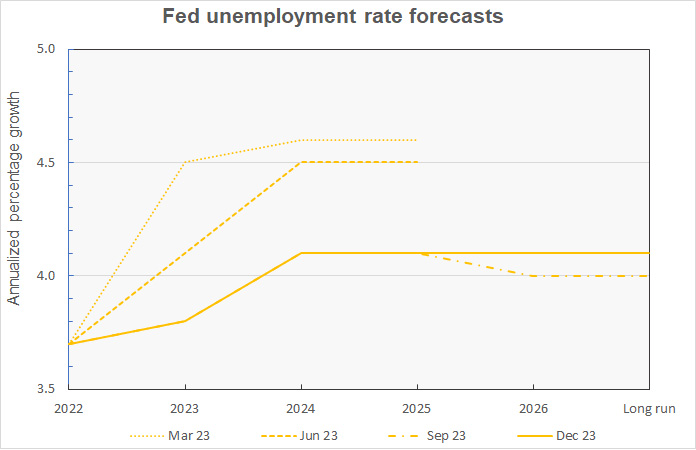

Unemployment forecast to stabilize

The current Q4 2023 unemployment rate is forecast to be 3.8 percent, unchanged from the September forecast. The Fed forecasts that the Q4 unemployment rate will rise to 4.1 percent in 2024 and remain at that level through their entire forecast horizon. The forecast unemployment levels are unchanged from those in the September forecast for both 2024 and 2025 but are up 0.1 percentage point for 2026 and for the long-run forecast.

The history of the Fed’s recent unemployment rate forecasts is shown in the next chart.

The next updates to the Federal Reserve’s forecasts for the economy will come after the March 2024 FOMC meeting.