As 2023 comes to a close and inflation eases a bit, consumer confidence has rebounded, according to two December surveys. Renewed consumer confidence is boosting apartment demand in markets across the nation.

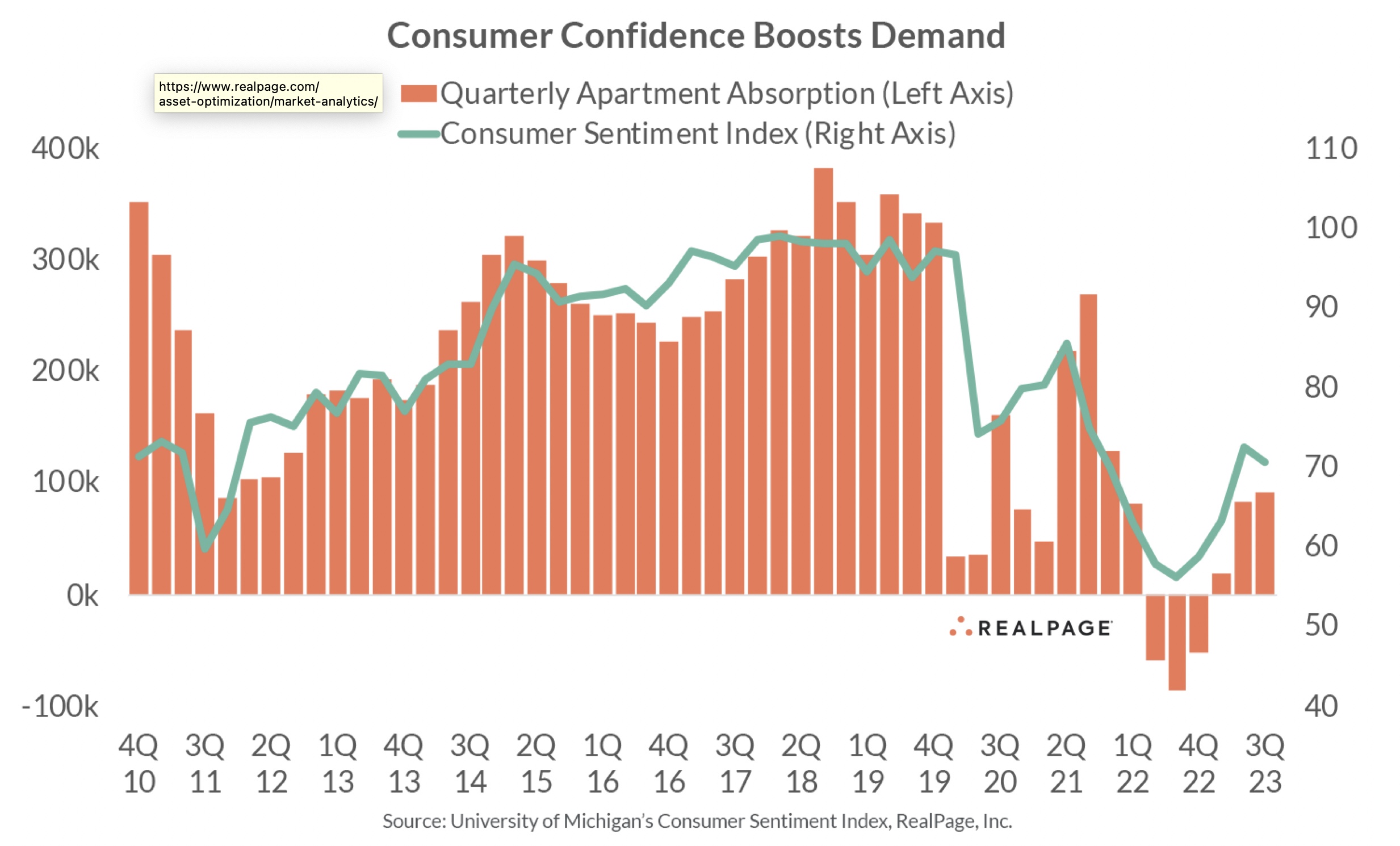

Consumer confidence and apartment demand trend together, according to a new report from RealPage. Apartment demand increases when consumers feel positive about the economy.

Consumer confidence is a catch-all phrase for the opinions and attitudes of consumers about the current and future strength of the economy.

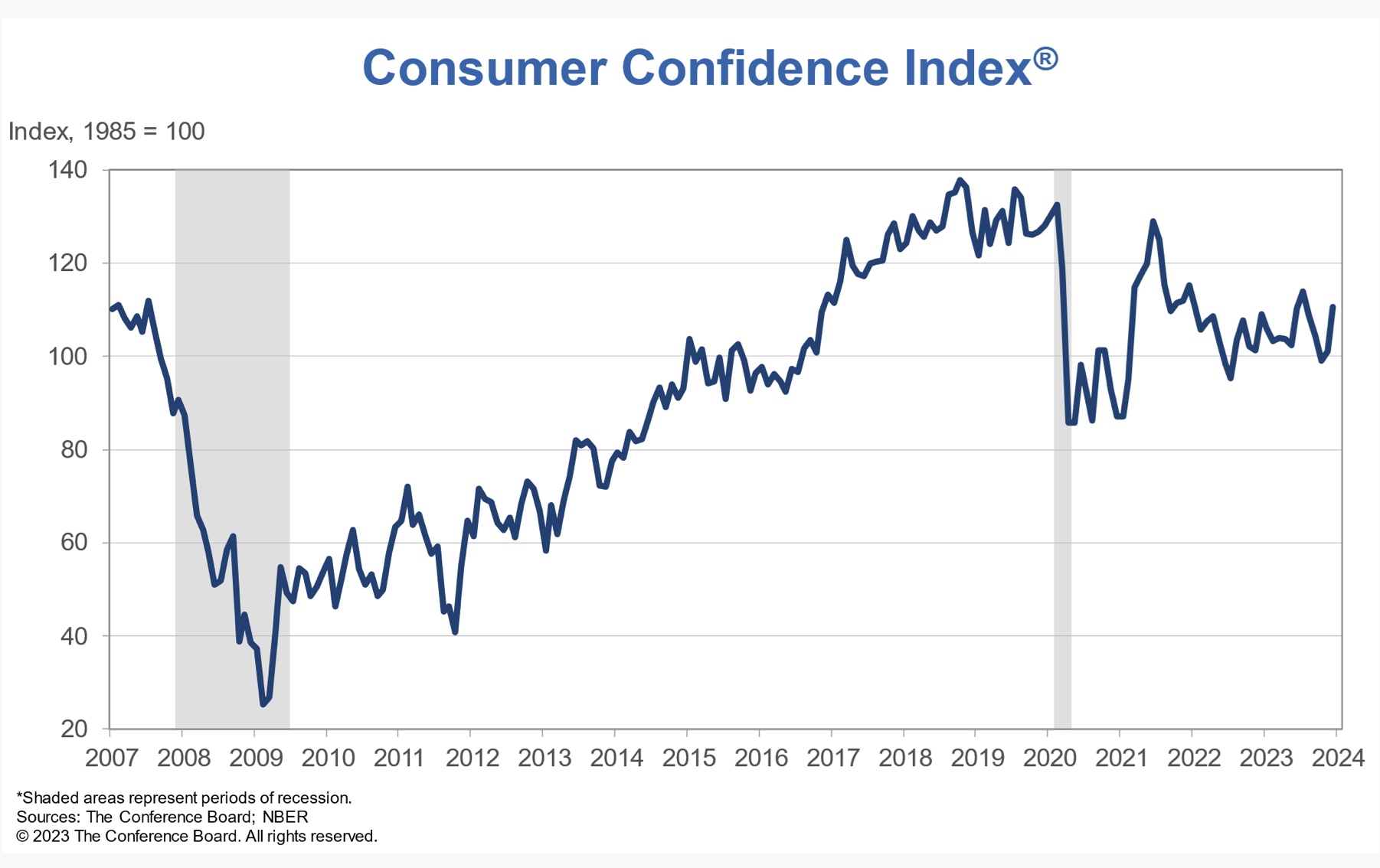

The University of Michigan’s Consumer Sentiment Index and the Conference Board ‘s Consumer Confidence Index both measure consumer confidence on a monthly basis by asking a random sample of consumers five questions about current and expected economic conditions. Consumers also are asked to assess their personal financial situation.

These two monthly surveys suggest consumer confidence is on the rise.

Consumer sentiment hit near 30-year lows in 2022 as inflation climbed to a 40-year high and the Federal Reserve started hiking interest rates to combat that increase, according to the University of Michigan’s survey.

“While the economy was actually in good standing, it didn’t feel that way to consumers, who were paying more and more in interest rates throughout the year,” according to RealPage’s report.

As inflation began to ease in 2023, consumer confidence improved, boosting apartment demand.

In Q3, the U.S. apartment market absorbed a little over 90,800 units, according to data from RealPage Market Analytics. While that was well below the quarterly demand tallies from much of the decade leading up to the COVID-19 pandemic, positive demand in 2023 is a notable turnaround from the net move-outs seen throughout much of 2022, when consumer sentiment hit a record low.

“While consumer sentiment is not as high as it was before the pandemic, it’s at least on its way up once again. As a result, household formation has improved, bolstering apartment demand,” said RealPage in its report.

In addition, the Conference Board’s consumer index increased to 110.7 in December, the highest reading since July, beating out the forecasts of economists polled by Reuters, who predicted the index would rise to 104.0 from the previously reported 102.0.

The jump in confidence reported by the Conference Board occurred across all age groups and household income levels.