Hedge funds and private equity investors are the latest culprits in the nation’s lack of affordable housing, say lawmakers. But housing experts provide evidence that the SFR industry is being unjustly targeted in the housing supply and affordability crisis.

Democratic lawmakers in both the U.S. House of Representatives and the U.S. Senate have introduced bills that would ban hedge funds and large investment groups from participating in the single-family housing market, citing supply and affordability as justifications.

The End Hedge Fund Control of American Homes Act would force mandatory evictions of renters living in homes owned by any large investors, and then require those homes be sold to individual buyers over a period of ten years, eventually banning hedge funds from owning any single-family homes.

The Cato Institute points out that despite increased media attention, equity investors in the single-family housing market are not a new, post‐pandemic phenomenon. They sprung up after the 2008 financial crisis, when large private equity firms and hedge funds seized opportunities to acquire portfolios of foreclosed homes and put a floor under the distressed housing market. From this perspective, they filled a void and served a valuable purpose in the rocky days and years following the crisis.

On his LinkedIn page, Jay Parsons called the bill another well-intentioned, but poorly thought-through proposal that would obviously discriminate against renters, reduce rental housing supply from those who need it and drive up the cost of rents, ostensibly to drive hedge funds out of the single-family housing markets.

He points out that blaming the housing crisis on private equity and hedge funds will hurt housing availability and affordability, not help it.

“The overwhelming majority of single-family rental owners are small, local groups and “mom and pops,” yet media coverage and political chatter routinely misrepresents all investors as “institutional” or “Wall Street” or “hedge funds,” which is grossly misleading and contributing to the false narratives that lead to ill-informed proposals like this one,” he writes.

Only 3.4 percent of U.S. homes are owned by groups with ten or more homes, according to Parcl Labs. And among those, a big chunk are non-institutional local groups. And in Q2 2023, institutions accounted for only .4 percent of home purchases, according to John Burns Research.”

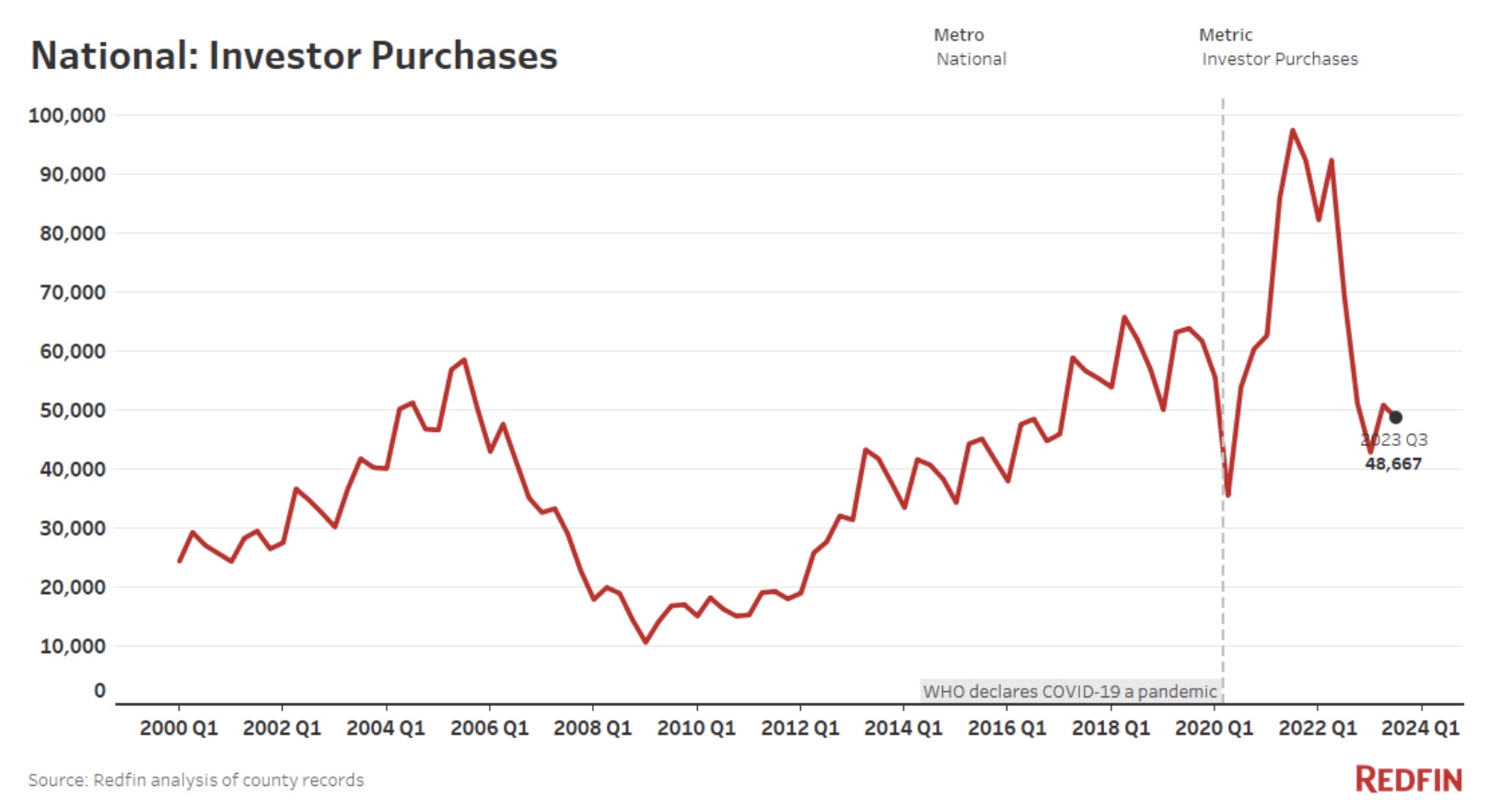

Meanwhile, investors are offloading SFR inventory into the resale market because of high interest rates and investor purchases of U.S. homes dropped almost 30 percent year over year in Q3 to the lowest level of any third quarter since 2016, according to Redfin News. By comparison, overall home purchases fell 22.2 percent, the lowest Q3 level since 2012.

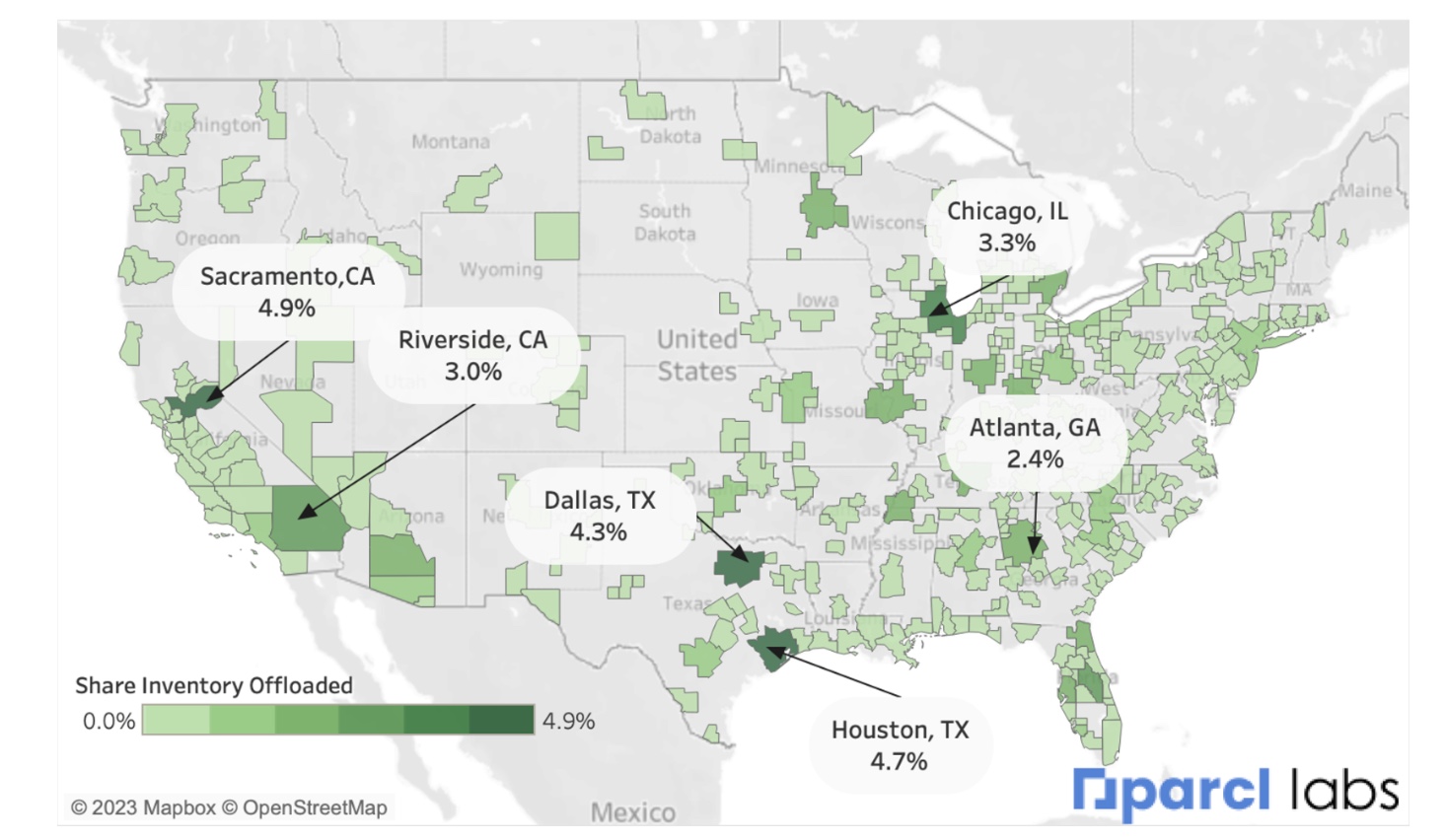

Five markets account for one-fifth of all inventory sold by SFR operators in the last 12 months, with Sacramento leading at five percent of all observed sales in this period.

Parsons states the obvious: “If you remove homes from the rental supply, rents will go up. Supply and demand. To pretend otherwise is dishonest.”

“Do we need more for-sale homes? Absolutely. But playing musical chairs where wealthier buyers win out over less-wealthy renters is discrimination, not a solution. Let’s focus on real solutions,” he writes.

National Rental Home Council CEO David Howard’s statement to The Times shines a light on the real issue and solution. “The issue is not institutional investors as much as a lack of action from homebuilders. Policies are needed that support production, investment and development of new housing.”

“I think bills that work aganst that ultimately are just going to perpetuate the challenges we’re already faceing,” he said.