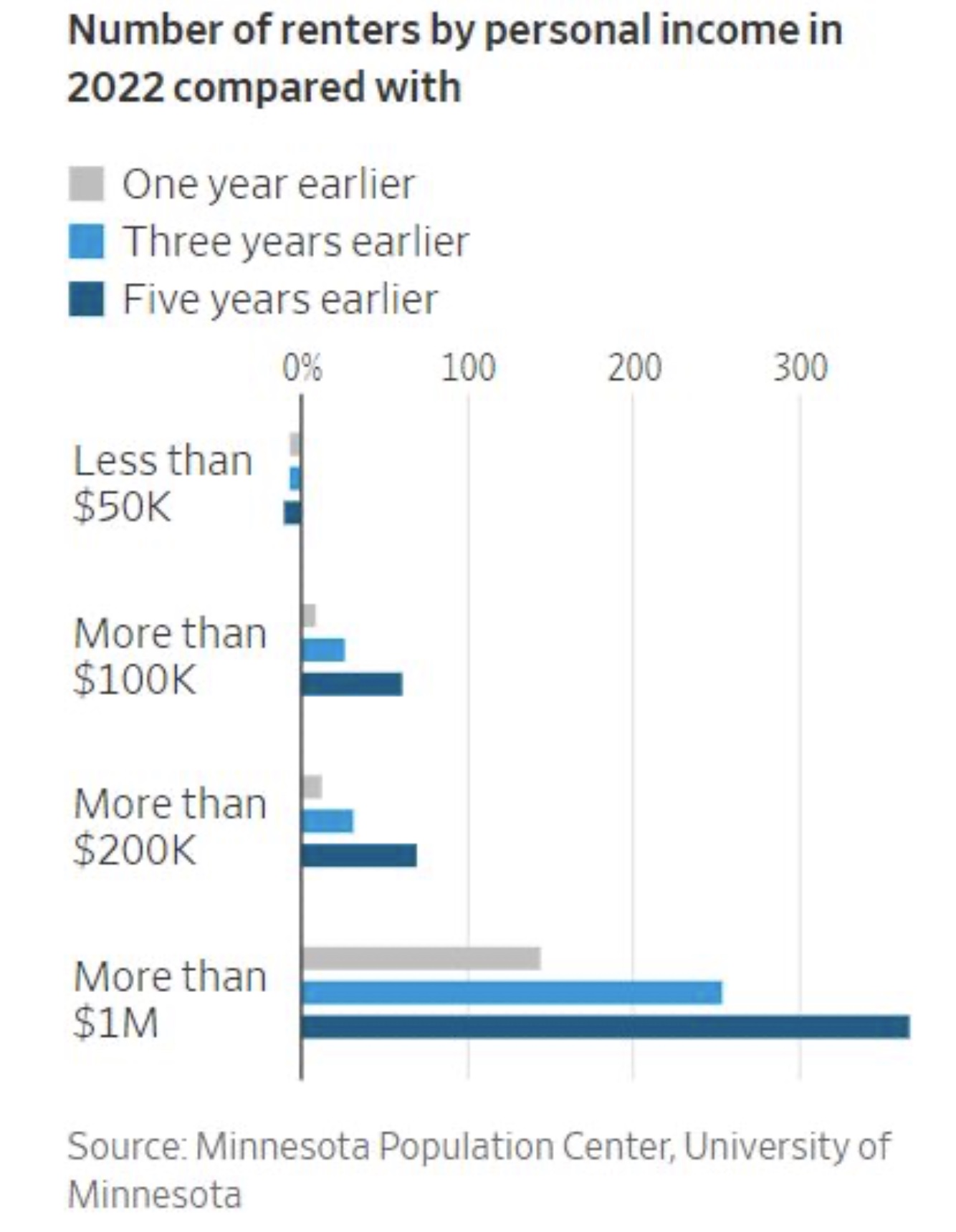

Data from several sources suggests high-income renters drive renter growth.

What does it mean that the number of renters with incomes above $100K grew by 61 percent over the past five years? RealPage SVP and chief economist Jay Parsons tackles this question on his LinkedIn page.

He concludes that high-income households, or renters by choice, are driving growth in the number of people who rent their homes.

“It’s often assumed that people rent only because they can’t afford to buy. But it’s not that simple,” he writes, citing a piece in the Wall Street Journal (WSJ) titled The Rise of the Forever Renters that adds to the evidence that most new renters over the past five years have six-figure incomes.

There is even greater growth in the percentage of millionaire renters, according to the WSJ’s analysis of recent Census data. Mirroring the WSJ study is a 2020 study by the Harvard Joint Center for Housing Studies, concluding that over the last decade, “high-income households have driven most of the growth in renters.”

YieldPro noted this shift in 2020 with a piece titled Renters are richer, older and have larger households.

This data suggests that life-style choices are a main reason people rent, said Parsons. “Many of them could afford to buy, but choose not to, at least for this current phase of life.”

Additional support comes from the 2023 Center for Generational Kinetics Study for RealPage suggesting 63 percent of apartment renters rent for reasons OTHER than not being able to afford to buy a home.

“It’s also evidence that affordability isn’t the massive headwind to the market-rate apartment and single-family rental market as some have suggested. Rent-to-income ratios remain in the low 20 percent range and, with supply now topping demand in apartments, it’s actually ticking back down again a bit,” writes Parsons.

A look from both sides now

On the other end of the spectrum, the number of low-income renters has actually dropped, says Parsons.

But data from CoreLogic 2023 October study suggests that low-to-moderate-income households make up nearly 70 percent of all renters. Affordable housing advocate Laura Cole Jackson cites this study to rebut Parson’s stated rent-to-income ratios. According to CoreLogic, rent-to-income ratios for the entire renter sphere are 40 percent and rental affordability is at its lowest level in decades.

“With 36 percent of the population renting and only 2.8 percent living in subsidized housing, a whopping 23.2 percent of the population are both low/moderate income AND occupants of market rate rentals,” she writes. “I get that 20 percent is the ratio for the limited data (Parsons cites), but it’s not reflective of the situation at large.” She suggests he qualify his data by clarifying that the low 20-percent income ratio is limited to the properties surveyed.

Commercial real estate researcher Andrew Rybczynski concurs.

“When you cite the 20 percent rent-to-income figure, which is consistent with what I’ve seen for high-income households, it’s important to caveat it. (My analysis) always suggests that the average rent-to-income hides huge disparities between high and low income households.”

Parson’s acknowledges the incongruities. RealPage compares rents versus incomes for actual lease signers in market-rate apartments owned by REITs and large privates, not mom and pop owners. Moreover, there’s a massive gulf between what the industry is seeing on the rent rolls versus what academics see from Census data, he writes.

“That many households are still struggling is a separate but arching topic…but, two things can be true: We need more affordable housing, while at the same time there’s ample demand among upper-income households for market-rate rentals,” he said, adding that none of this data means the USA is becoming a nation of renters.

“Too many homeowners err in thinking everyone wants to be them. It’s okay if they don’t,” Parsons writes.