Office-to-apartment conversions gather steam as developers seek adaptive reuse as a way to fix pandemic-related problems in the office market. Adaptive reuse of office buildings has become so popular, CoStar dubbed 2023 the year of the office conversion. But 2024 is setting a record for the highest number of office-to-apartment conversions.

RENTCafe released its annual Adaptive Reuse report on January 23, highlighting the office-to-apartment conversion trend that began in 2020 when all workplaces deemed non-essential were shut down and those still employed began working remotely from home.

Businesses began calling their employees back to the office last year, but employees accustomed to working from home have pressured their employers to agree to a hybrid workplace, either out of convenience or necessity to retain workers.

With fewer workers in the office, many employers have already downsized and others are waiting until their leases expire to decrease the amount of office space they plan to use, leaving many offices empty.

Distress is coming

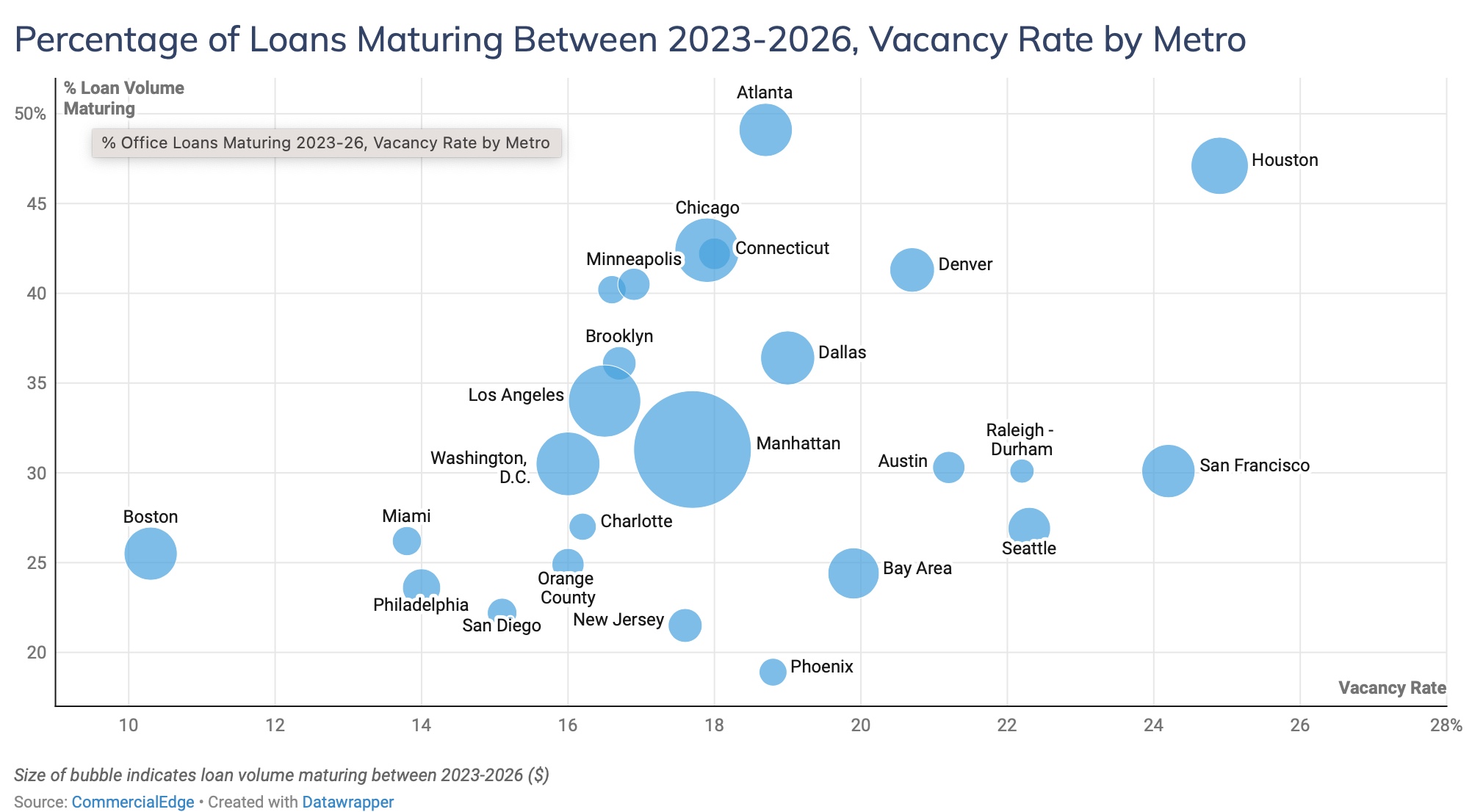

Analysts see the office sector positioned for distress, as weakening demand and rising vacancies push the sector into oversupply in many metros. Demand for space has dropped 10 to 20 percent since the pandemic and vacancies have risen from 13.4 percent in January 2020 to 18.3 percent at the end of December, according to a January report from CommercialEdge, a Yardi subsidiary.

In 2024, $150 billion in office mortgages will come due. And,by 2026, $300 billion, or one third, of all office loans mature. “Delinquency rates are rising and likely to get worse as the growing number of underwater loans mature,” according to CommercialEdge.

The anticipated wave of foreclosures has yet to materialize, but analysts expect loan extensions, workouts, defaults and foreclosures will become common this year.

An attractive fix

Turning vacant office buildings into residential space is considered an attractive fix for the problems created by the pandemic, says CommercialEdge.

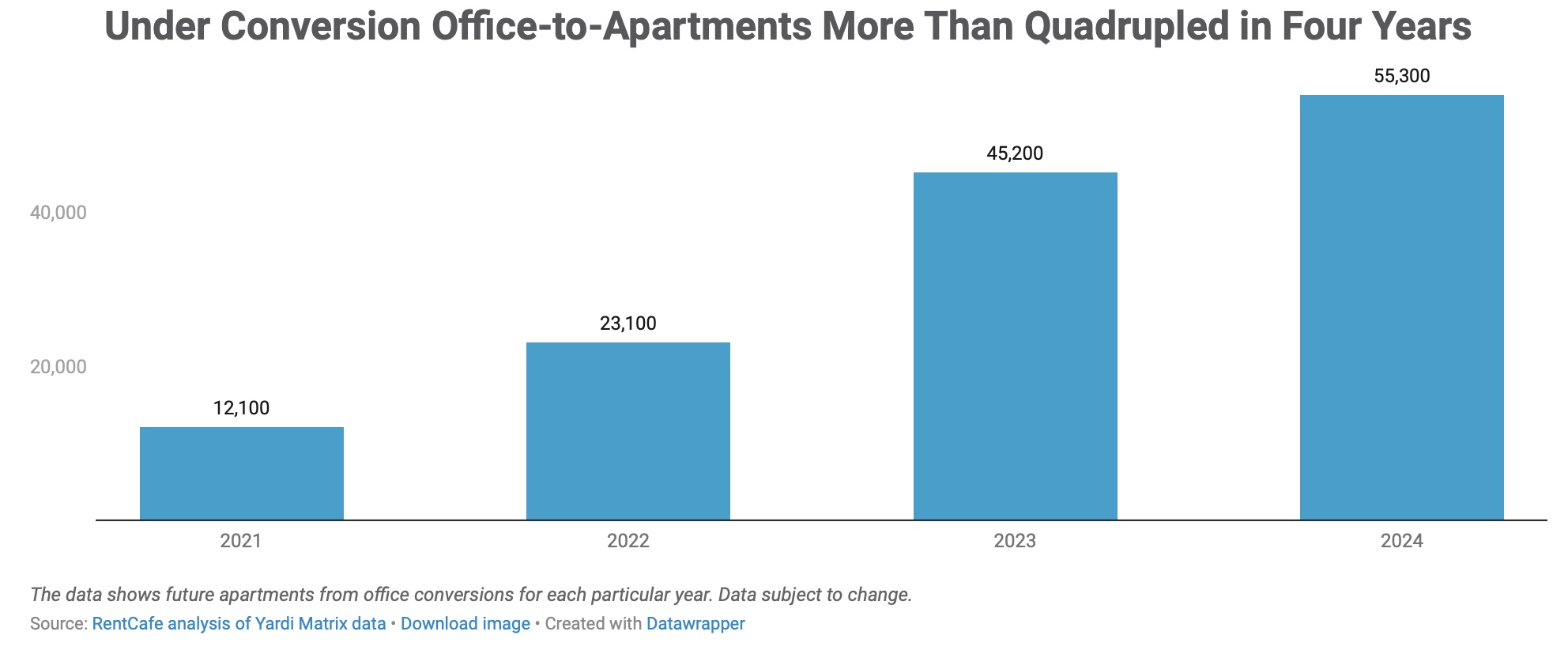

The number of office-to-apartment conversions since 2020 has increased four-fold, based on Yardi Matrix data and RENTCafe anticipates the pace of these projects will hold steady at last year’s levels in 2024.

The chart above illustrates how the pipeline of office-to-apartment conversions has grown since 2021.

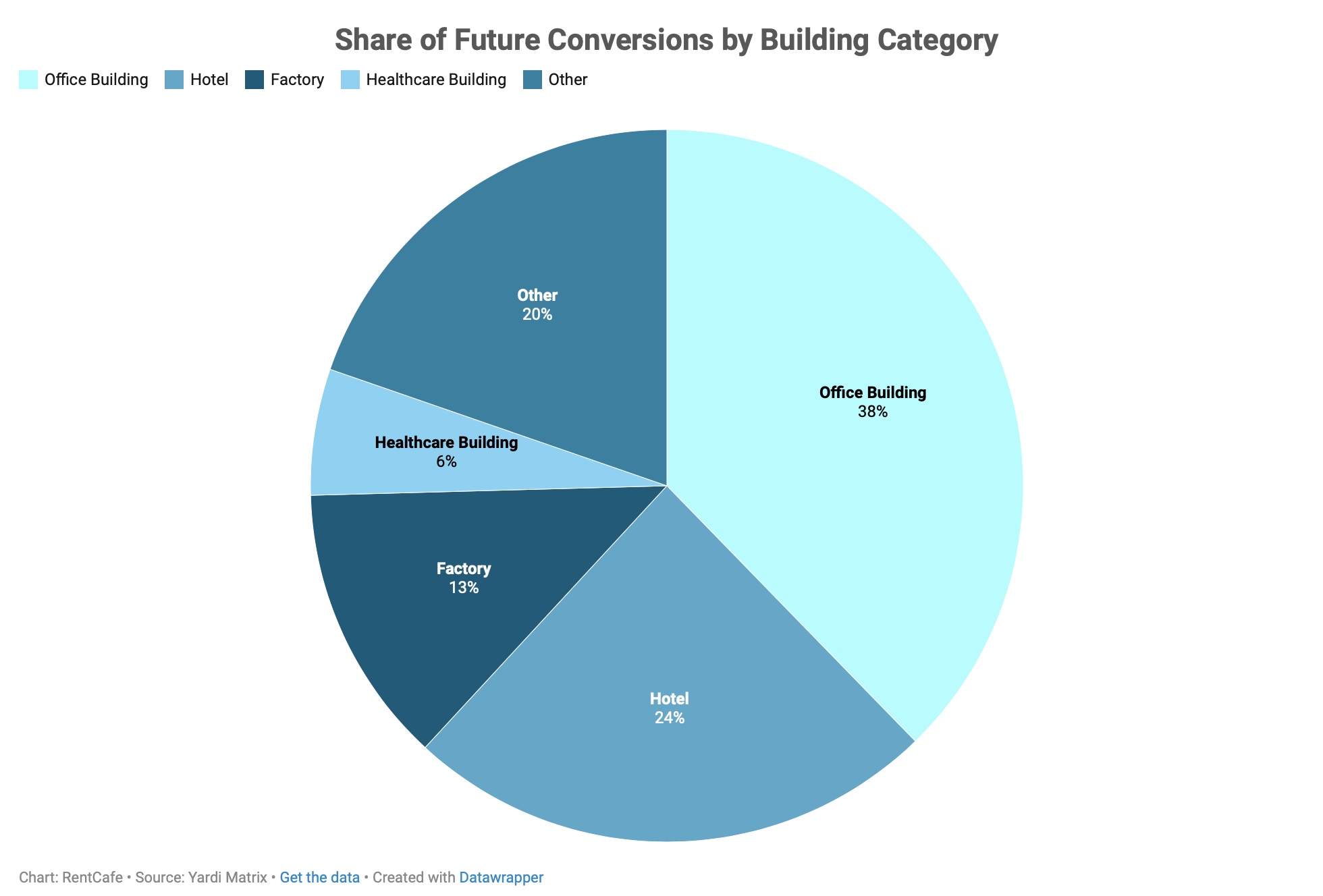

Of the 147,000 apartments slated for future adaptive reuse projects, 38 percent are office buildings, but they aren’t the only properties targeted by multifamily developers for conversion to apartments. RentCafe reports that hotels represent 24 percent, factories 13 percent, and healthcare buildings six percent.

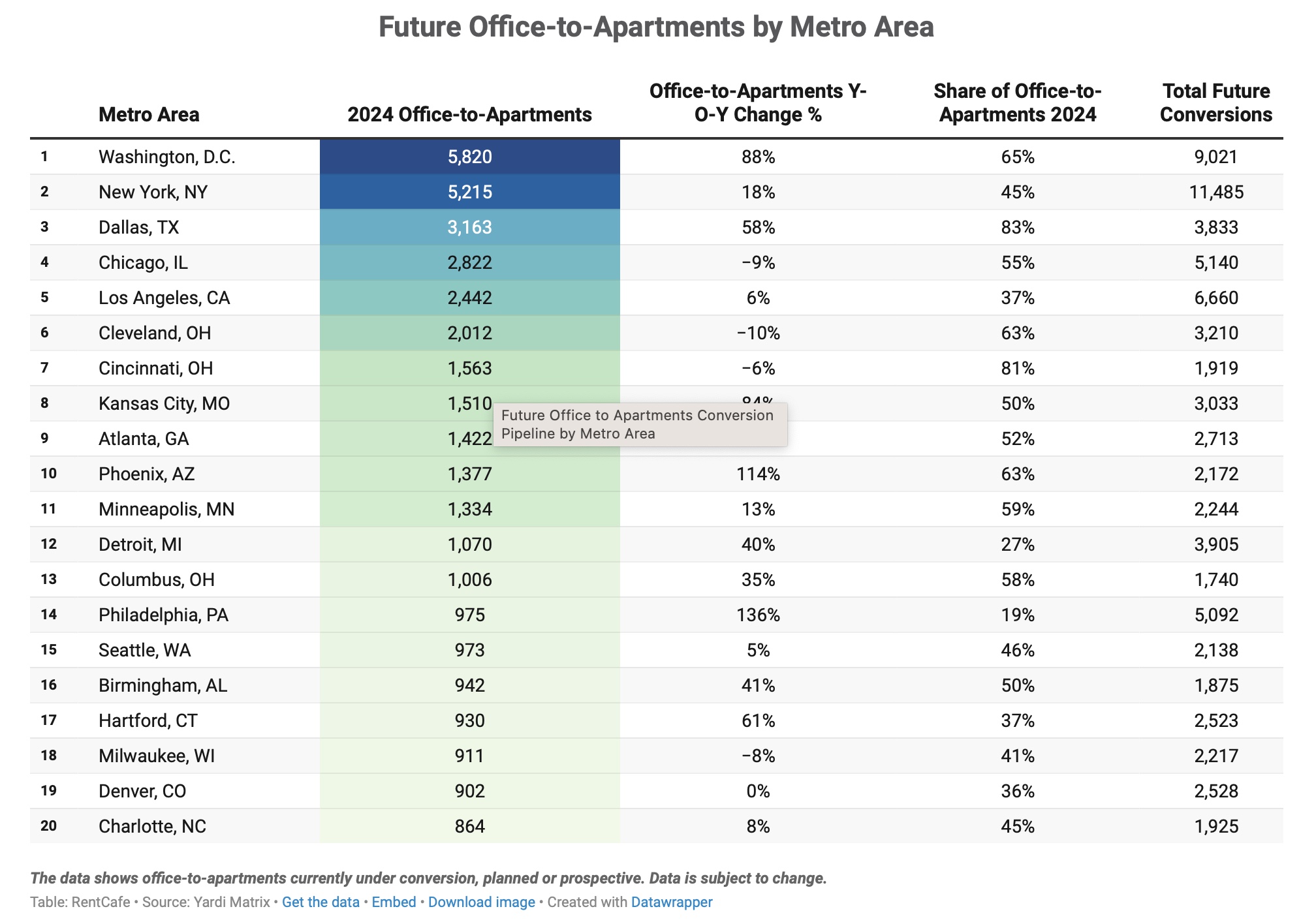

The metros with the largest pipelines of office-to-apartment conversions are Washington, D.C., New York and Dallas, TX, where 5,820 units, 5,215 units and 3,163 units are set to transition from office space to housing, respectively. The top 20 metros where future office-to-apartment conversions are underway this year are listed below.

Roadblocks to success

Many state and local governments are counting on office-to-apartment conversions to address the nation’s shortage of affordable housing and the post-pandemic surplus of vacant office buildings. They hope to revitalize struggling business districts and shrinking tax revenues and transform distressed work hubs into thriving urban communities.

City and state tax credits and billions from the Biden Administration are earmarked to help subsidize the often prohibitive costs of these adaptive reuse projects. But even with incentives, developers must overcome substantial roadblocks to convert an aging office building to a housing unit.

The greatest challenge is finding buildings suitable for conversion. Office buildings are structurally different from multifamily and the costs associated with making the necessary physical changes can render these projects financially unfeasible without subsidies.

The average age of the office buildings developers are targeting for reuse today is 72-years, 20 years younger than those previously converted. According to RENTCafe, this “suggests a strategic preference for buildings that might require less investment in refurbishment and are more likely to meet modern standards, potentially simplifying the conversion process.”

The needs of daily workers differ from those of residents and business districts lack many of services and amenities that entice renters to make a submarket their home.

So, any plan to repopulate downtown business districts by converting office to living space must first focus on creating a neighborhood that people want to live in, one that includes schools, playgrounds, daycare centers, affordable grocery stores and entertainment venues.