A new Biden administration rule goes into effect March 11, imposing stricter measures to determine whether companies can classify their workers as independent contractors. The new regulation could affect millions of workers.

A new Biden administration rule goes into effect March 11, imposing stricter measures to determine whether companies can classify their workers as independent contractors. The new regulation could affect millions of workers.

443,000 total overstatement of employment by the federal government in 2023. Every month (except July) was over reported ranging from 19,000 to 104,000

Breaking economics In January President Biden renominated Julie Su as Labor Secretary. Su was the deputy to Biden’s first labor secretary, Marty Walsh, who departed a year ago. The Senate didn’t vote on her nomination to the cabinet post last year.

Shift more contractors to payroll What could go wrong? Replacing a Trump-era rule that made it easier to classify workers as independent contractors, the Biden administration seeks to move more workers to payrolls. The new rule is expected be challenged in court.

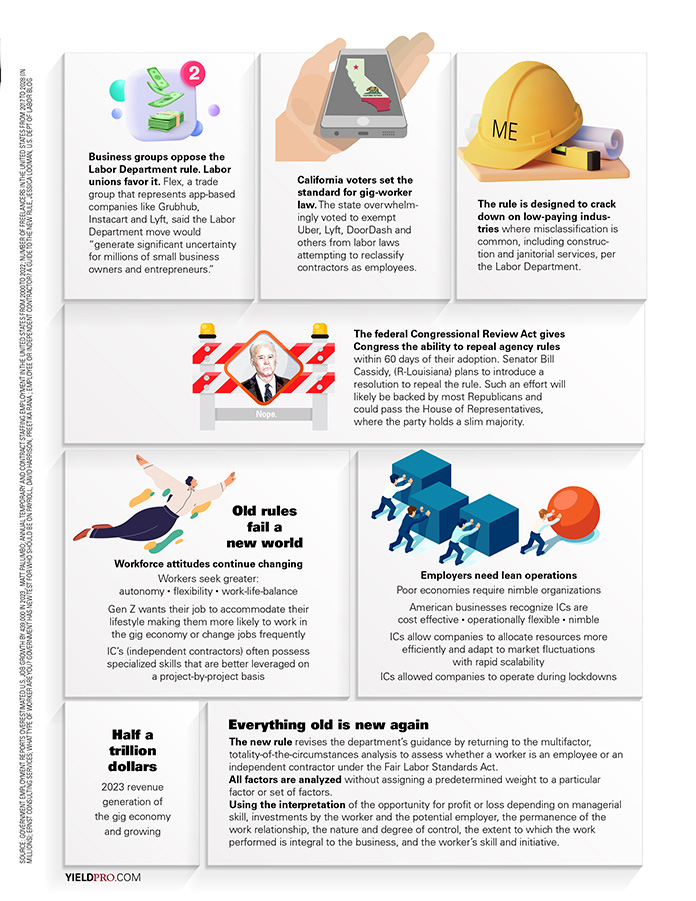

Business groups oppose the Labor Department rule. Labor unions favor it. Flex, a trade group that represents app-based companies like Grubhub, Instacart and Lyft, said the Labor Department move would “generate significant uncertainty for millions of small business owners and entrepreneurs.”

California voters set the standard for gig-worker law. The state overwhelmingly voted to exempt Uber, Lyft, DoorDash and others from labor laws attempting to reclassify contractors as employees.

The rule is designed to crack down on low-paying industries where misclassification is common,including construction and janitorial services, per the Labor Department.

The federal Congressional Review Act gives Congress the ability to repeal agency rules within 60 days of their adoption. Senator Bill Cassidy, (R-Louisiana) plans to introduce a resolution to repeal the rule. Such an effort will likely be backed by most Republicans and could pass the House of Representatives, where the party holds a slim majority.

Old rules fail a new world Workforce attitudes continue changing. Workers seek greater: autonomy • flexibility • work-life-balance

Gen Z wants their job to accommodate their lifestyle making them more likely to work in the gig economy or change jobs frequently.

IC’s (independent contractors) often possess specialized skills that are better leveraged on a project-by-project basis.

Employers need lean operations Poor economies require nimble organizations. American businesses recognize ICs are cost effective • operationally flexible • nimble

ICs allow companies to allocate resources more efficiently and adapt to market fluctuations with rapid scalability.

ICs allowed companies to operate during lockdowns.

Half a trillion dollars 2023 revenue generation of the gig economy and growing.

Everything old is new again.

The new rule revises the department’s guidance by returning to the multifactor, totality-of-the-circumstances analysis to assess whether a worker is an employee or an independent contractor under the Fair Labor Standards Act.

All factors are analyzed without assigning a predetermined weight to a particular factor or set of factors.

Using the interpretation of the opportunity for profit or loss depending on managerial skill, investments by the worker and the potential employer, the permanence of the work relationship, the nature and degree of control, the extent to which the work performed is integral to the business, and the worker’s skill and initiative.

SOURCE: GOVERNMENT EMPLOYMENT REPORTS OVERESTIMATED U.S. JOB GROWTH BY 439,000 IN 2023 , MATT PALUMBO; ANNUAL TEMPORARY AND CONTRACT STAFFING EMPLOYMENT IN THE UNITED STATES FROM 2000 TO 2022; NUMBER OF FREELANCERS IN THE UNITED STATES FROM 2017 TO 2028 (IN MILLIONS); ERNST CONSULTING SERVICES; WHAT TYPE OF WORKER ARE YOU? GOVERNMENT HAS NEW TEST FOR WHO SHOULD BE ON PAYROLL, DAVID HARRISON, PREETIKA RANA; EMPLOYEE OR INDEPENDENT CONTRACTOR? A GUIDE TO THE NEW RULE, JESSICA LOOMAN, U.S. DEPT OF LABOR BLOG